The big shrink commences

By Colin Twiggs

September 22, 2017 11:00 p.m. EDT (1:00 p.m. AEST)

Please note changes to the Disclaimer

Colin Twiggs is a director of The Patient Investor Pty Ltd, an Authorised Representative (no. 1256439) of MoneySherpa Pty Limited which holds Australian Financial Services Licence No. 451289.

Everything contained in this web site, related newsletters, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers and viewers (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

The decision to invest or trade is for the Reader alone. We expressly disclaim all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.

"The Federal Reserve left its benchmark interest rate unchanged and said Wednesday that it would begin to withdraw some of the trillions of dollars that it invested in the US economy after the 2008 financial crisis." ~ Binyamin Applebaum

The Federal Reserve balance sheet ballooned in the last decade to current holdings of $2.5 trillion of US Treasury securities and $1.8 trillion of mortgage-backed securities.

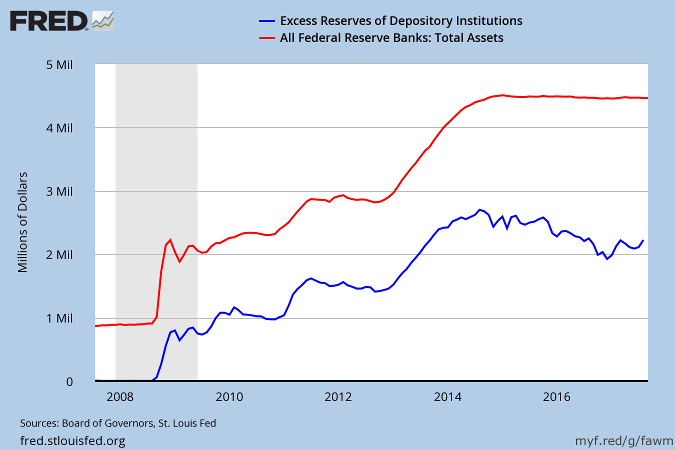

Fed total assets of $4.5 trillion (the red line on the above chart) does not give the full picture. Of the cash injected into the economy, $2.2 trillion found its way back to the Fed by way of excess reserves deposited by banks (the blue line). These deposits earn interest at the rate of 1.25% p.a., providing a secure return on surplus funds. What this means is that the net effect of the balance sheet expansion is the difference between the two lines, or $2.3 trillion.

Even $2.3 trillion is a big number and any meaningful sale of securities by the Fed would contract the supply of money, tipping the economy into recession. So how does the Fed propose to manage "normalization of its balance sheet" without disrupting the economy?

Firstly, the Fed does not intend to sell securities. It will simply decrease the "reinvestment of principal repayments it receives from securities held" according to its June 2017 Normalization Plan.

The amount withheld from reinvestment will commence at $10 billion per month ($6bn US Treasuries and $4bn MBS) and step up by $10 billion each quarter until it reaches a total of $50 billion per quarter.

That means that $100 billion will be withheld in the first year and $200 billion in each year thereafter...."so that the Federal Reserve's securities holdings will continue to decline in a gradual and predictable manner until the Committee judges that the Federal Reserve is holding no more securities than necessary to implement monetary policy efficiently and effectively."

Second, the Fed will reduce the level of excess reserves by an appreciable amount in order to soften the impact of the first step. So a $100 billion reduction in investments may only result in a net reduction of say half that figure, after taking into account the decline in reserves.

Third, the federal funds rate will remain the primary tool of monetary policy and will be used to fine tune monetary policy to fit economic conditions.

It appears that the Fed will start quite tentatively, withholding only $30 billion in the first quarter, but the longer term targets seem ambitious.

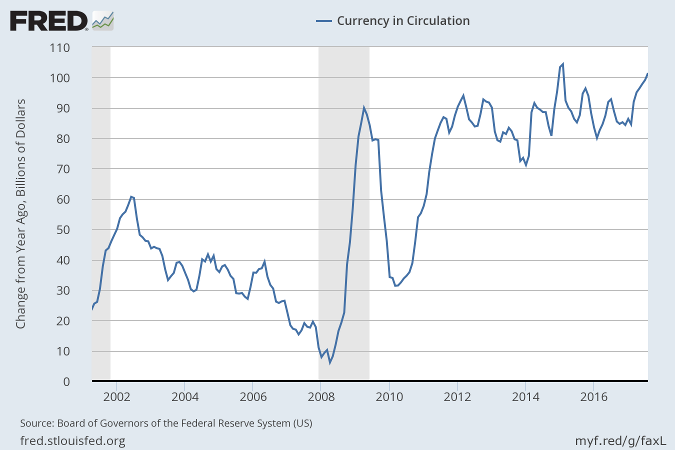

With currency in circulation now growing at an annual rate of $100 billion, even a $50 billion reduction in the first year (net of excess reserves) could leave a big hole.

This is bound to take some of the heat out of the stock market. The plus side is it may restore some sanity to market valuations, but any sudden moves could cause an overreaction.

The difficulty lies not so much in developing new ideas as in escaping from old ones.

~ John Maynard Keynes

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.