S&P 500 VIX hits record low, Australia job gains

By Colin Twiggs

July 21, 2017 11:30 p.m. EDT (1:30 p.m. AEST)

Disclaimer

Please read the Disclaimer. I am not a licensed investment adviser.

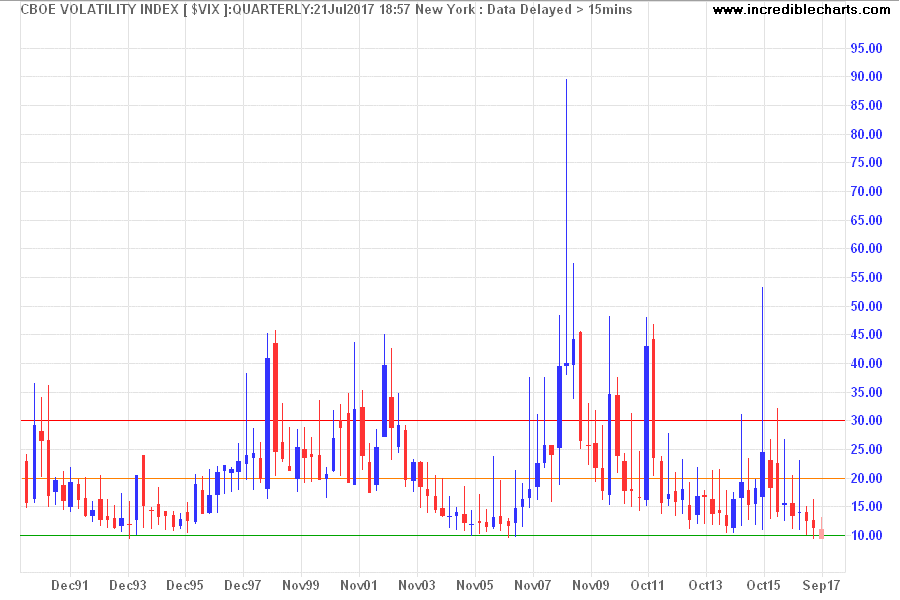

The CBOE Volatility Index (VIX) made a new low of 9.30, indicating record low levels of stock volatility. High levels of stock buybacks and large ETF fund inflows may both have contributed, but this is only the third time in its 27-year history that VIX has broken below 10%. The first was in late 1993. The second, in late 2006, was followed a year later by a massive market snap-back.

This time may be different but volatility is unlikely to remain at such low levels. Eventually we will see a market down-turn, accompanied by high volatility. But there is no crystal ball to tell us whether that will be in one year or in five.

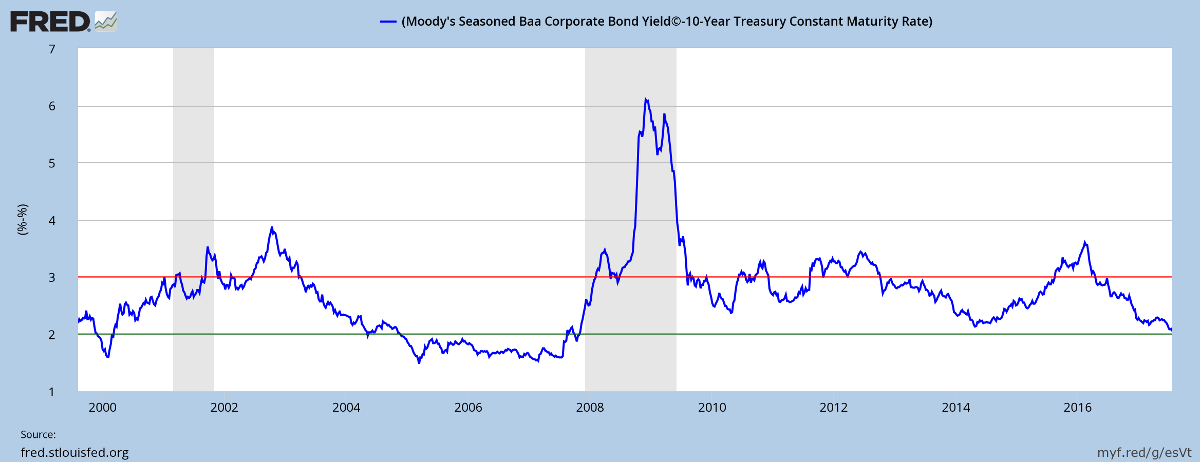

Corporate bond spreads are also falling, suggesting low default risk. The spread between lowest investment grade (Baa) and equivalent 10-year Treasury yields is at its lowest point since 2008.

Source: St Louis Fed & Moody's

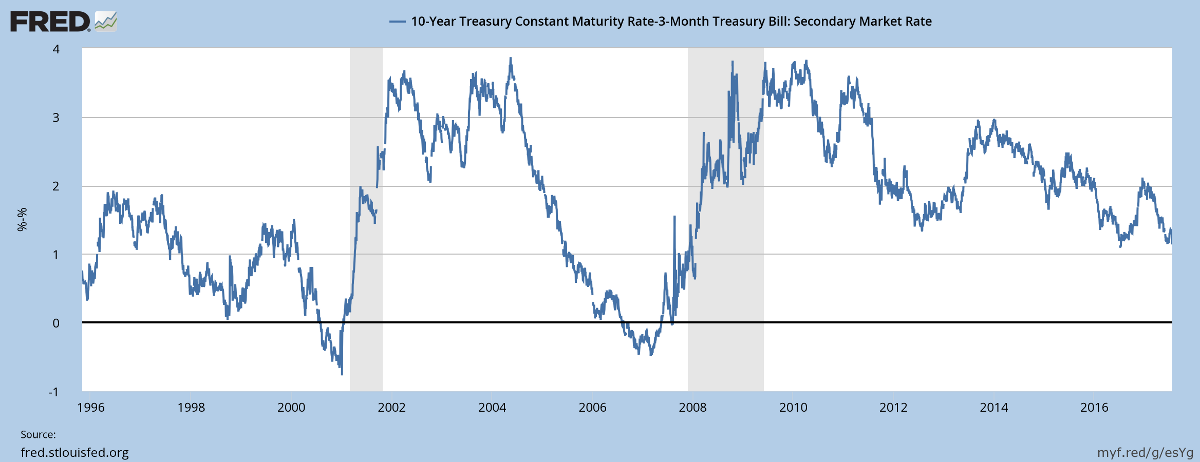

The yield curve is flattening but remains comfortably above a negative yield curve when the yield differential (10-year minus 3-month yields) falls below zero. A negative yield curve would reliably warn of a recession in the next 12 months.

Source: St Louis Fed

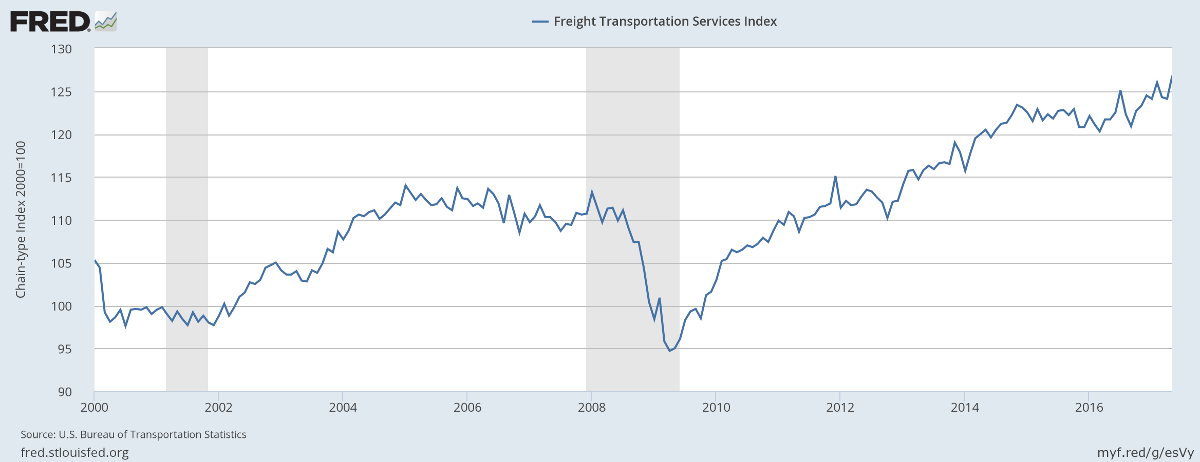

The Freight Transportation Services Index shows a steady increase in economic activity.

Source: St Louis Fed & US Bureau of the Census

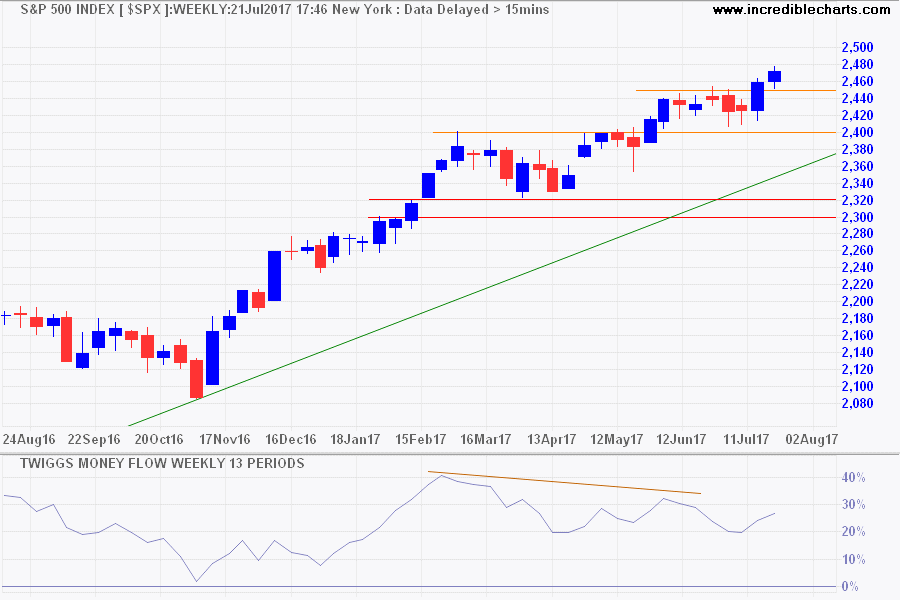

And the S&P 500 continues its advance towards 2500.

Target 2400 + ( 2400 - 2300 )

Australia: Job gains

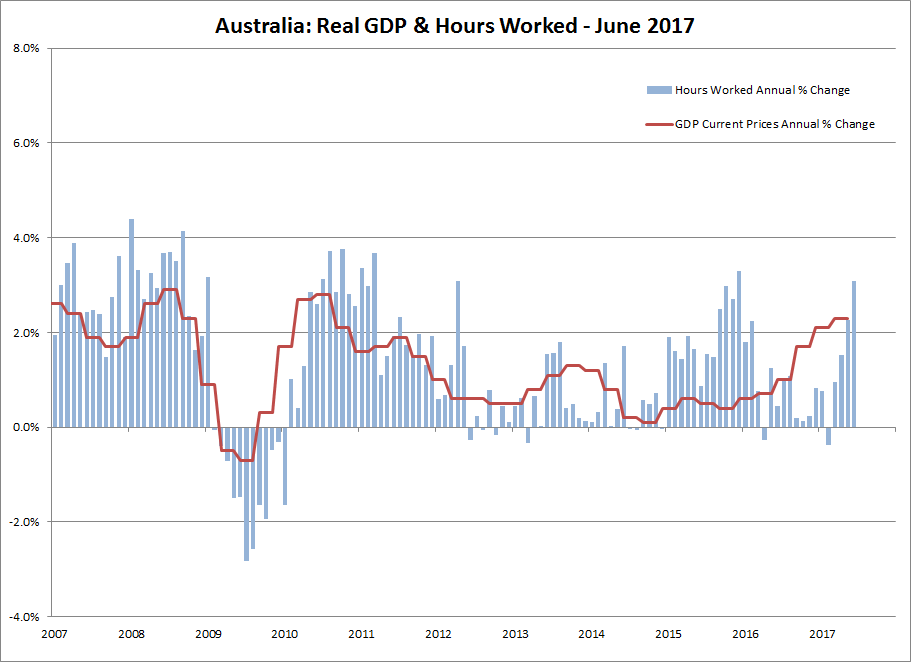

ABS June figures reflect solid gains for the labor market. Justin Smirk at Westpac writes:

"....The annual pace of employment growth has lifted from 0.9%yr in February to 2.0%yr in May and it held that pace in June. In the year to Feb there was a 106.9k gain in employment; in the year to June this has lifted to 240.2k. The Australian labour market went through a soft patch in 2016 that was particularly pronounced through August to November when the average gain in employment per month was a paltry 2.2k. We have clearly bounced out of this soft patch and now holding a firmer trend."

My favorite measure, monthly hours worked (year-on-year), jumped by a healthy 3.1%.

Infrastructure spending, particularly in NSW and Victoria, is doing its best to offset weakness in other areas.

Wage rate growth, however, remains subdued, indicating little pressure on the RBA to lift rates.

The line separating investment and speculation, which is never bright and clear, becomes blurred still further when most market participants have recently enjoyed triumphs. Nothing sedates rationality like large doses of effortless money. After a heady experience of that kind, normally sensible people drift into behavior akin to that of Cinderella at the ball. They know that overstaying the festivities—that is, continuing to speculate in companies that have gigantic valuations relative to the cash they are likely to generate in the future—will eventually bring on pumpkins and mice. But they nevertheless hate to miss a single minute of what is one helluva party.

~ Warren Buffett

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.