Investment the key to growth

By Colin Twiggs

June 30, 2017 9:30 p.m. EDT (11:30 a.m. AEST)

Disclaimer

Please read the Disclaimer. I am not a licensed investment adviser.

Elliot Clarke at Westpac recently highlighted the importance of investment in sustaining economic growth:

The importance of sustained investment in an economy cannot be understated. Done well, investment in real capacity begets greater production volume and employment as well as a productivity dividend. Its absence in recent years is a key factor behind sustained soft wage inflation and the US economy's inability to consistently grow at an above-trend pace despite the economy being at full-employment and household balance sheets having more than fully recovered post GFC.

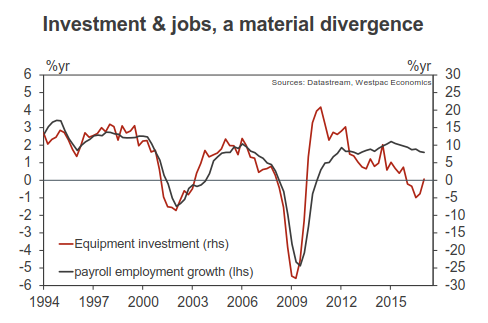

The graph below highlights declining US investment in new equipment post GFC.

source: Westpac

There are three factors that may influence this:

- Accelerated tax depreciation allowances after the GFC encouraged companies to bring forward capital spending in order to stimulate the recovery. But the 2010 to 2012 surge is followed by a later trough when the intended capital expenditure was originally planned to have taken place.

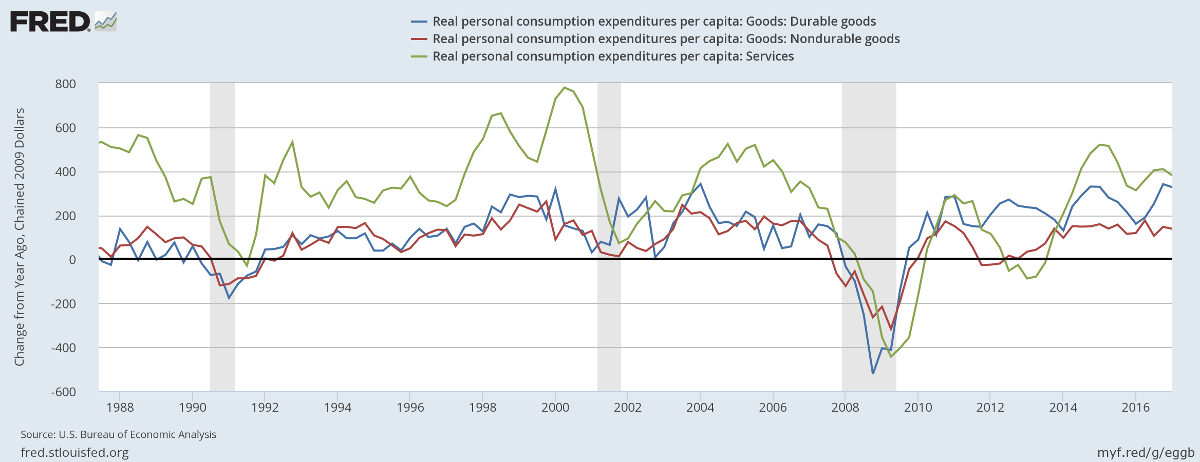

- Low growth in personal consumption, especially of non-durable goods and of services, would discourage further capital investment.

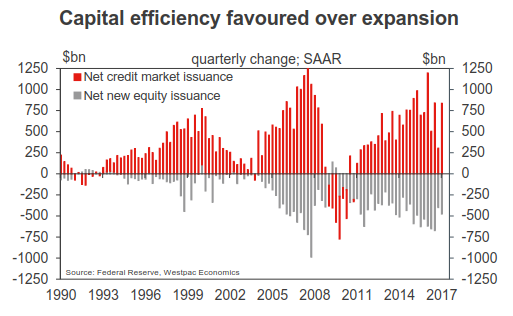

- The level of stock buybacks increased as companies sought alternative measures to sustain earnings (per share) growth. The graph below shows debt issuance has soared while net equity issuance remains consistently negative.

source: Westpac

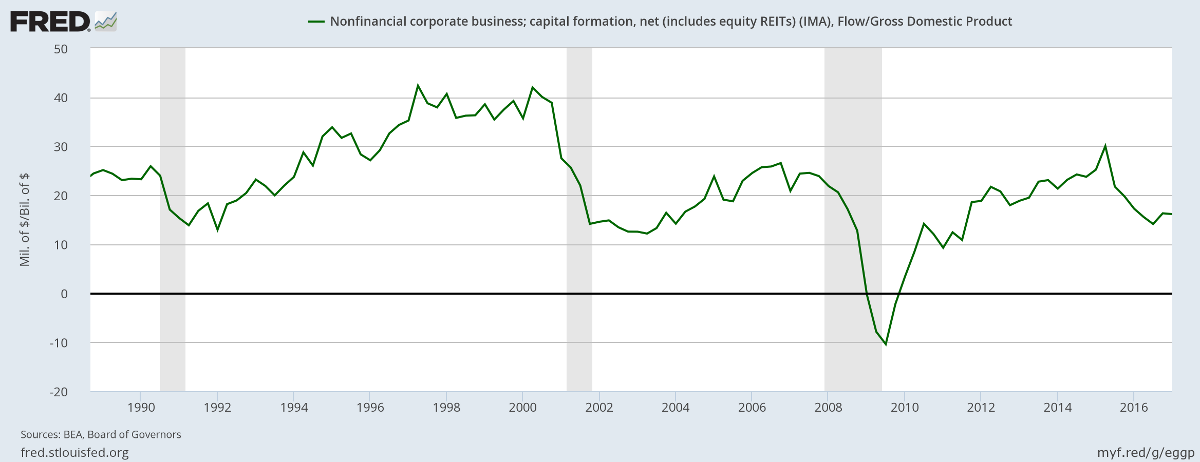

Net capital formation (the increase in physical assets owned by nonfinancial corporations) declined between 2015 and 2017. While this is partly attributable to the falling oil price curtailing investment in the Energy sector, continuation of the decline would spell long-term trouble for the economy.

The cycle becomes self-reinforcing. Low growth in personal consumption leads to low levels of capital investment ....which in turn leads to low employment growth.....leading to further low growth in personal consumption.

Major infrastructure investment is needed to break the cycle. In effect you need to "prime the pump" in order to create a new virtuous cycle, with higher investment leading to higher growth.

It is obviously important that infrastructure investment target productive assets, that generate income, else taxpayers are left with increased debt and no income to service it. Or assets that can be sold to repay the debt. But the importance of infrastructure investment should be evident to both sides of politics and any attempt to obstruct or delay this would be putting political ahead of national interests.

Australia

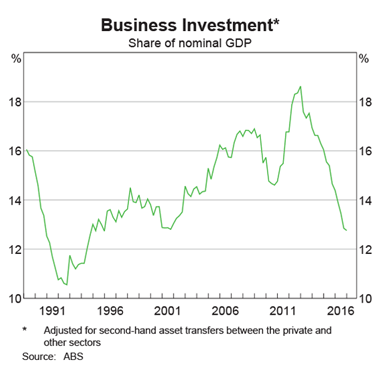

Australia is in a worse position, with a dramatic fall in investment following the mining boom.

source: RBA

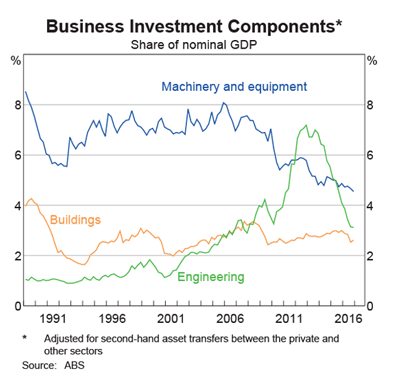

If we examine the components of business investment, it is not just Engineering that has fallen. Investment in Machinery & Equipment has been declining for the last decade. And now Building Investment is also starting to slow.

source: RBA

You've got to prime the pump.... You've got to put something in before you can get anything out.

~ Zig Ziglar

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.