S&P 500 hesitates at 2450/ Bearish outlook for ASX

By Colin Twiggs

June 23, 2017 9:30 p.m. EDT (11:30 a.m. AEST)

Disclaimer

Please read the Disclaimer. I am not a licensed investment adviser.

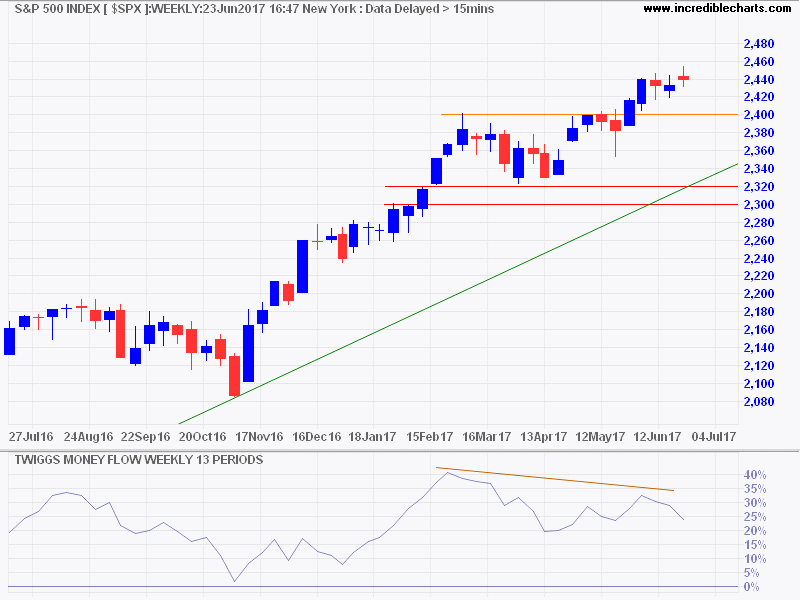

The S&P 500 hesitated at 2450, short of its target of 2500*. Bearish divergence on Twiggs Money Flow warns of medium-term selling pressure. Expect stronger resistance at 2500.

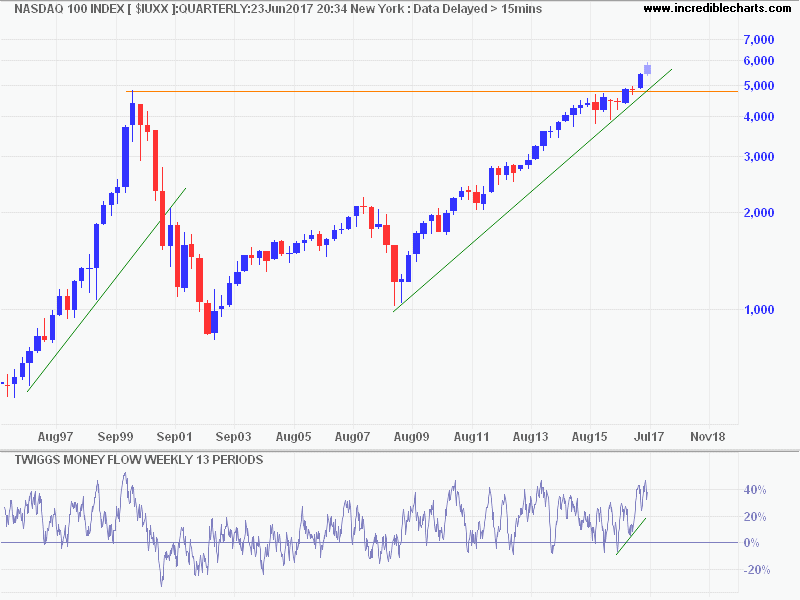

Tech stocks are advancing at a rapid pace, with the Nasdaq 100 approaching 6000 after only breaking 5000 in January. Rising troughs on Twiggs Money Flow signal strong buying pressure. No signs of a 'blow-off' yet.

Stage III of a bull market can last several years.

Australia

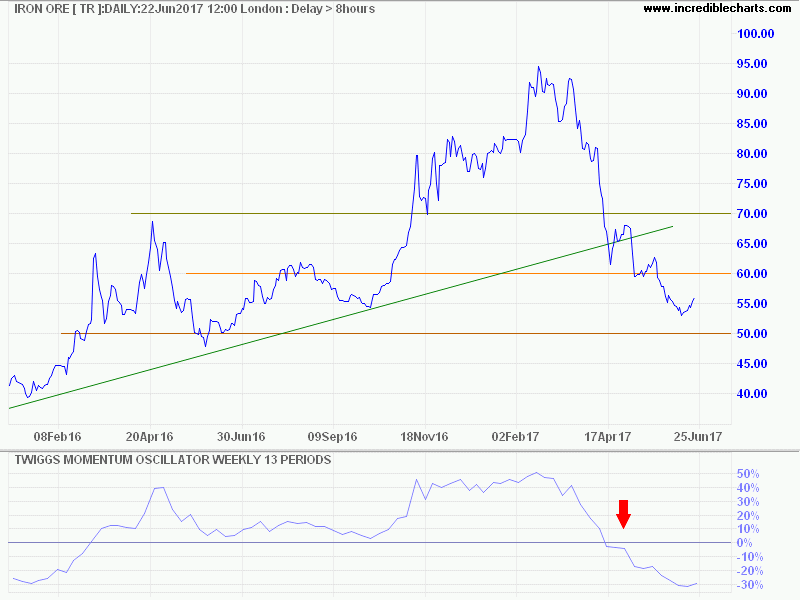

Iron ore rallied slightly during the week. But this is a bear market. Expect resistance at $60 to hold and breach of support at $50 is likely, signaling another decline.

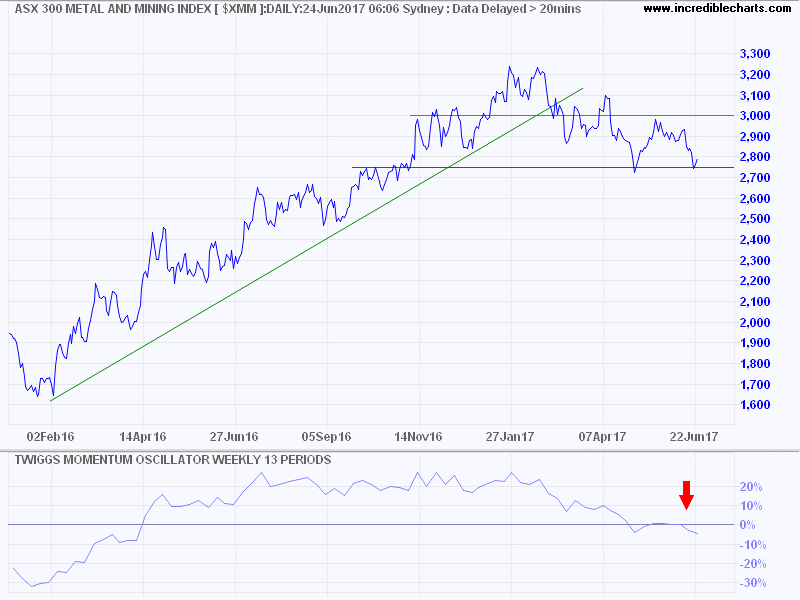

The ASX 300 Metals & Mining index is testing support at 2750. Breach is likely and would signal a primary down-trend.

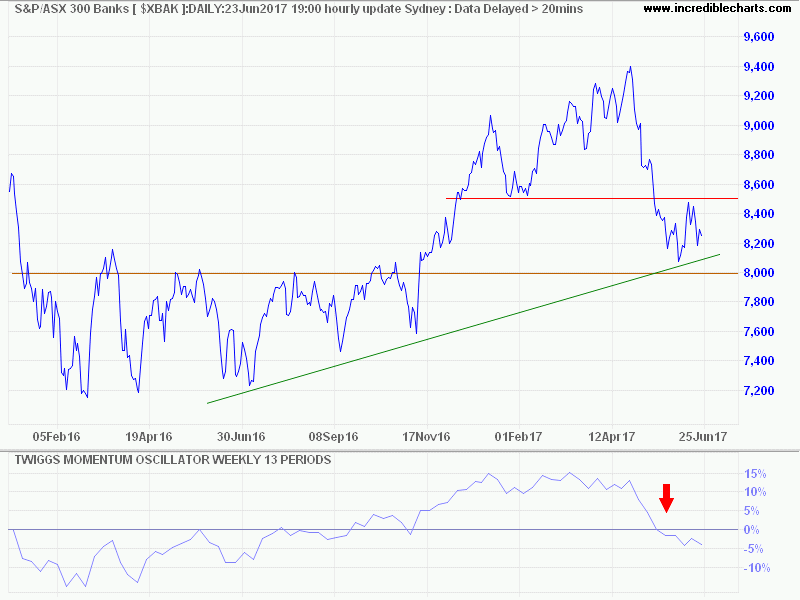

Banks are also under pressure, with the ASX 300 Banks index consolidating between 8000 and 8500. Breach of 8000 is likely and would confirm the primary down-trend.

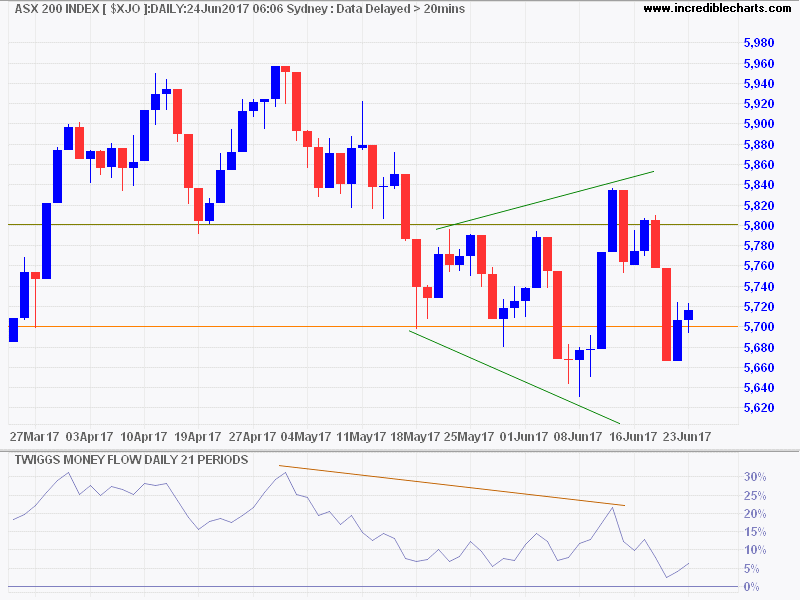

The ASX 200 displays a broadening wedge consolidation. A failed down-swing, recovering above 5800 without reaching the lower border, would be a bullish sign. But this seems unlikely with a bearish outlook for the two largest sectors.

In a time of drastic change it is the learners who inherit the future. The learned usually find themselves equipped to live in a world that no longer exists.

~ Eric Hoffer, Reflections on the Human Condition (1973)

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.