US hours worked show steady growth/ RBA hands tied

By Colin Twiggs

June 10, 2017 3:00 a.m. EDT (5:00 p.m. AEST)

Disclaimer

Please read the Disclaimer. I am not a licensed investment adviser.

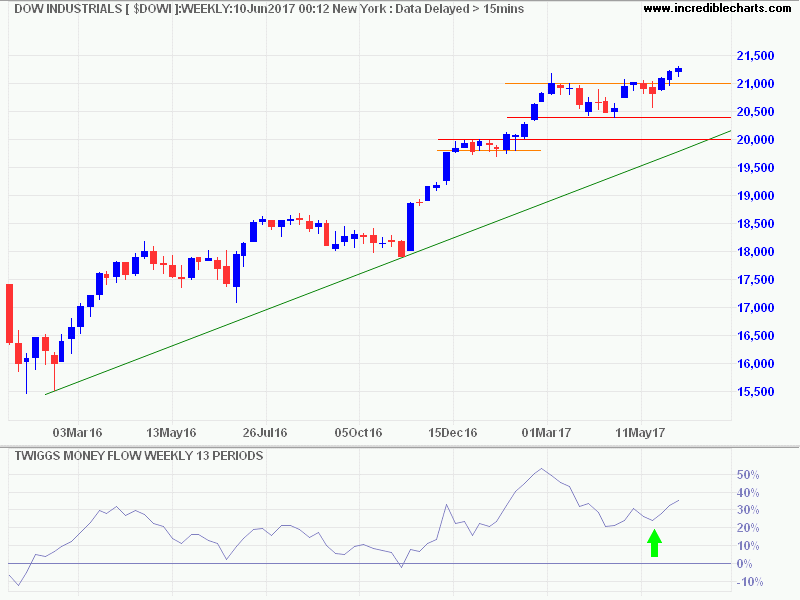

Dow Jones Industrial Average continues to advance. Rising troughs on Twiggs Money Flow signal long-term buying pressure.

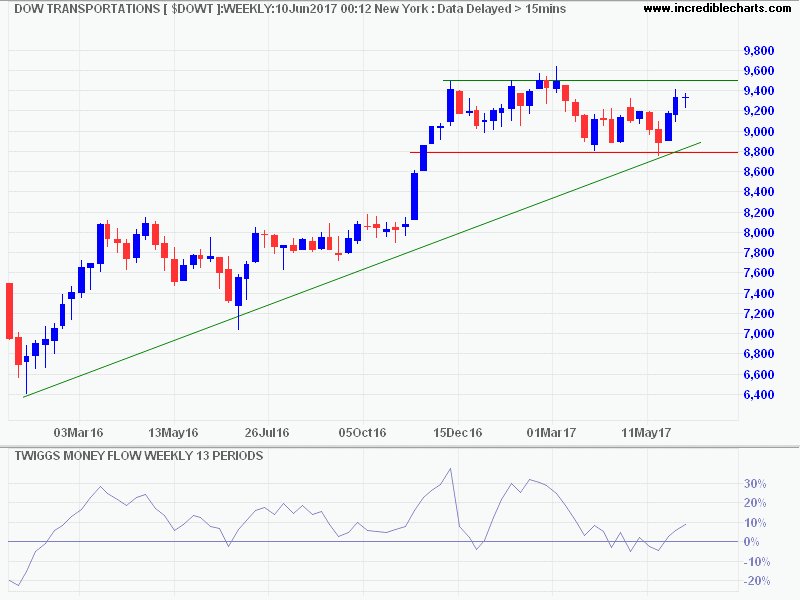

Dow Jones Transportation Average is slower, headed for a test of resistance at 9500. But recent breakout of Fedex above $200 is an encouraging sign and the index is likely to follow.

We are in stage III of a bull market, but this can last for several years.

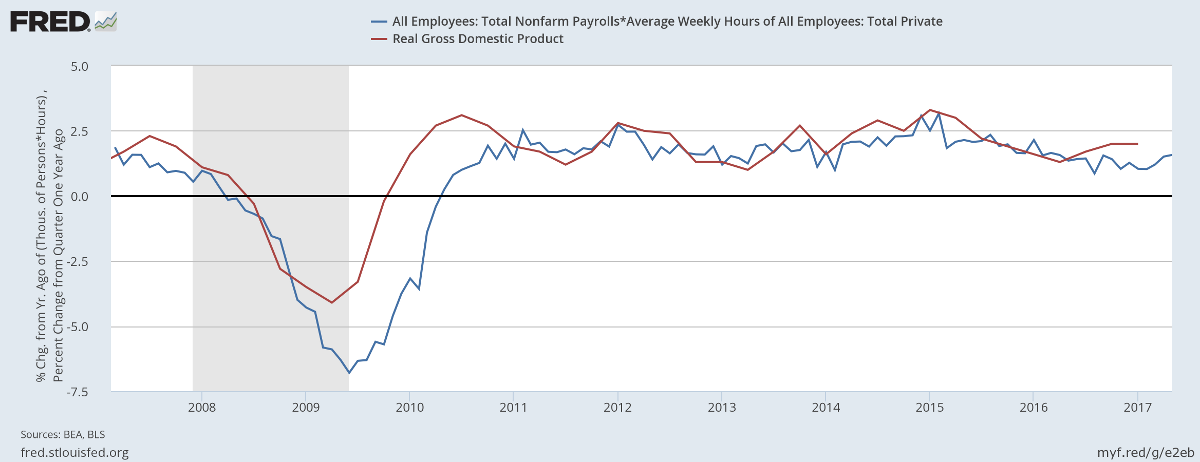

Growth of total hours worked, calculated as Total Nonfarm Payroll multiplied by Average Hours worked, improved to 1.575% for the 12 months to May 2017.

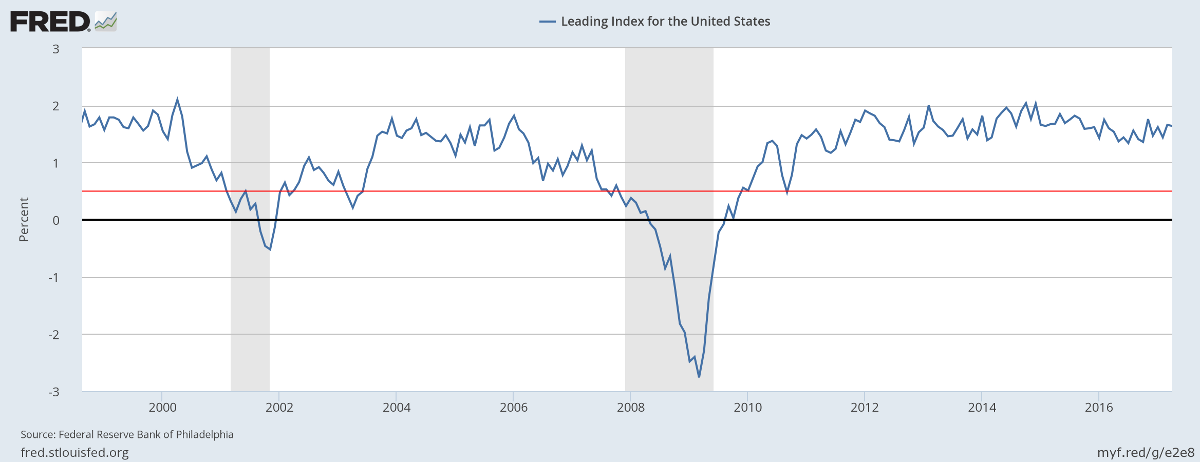

And the April 2017 Leading Index, produced the Philadelphia Fed, is tracking at a healthy 1.64% (Decline below 1.0% often gives early warning of a slow-down; below 0.5% is more serious).

Australia: Hands tied

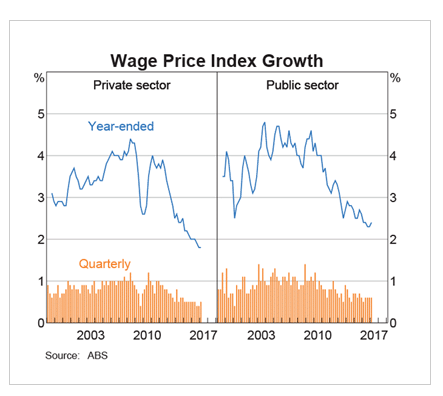

Falling wage rate growth suggests that we are headed for a period of low growth in employment and personal consumption.

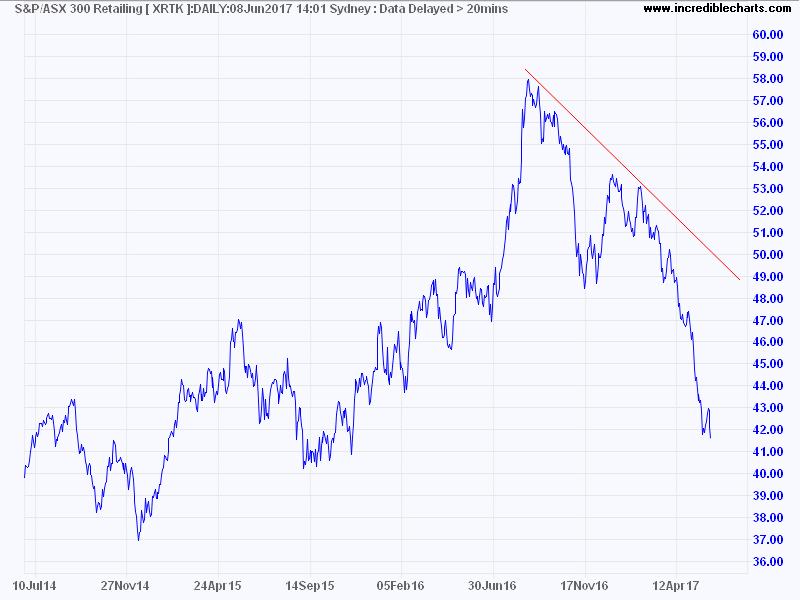

The impact is already evident in the Retail sector.

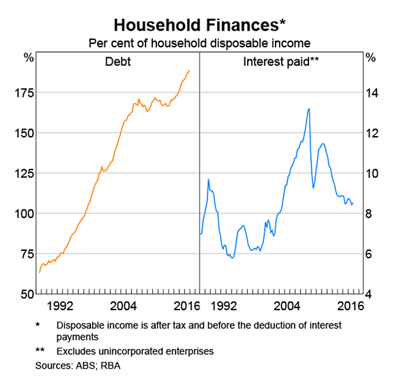

The RBA would normally intervene to stimulate investment and employment but its hands are tied. Lowering interest rates would aggravate the housing bubble. Household debt is already precariously high in relation to disposable income.

Like Mister Micawber in David Copperfield, we are waiting in the hope that something turns up to rescue us from our predicament. It's not a good situation to be in. If something bad turns up and the RBA is low on ammunition.

Annual income twenty pounds, annual expenditure nineteen nineteen and six, result happiness. Annual income twenty pounds, annual expenditure twenty pounds ought and six, result misery. The blossom is blighted, the leaf is withered, the god of day goes down upon the dreary scene, and — and in short you are for ever floored....

~ Mr. Micawber in Charles Dickens' David Copperfield

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.