Is the US labor market tightening?/ ASX rallies

By Colin Twiggs

June 02, 2017 11:00 p.m. EDT (1:00 p.m. AEST)

Disclaimer

Please read the Disclaimer. I am not a licensed investment adviser.

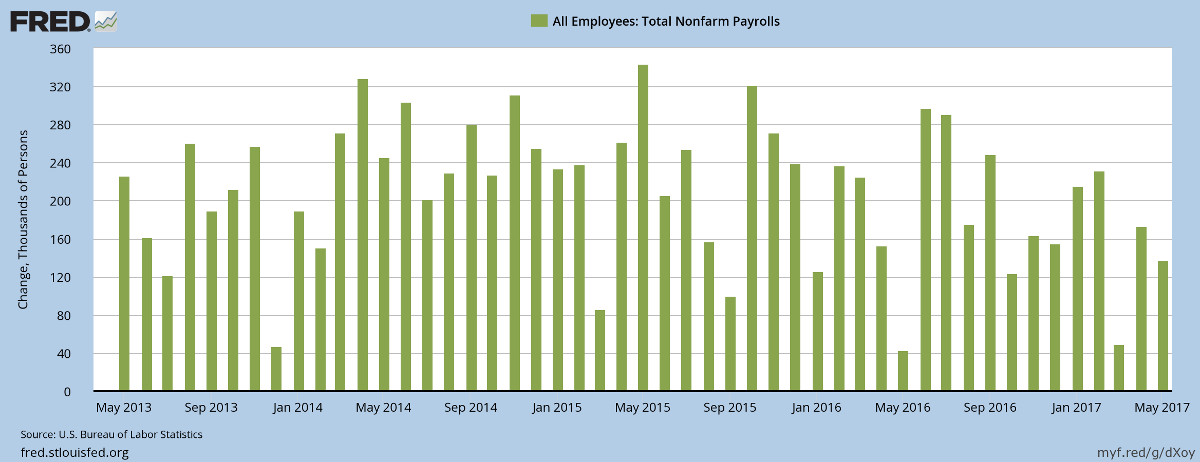

I wouldn't read too much into weaker US job gains of 138 thousand for May 2017. Job gains are tapering in 2017, with February highest at 232 thousand, but this could be a sign of tightening labor conditions.

Comments from respondents in yesterday's ISM report hint at a tighter labor market:

- "Business conditions are steady, and with competition increasing, it's making negotiations even more intense to reduce costs." (Machinery)

- "Business is booming, and getting direct employees is increasingly difficult." (Fabricated Metal Products)

- "Difficult to find qualified labor for factory positions." (Food, Beverage & Tobacco Products)

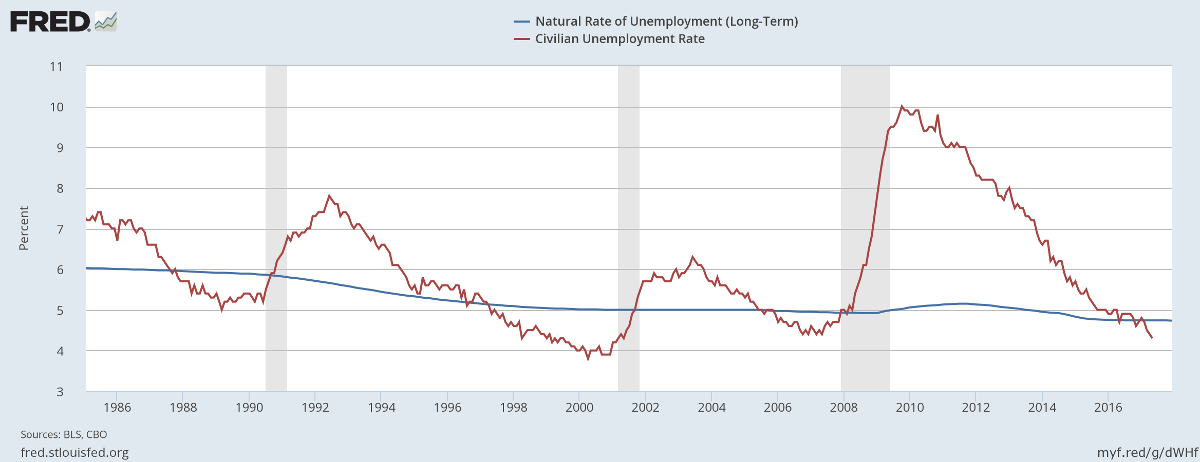

Unemployment continues to fall, reaching 4.3% for May 2017. The dip below the natural rate of unemployment also warns of tighter labor market conditions.

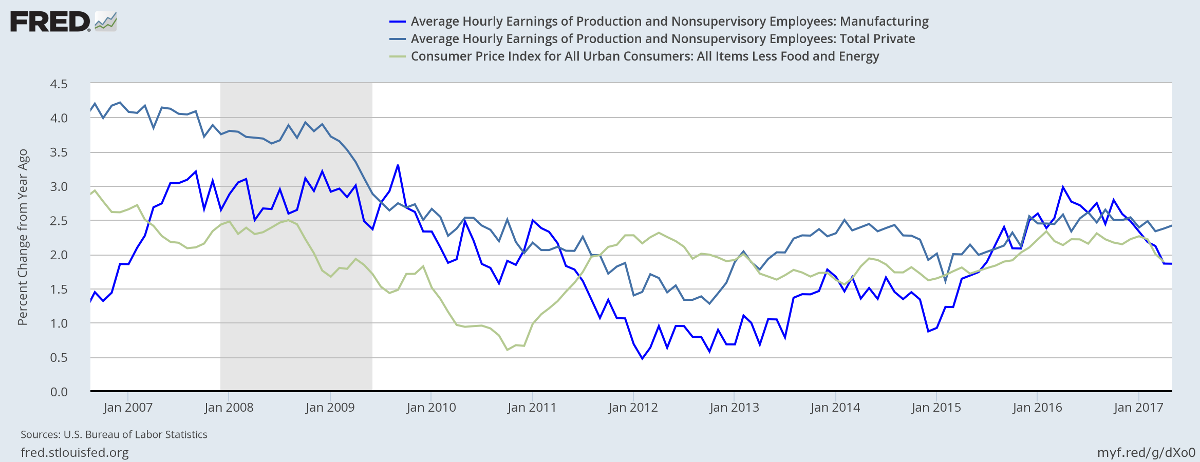

But there are no real signs of upward pressure on hourly wages. In fact, hourly wage rate growth in the manufacturing sector is slowing.

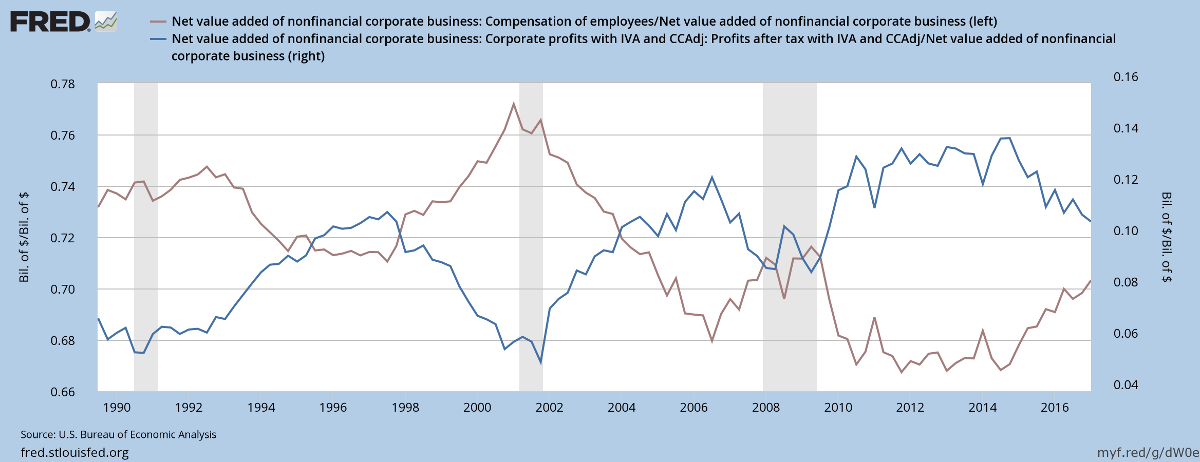

Employee compensation as a percentage of value added (Q1 2017) is starting to rise and the percentage of profits (after tax) is declining. The lines tend to invert, with employee compensation peaking and profits dipping, ahead of a recession. But this seems at least 12 months away.

In summary, declining unemployment and rising employee compensation as a percentage of value added both indicate a tight labor market. But soft wage rate growth and falling core CPI suggest the Fed is in no haste to apply the brakes. At least for the next three/four quarters.

Australia: ASX rallies

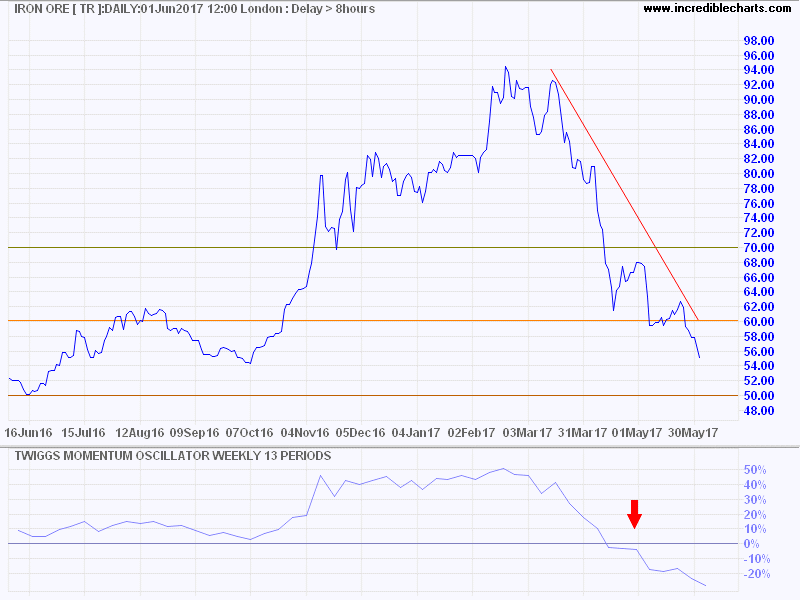

Iron ore is falling.

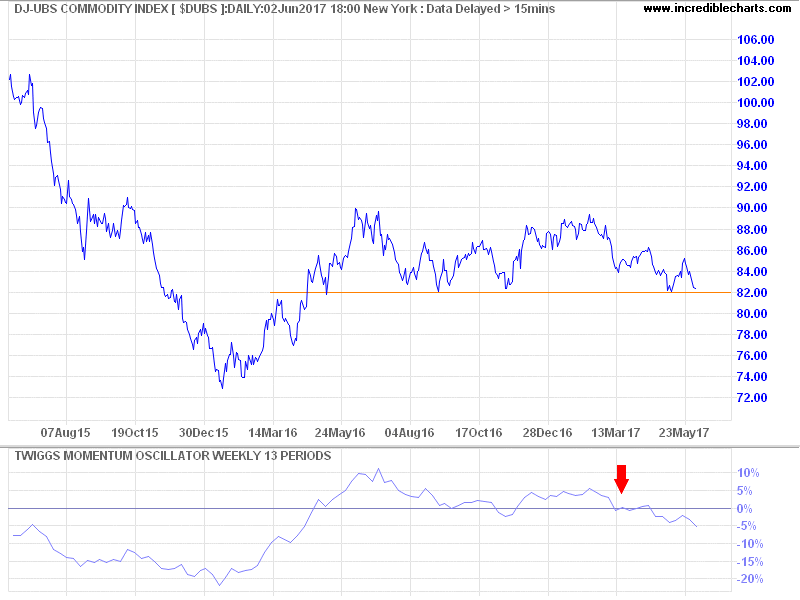

And the broader DJ-UBS Commodity Index is testing support at 82. Breach would signal a decline to test the 2015 low at 74.

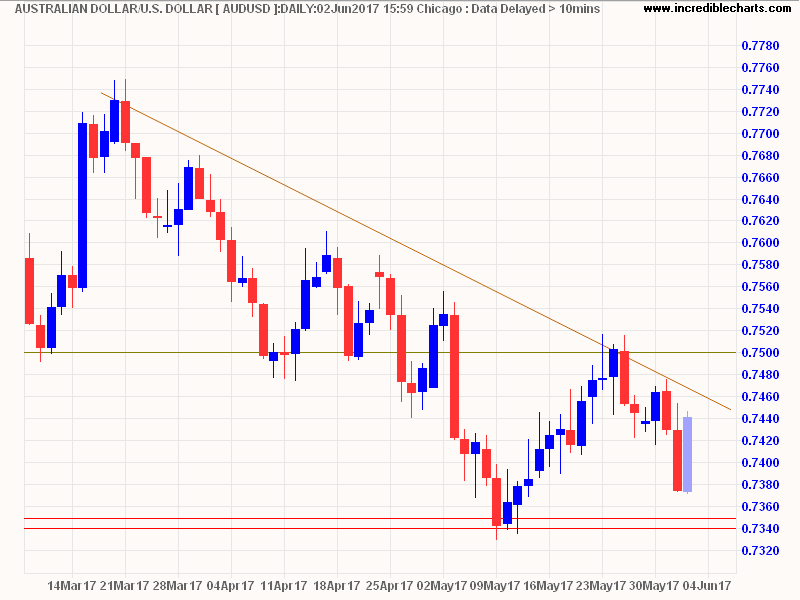

But the Aussie Dollar rallied Friday, the large engulfing candle suggesting another test of resistance at 75 US cents.

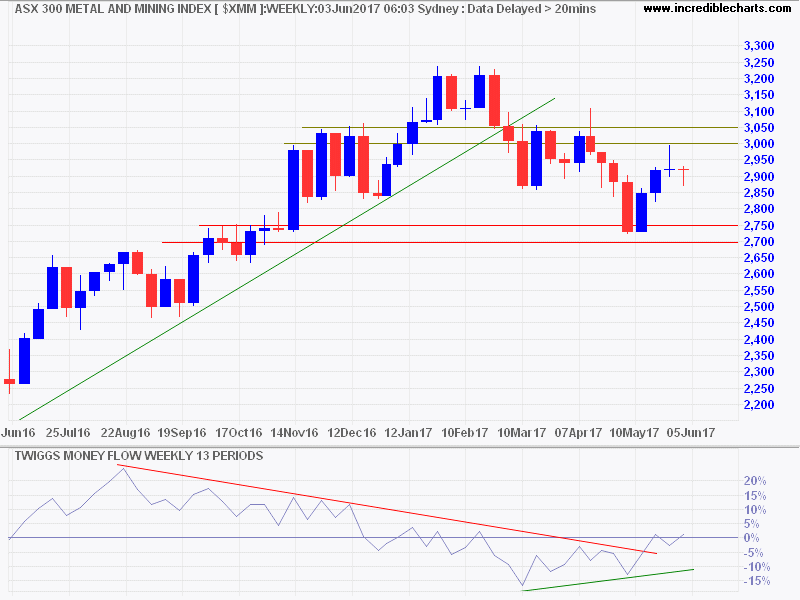

Miners finished strongly, with the ASX 300 Metals & Mining index reflecting short-term buying pressure. 13-Week Twiggs Money Flow recovered above zero.

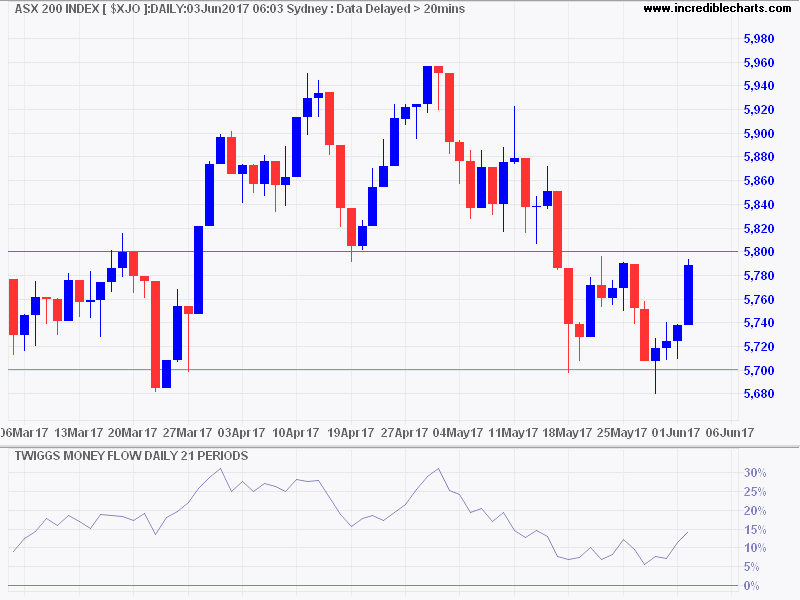

The ASX 200 is testing resistance at 5800. A 21-day Twiggs Money Flow trough above zero indicates medium-term buying pressure. Breakout above 5800 is likely and would suggest another test of 5950/6000.

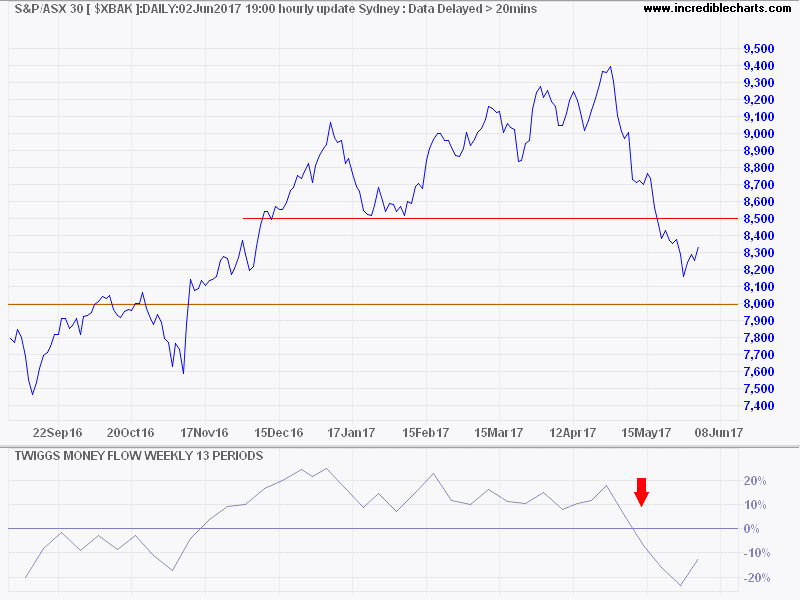

Banks also rallied, with the ASX 300 Banks index headed for a test of 8500. Expect strong resistance.

Perhaps this report from UBS had something to do with it.

I believe that the latest rally is a secondary reaction and that the ASX is headed for a down-turn, with miners and banks leading the way. But it's no use arguing with the (ticker) tape.

A prudent speculator never argues with the tape. Markets are never wrong, opinions often are.

~ Jesse Livermore

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.