Tall shadows warn of selling pressure

By Colin Twiggs

May 19, 2017 7:00 p.m. EDT (9:00 a.m. AEST)

Disclaimer

Please read the Disclaimer. I am not a licensed investment adviser.

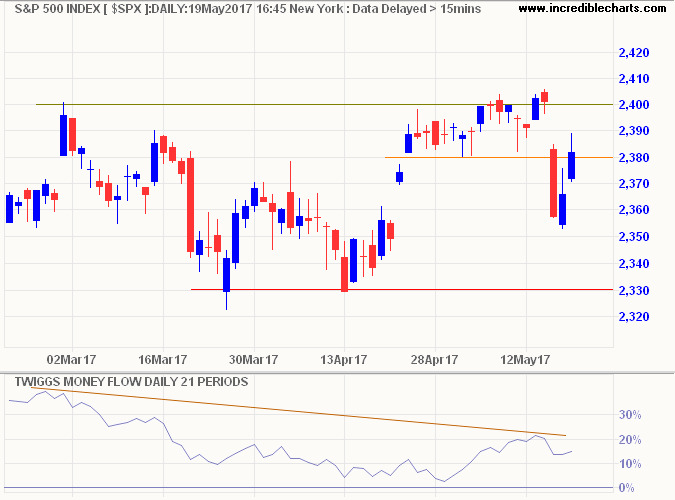

The S&P 500 is recovering after Wednesday's sharp fall but tall shadows on the last two candles indicate selling pressure. This is supported by a bearish divergence on 21-day Twiggs Money Flow, signaling medium-term selling pressure. Respect of resistance at 2400 is likely and would warn of another test of primary support at 2330.

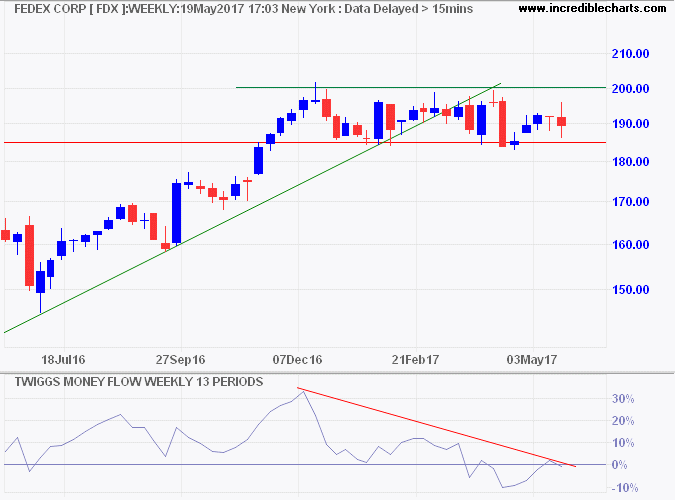

Bellwether transport stock Fedex [FDX] has consolidated in a broad rectangle over the last six months. Bearish divergence on 13-week Twiggs Money Flow indicates long-term selling pressure. Breach of support at 185 would signal a primary down-trend, warning that economic activity is slowing.

No government is perfect. One of the chief virtues of a democracy, however, is that its defects are always visible and under democratic processes can be pointed out and corrected.

~ President Harry S. Truman

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.