US Jobs Surge but ASX Warning Signs

By Colin Twiggs

May 05, 2017 9:00 p.m. ET (11:00 a.m. AEST)

Disclaimer

Please read the Disclaimer. I am not a licensed investment adviser.

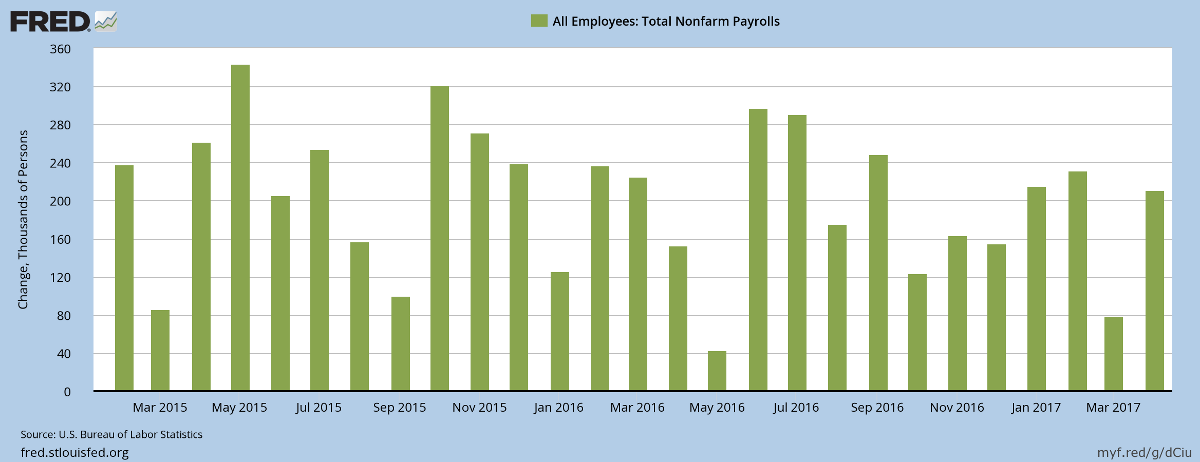

The latest jobs data shows that Nonfarm Payrolls jumped by a healthy (seasonally adjusted) 211,000 with unemployment falling to 4.4%.

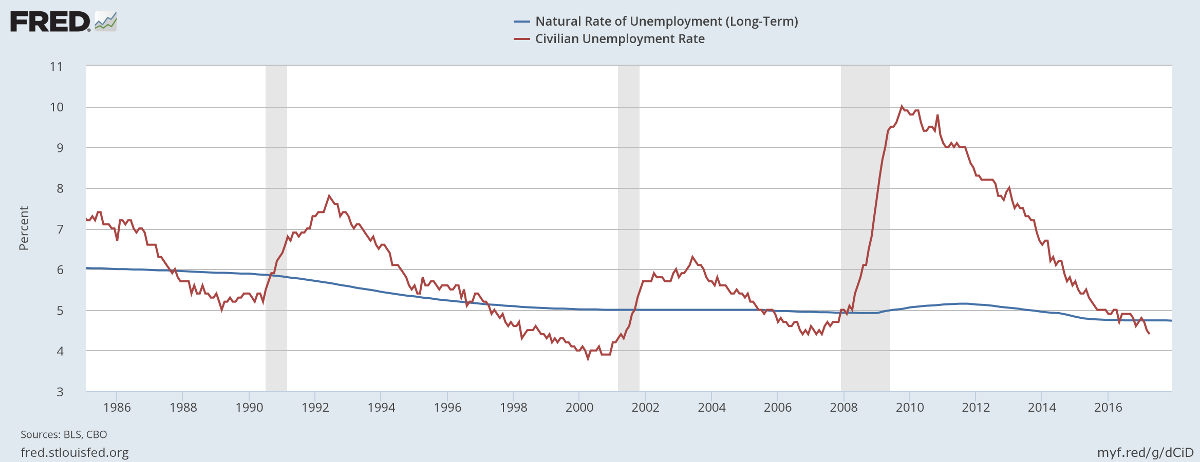

Unemployment is now below the long-term natural rate of unemployment, a sign that inflationary pressures may be building.

Past experience shows that when unemployment dips below the long-term natural rate it is followed within a year or two by the Fed adopting a restrictive monetary stance to cool inflationary pressures — which normally leads to a recession.

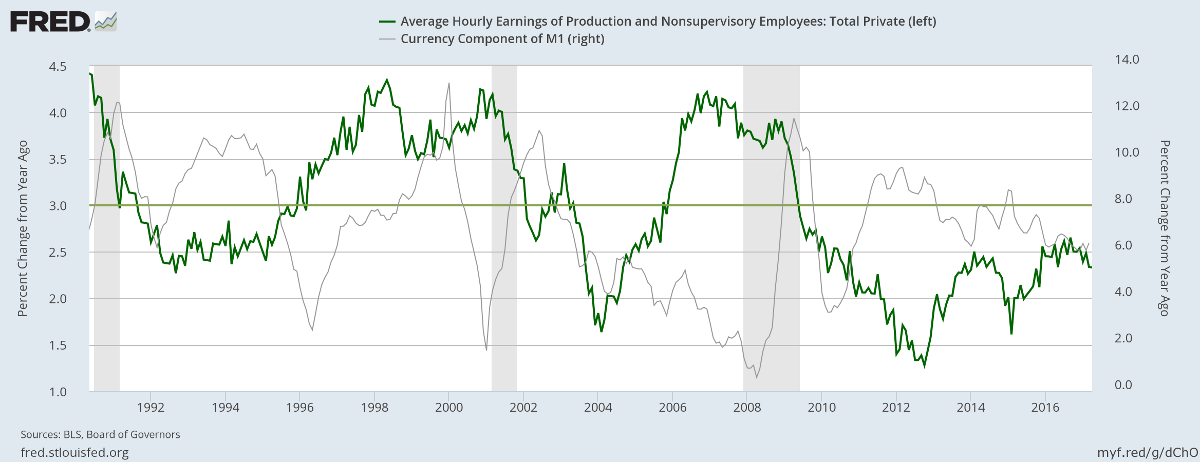

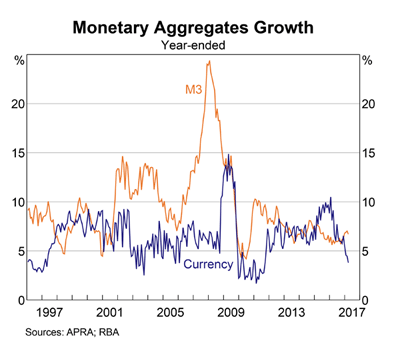

So far wage rate growth is holding below the usual 3.0% trigger level that prods the Fed into slowing money supply growth (illustrated in the graph below by sharp falls in the currency component of M1 - right hand scale).

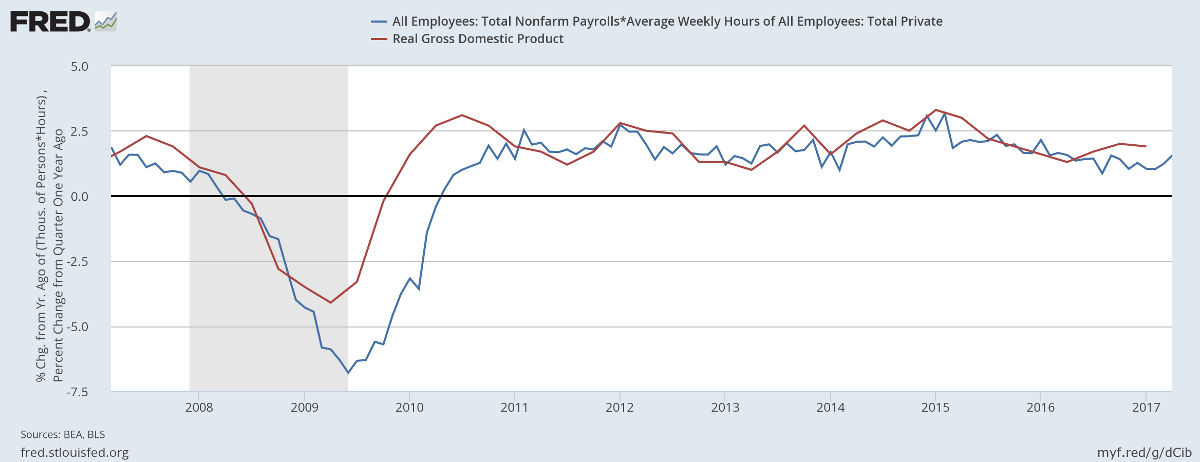

Moderate GDP growth looks set to continue. The graph below compares real GDP growth (adjusted for inflation) to that of Nonfarm Payrolls x Average Weekly Hours Worked which I find a useful approximation.

Australia - Three Warning Signs

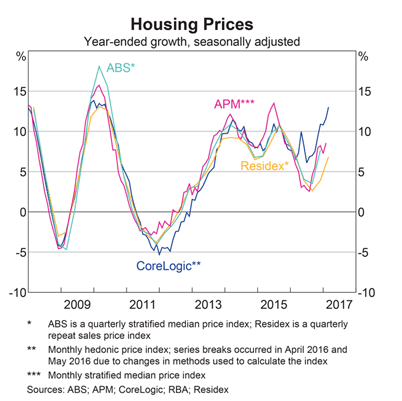

Regulators are growing increasingly concerned about the housing bubble, with average prices rising faster than 10% p.a. despite a sharp slow-down in West Australia.

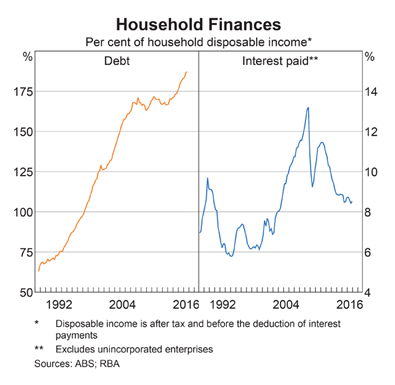

Household debt is at record levels compared to disposable income and shows no signs of slowing.

This puts the RBA in a precarious position as a sharp rise in interest rates would generate massive mortgage stress and require the banking system to be rescued, with capital ratios insufficient to weather collapse of the housing bubble.

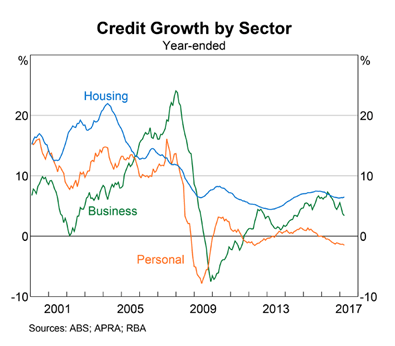

APRA are putting pressure on the banks to improve their capital ratios and slow lending, especially on investor mortgages. There are clear signs that business and personal credit growth is slowing, while housing credit is proving stubborn and will warrant further measures to take the heat out of the market.

The catch is that the economy has grown addicted to strong credit growth and a slow-down would cause a contraction.

The RBA is faced with Hobson's choice: either kick the can down the road in the hope that something, like another China boom, will turn up; or take it on the chin and face the consequences. My experience of politicians is that they will take the first option almost every time.

We already have the first warning sign of a contraction, with currency growth falling sharply. Growth below 5.0% is normally synonymous with a recession.

Read more: Two More Warning Signs for the ASX.

There is no avoiding war; it can only be postponed to the advantage of others.

~ Niccolo Machiavelli, The Prince (1513)

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.