Inflation surges

By Colin Twiggs

April 07, 2017 9:00 p.m. ET (11:00 a.m. AEST)

Disclaimer

Please read the Disclaimer. I am not a licensed investment adviser.

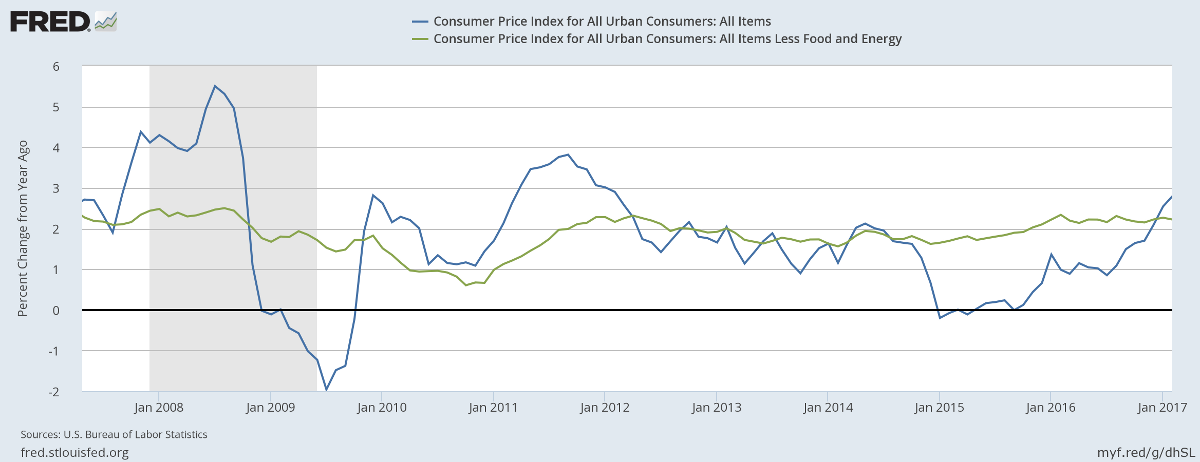

Inflation is rising, with CPI climbing steeply above the Fed's 2% target. But core CPI excluding energy and food remains stable.

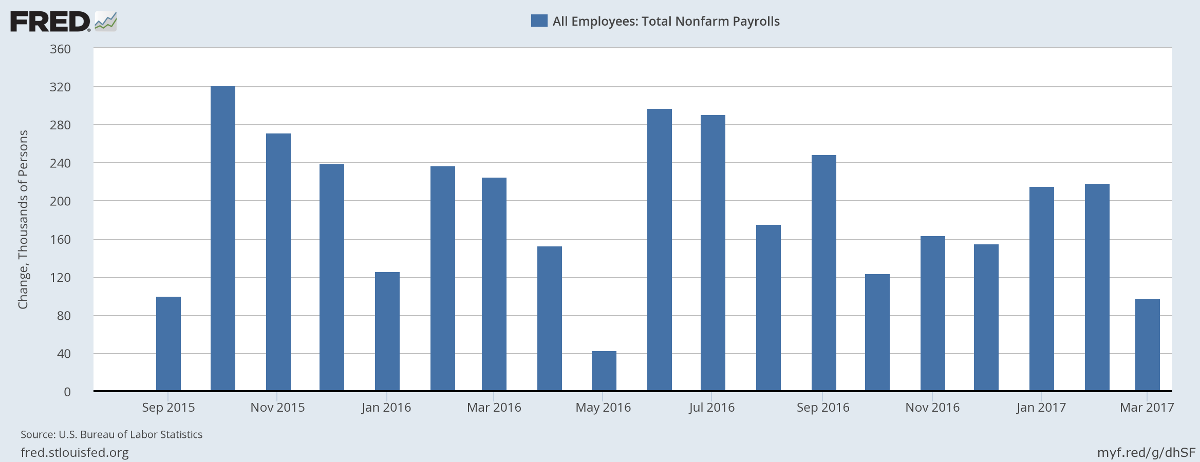

Job gains were the lowest since May 2016.

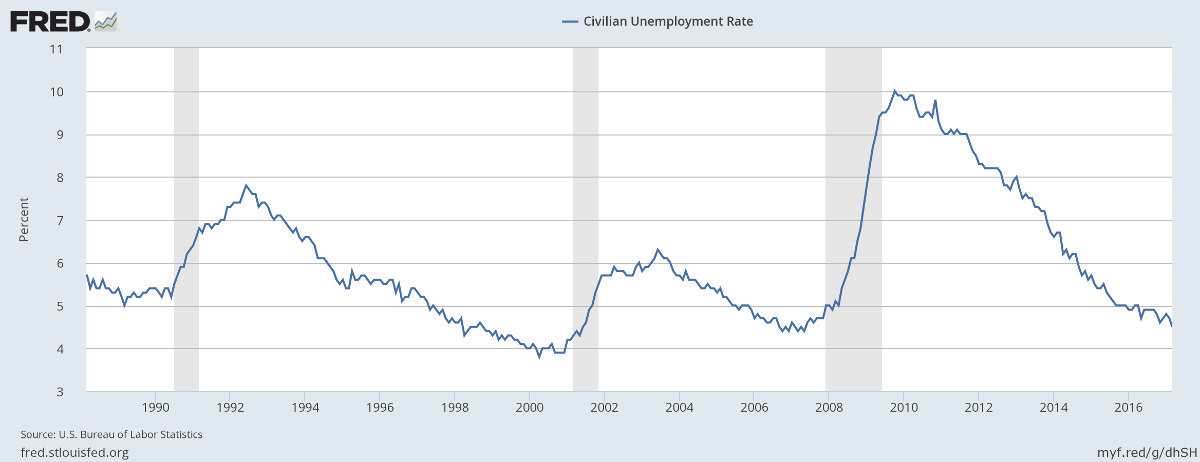

But the unemployment rate fell to a low 4.5%.

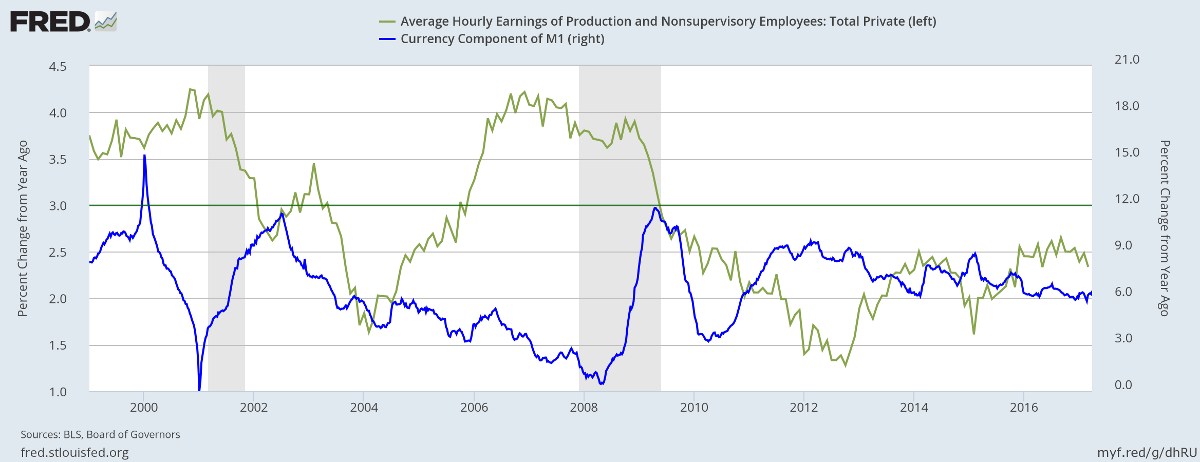

Hourly wage rate growth has eased below 2.5%, suggesting that underlying inflationary pressures are contained.

The Fed is unlikely to accelerate its normalization of interest rates unless we see a surge in core inflation and/or hourly earnings growth.

Australia

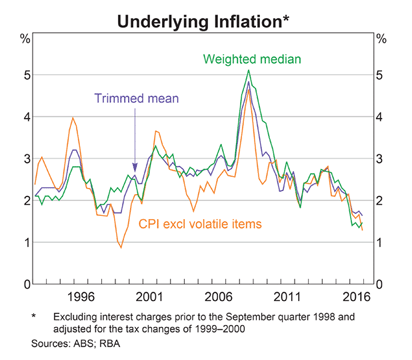

Australia faces shrinking inflationary pressures.

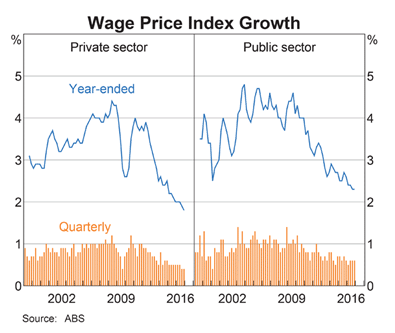

Wage growth is falling.

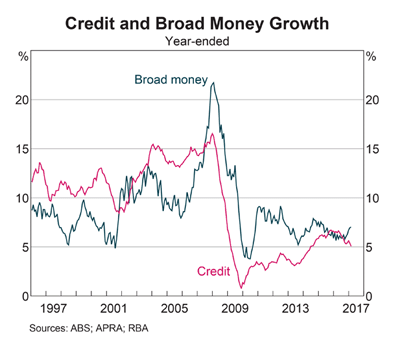

Credit growth is shrinking.

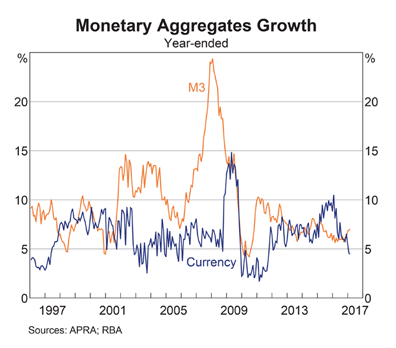

Growth of currency in circulation is also slowing. The fall below 5% warns of a contraction.

One piece of good news is that Chinese monetary policy seems to be easing. After a sharp contraction of M1 money stock growth in January, February shows a partial recovery. Collapse of the Chinese property bubble may be deferred a while longer.

Which is good news for iron ore exporters. At least in the short-term.

For my part, I favour an approach to statecraft that embraces principles, as long as it is not stifled by them; and I prefer such principles to be accompanied by steel along with good intentions.

~ Margaret Thatcher: Statecraft (2002)

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.