More evidence of a bull market, except in Australia

By Colin Twiggs

March 25, 2017 8:20 p.m. EDT (10:20 a.m. AEDT)

Disclaimer

Please read the Disclaimer. I am not a licensed investment adviser.

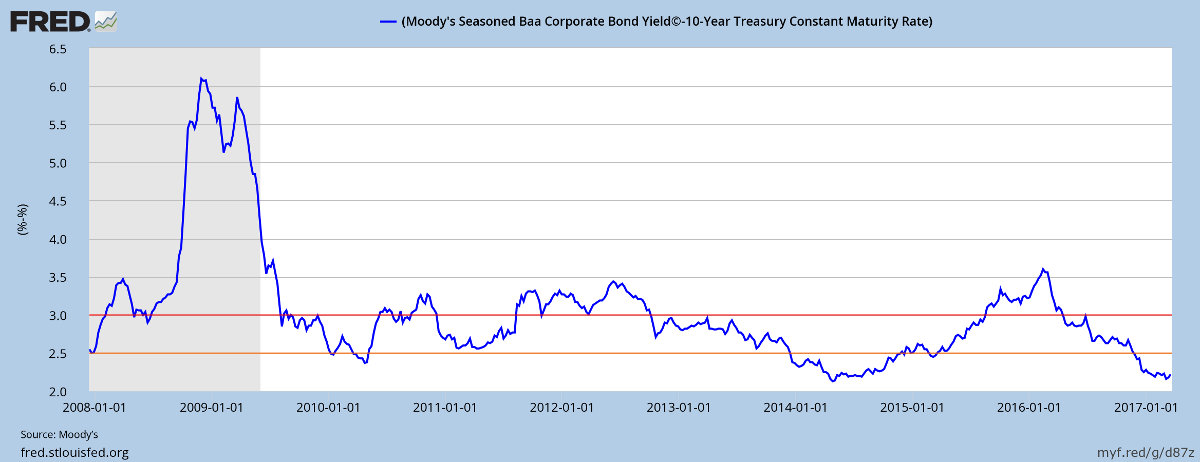

One of my favorite indicators of financial market stress is Corporate bond spreads. The premium charged on the lowest level of investment-grade corporate bonds, over the equivalent 10-year Treasury yield, is a great measure of the level of financial market stress.

Levels below 2 percent — not seen since 2004 - 2007 and 1994 - 1998 before that — are indicative of a raging bull market. The current level of 2.24 percent is slightly higher, reflecting some caution, but way below elevated levels around 3 percent.

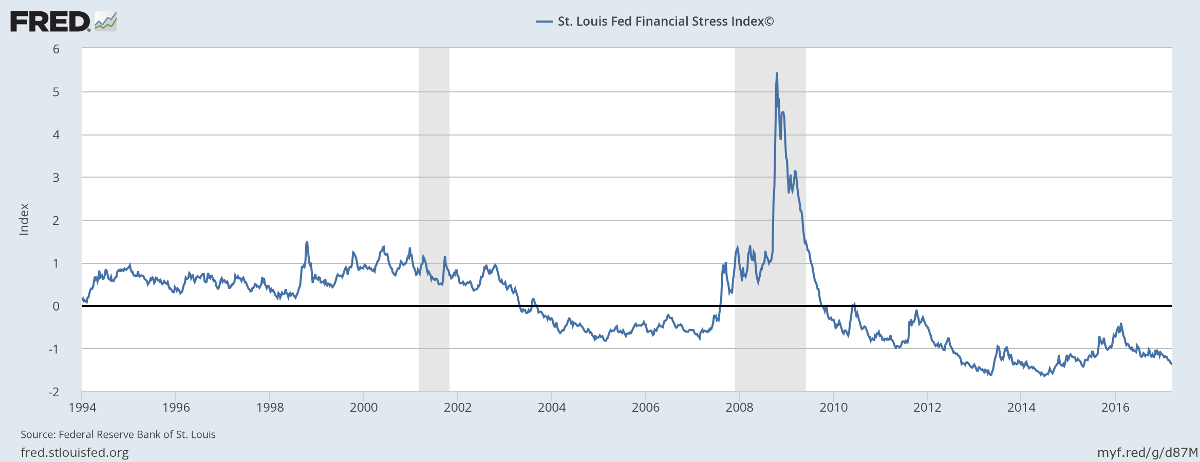

The Financial Stress Index from St Louis Fed measures the degree of stress in financial markets. Constructed from 18 weekly data series: seven interest rate series, six yield spreads and five other indicators. The average value of the index is designed to be zero (representing normal market conditions); values below zero suggest low financial stress, while values above zero suggest high market stress.

Current levels, below -1, also indicate unusually low levels of financial market stress.

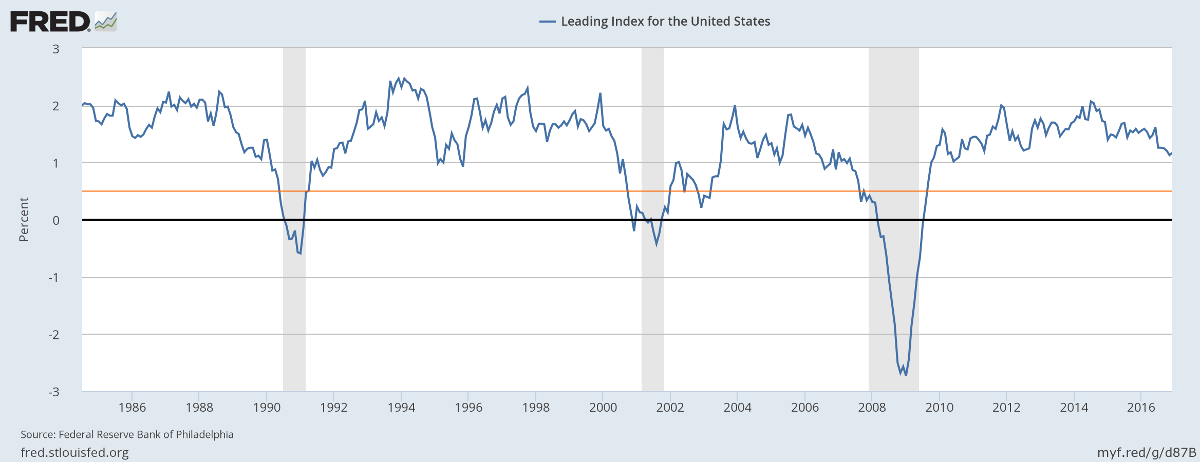

Leading Index

The Leading Index from the Philadelphia Fed has declined slightly in recent years but remains healthy, at above 1 percent.

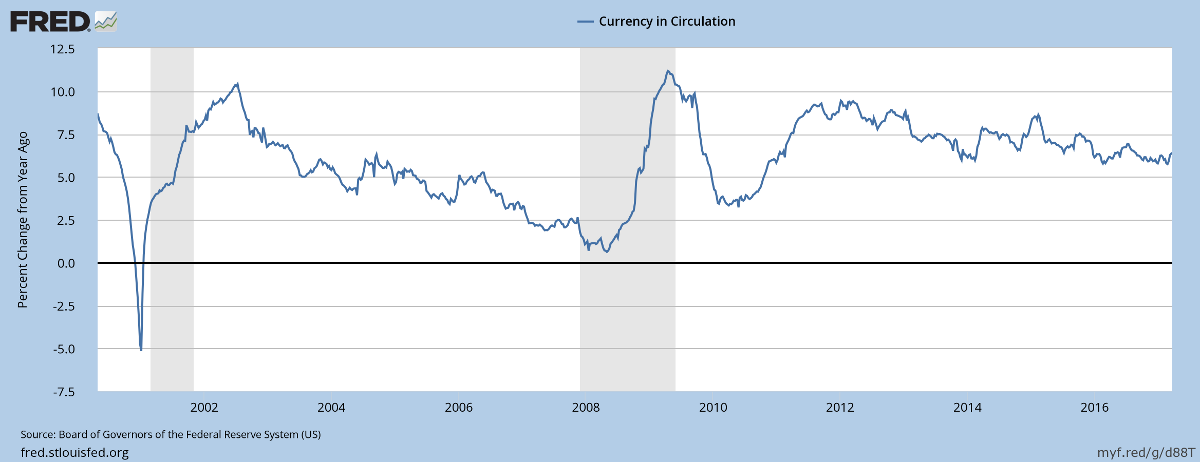

Currency in Circulation

Most recessions are preceded by growth in currency in circulation falling below 5 percent, warning that the economy is contracting.

Current levels, above 5 percent, reflect healthy financial markets.

Australia

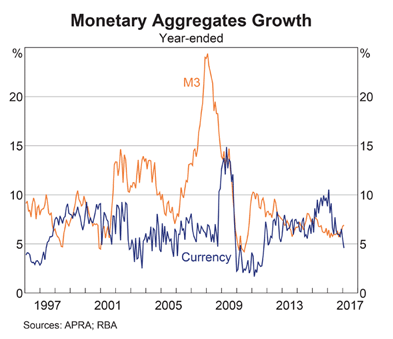

On the other side of the Pacific, currency growth is shrinking, below 5 percent for the first time in 7 years. A sustained fall would warn that the economy is contracting.

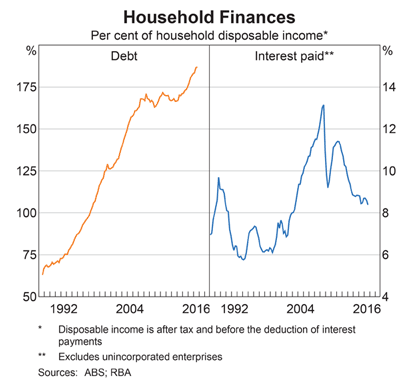

Further rate cuts, to stimulate the economy, are unlikely. The ratio of Household Debt to Disposable Income is climbing and the RBA would be reluctant to add more fuel to the bonfire.

There is no immediate pressure on the RBA to raise interest rates, but when the time comes the impact on the housing market could be devastating.

Most of the poverty and misery in the world is due to bad government, lack of democracy, weak states, internal strife, and so on. We do need to intervene, to improve political and economic conditions inside countries that have bad governments, where people are suffering. One way of doing this, without violating sovereignty, is through constructive actions — reinforcements and incentives for countries that are moving in the right direction, toward an open society, a market economy, et cetera. That is what I'm advocating. I'm advocating preventive action of a constructive nature. And I would use military force only as the very last resort, when nothing else works.

~ George Soros

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.