Dow: How long will stage III last?

By Colin Twiggs

March 10, 2017 8:40 p.m. ET (12:40 p.m. AEDT)

Disclaimer

Please read the Disclaimer. I am not a licensed investment adviser.

Job Growth, Wage Rates & Inflation

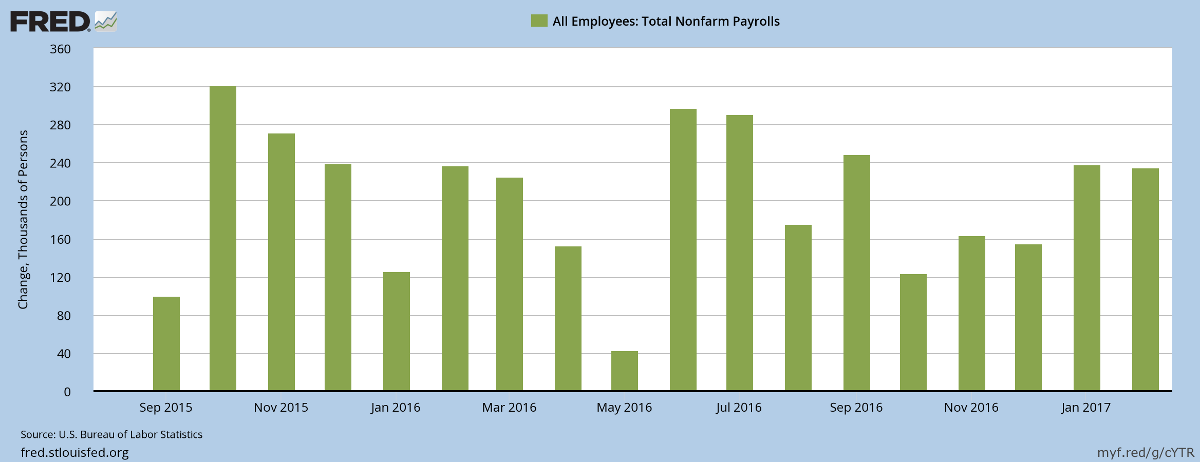

Payrolls jumped by a seasonally adjusted 235,000 jobs in February, setting the Fed on track for another rate rise next week.

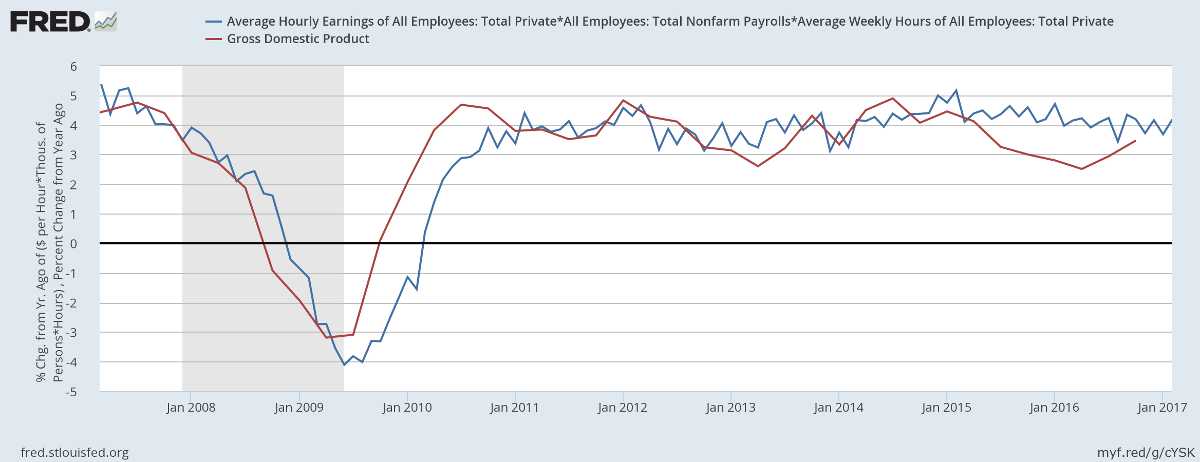

GDP growth is projected to lift in line with employment, wage rates and hours worked. At this stage, the Fed is still attempting to normalize interest rates rather than slow the economy to cool inflationary pressures.

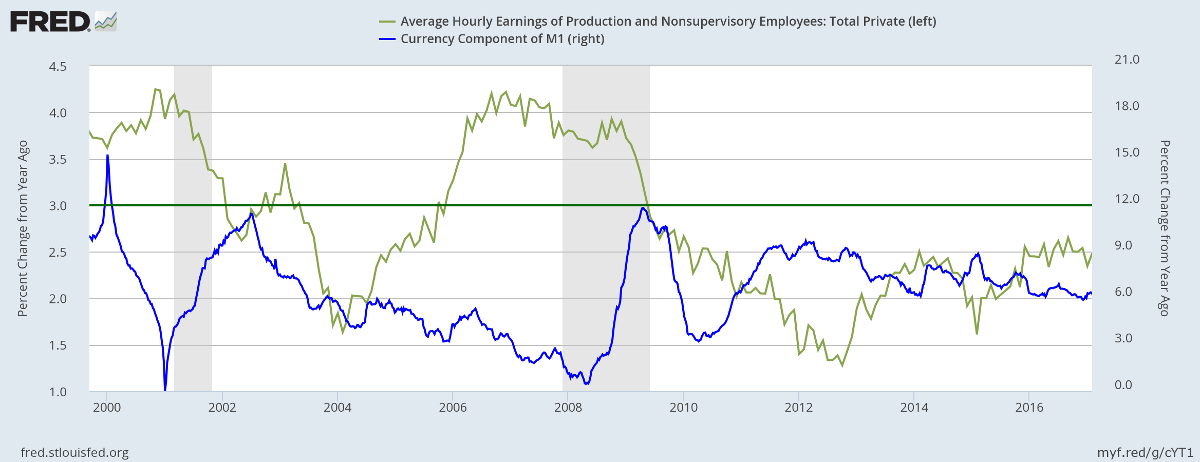

Wage rate growth remains muted, at close to 2.5 percent, so rate hikes are likely to proceed at a gradual pace.

The need to tighten monetary policy is only likely to be seriously considered when wage rate growth [light green] exceeds 3.0 percent [dark green line]. Then you are likely to witness a dip in money supply growth [blue], as in 2000 and 2006, with bearish consequences for stocks.

Dow Jones Industrial Average

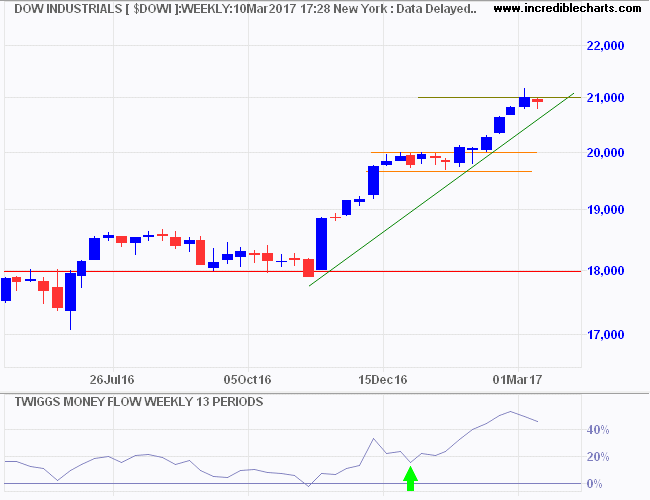

Dow Jones Industrial Average is testing resistance at 21000. Another narrow consolidation, as in December-January, would confirm strong buying pressure already signaled by rising Twiggs Money Flow troughs above zero.

We are witnessing stage III of a bull market. While this is the final leg, it could last several weeks or several years. My guess is that it will last until the Fed is forced to hike interest rates in 2018, to cool inflation.

Australia

Australia's economic growth is slowing.

Employment and Participation rates are falling.

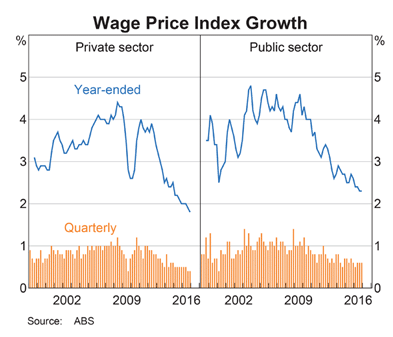

Wage rate growth is slowing.

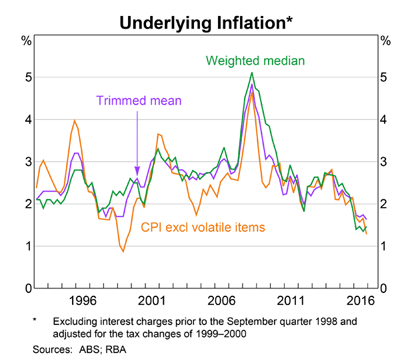

Slowing wage rate growth and inflation confirm that the economy is faltering.

The RBA, with one eye on the housing bubble, has indicated its reluctance to cut rates further. Increased infrastructure spending by Federal and State governments seems the only viable alternative.

With the motor industry winding down and apartment construction headed for a cliff, this is becoming increasingly urgent.

Men must be decided on what they will not do, and then they are able to act with vigor in what they ought to do.

~ Mencius

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.