A tectonic shift

By Colin Twiggs

January 20, 2017 8:30 p.m. ET (12:30 p.m. AEDT)

Disclaimer

I am not a licensed investment adviser. Please read the Disclaimer.

Donald Trump was sworn in today as the 45th President of the United States. After a particularly acrimonious campaign, moves are already afoot to discredit the new president. Leaking of unverified intelligence reports, speculating on compromising material that may be held by Russia, and investigation into financial linkages between the Trump business empire and Russian money, are merely the first salvos in an ongoing battle.

That is nothing new and is unlikely to have a major impact on the economy.

But we face a tectonic shift in global trade relations not seen since the 1930s. Donald Trump has opposed global trade liberalization since the 1980s, arguing that trading partners — Japan, Mexico, China and others — benefit from free trade while the US suffers. A long string of trade deficits — the US has not recorded a trade surplus since 1975 — are often cited as proof. Trump's new trade team has strong links to the US Steel industry which has been fighting foreign imports through anti-dumping laws and imposition of tariffs for decades.

International trading partners, notably China, have already indicated they will respond to Trump with protectionist policies of their own. This could lead to trade wars, if it gets out of hand, and harm global trade.

The second wild card is Brexit, where Theresa May has the unenviable task of crafting a new trade position that conforms with her mandate, to control immigration, while doing limited harm to the UK economy. Eventual outcome of negotiations with the EU are unknown.

New global trade policies will take time to formulate. The uncertainty is bound to delay new investment, by global manufacturers and exporters, and retard economic growth.

Investors are advised to be selective in their choice of investments, with an overall defensive bias. That may be difficult to achieve as I find many defensive stocks, especially in the S&P 500, to be over-priced.

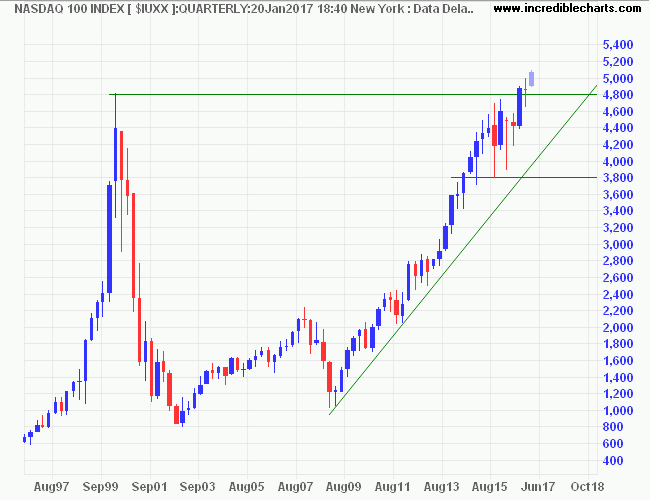

United States

The tech-heavy Nasdaq 100 followed through above 5000, after breaking its Dotcom-era high of 4800, signaling another primary advance.

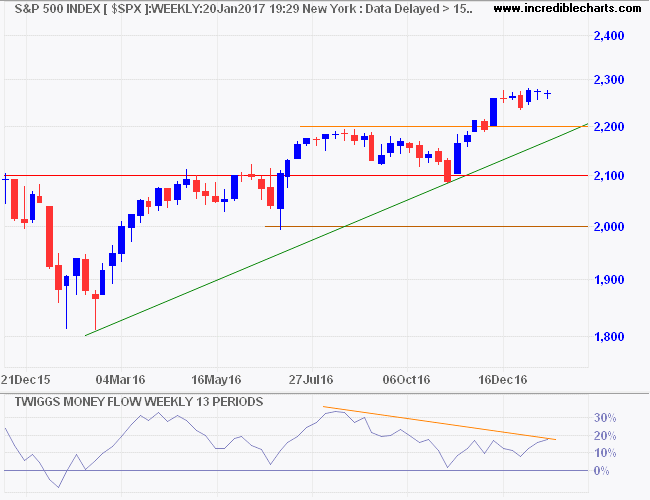

The S&P 500 has consolidated over the last month, with mild divergence on Twiggs Money Flow reflecting a lack of enthusiasm from buyers. Reversal below 2200 would warn that the long-term trend is losing momentum. Breakout above 2300 would offer a short-term target of 2400.

* Target short-term: 2300 + ( 2300 - 2200 ) = 2400

Europe

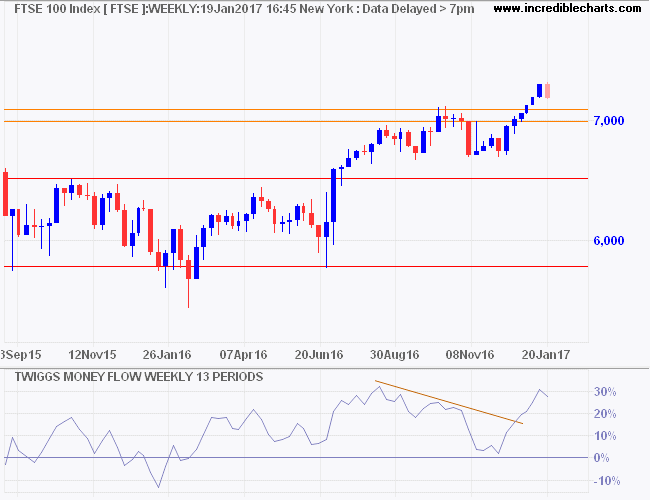

The FTSE 100 is retracing to test its new support level after breaking its Dotcom-era high of 7000. Respect would signal another primary advance, fueled by the weaker Pound Sterling.

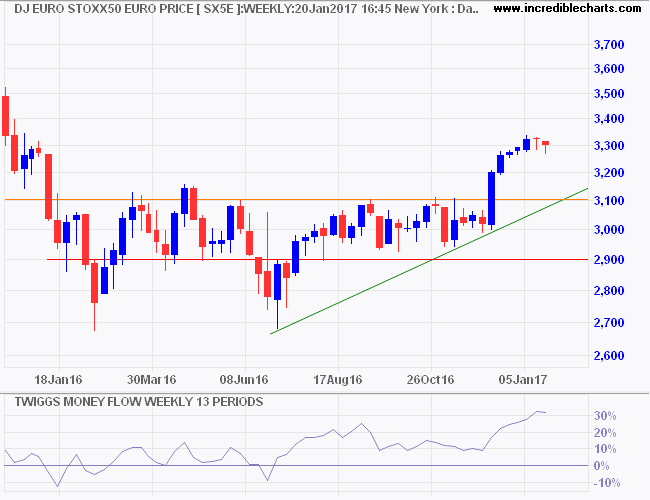

Dow Jones Euro Stoxx 50 also enjoyed a Trump rally but retracement now looks likely, testing new support at 3100. Rising Twiggs Money Flow troughs (above zero) suggest long-term buying pressure.

Australia

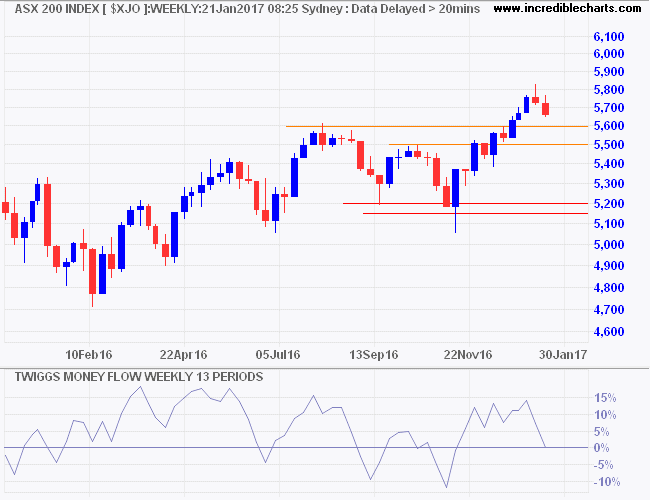

The ASX 200 is retracing to test support at 5500/5600. Decline of Twiggs Money Flow below zero would warn of selling pressure and a possible test of 5200.

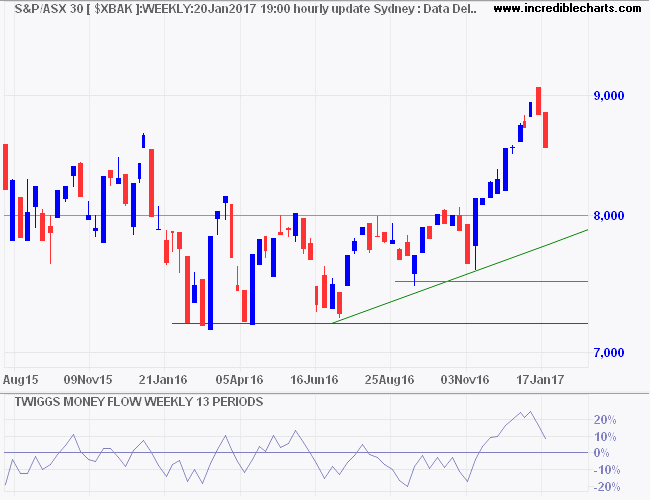

The ASX 300 Banks Index retreated from resistance at 9000. Expect a test of 8000. Respect would confirm the primary up-trend.

Some people get rich studying artificial intelligence. Me, I make money studying natural stupidity.

~ Carl Icahn

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.