Nasdaq 100 breaks its Dotcom high

By Colin Twiggs

December 15, 2016 2:30 a.m. ET (6:30 p.m. AEDT)

Disclaimer

I am not a licensed investment adviser. Please read the Disclaimer.

Seasons Greetings

This is my last weekly market update for the year. I will be taking a break over Christmas and the New Year and will return on January 16th. I will drop you a note if I see anything interesting. Otherwise, if I don't see you before then, I wish you peace and goodwill over the Christmas season and prosperity in the year ahead.

United States

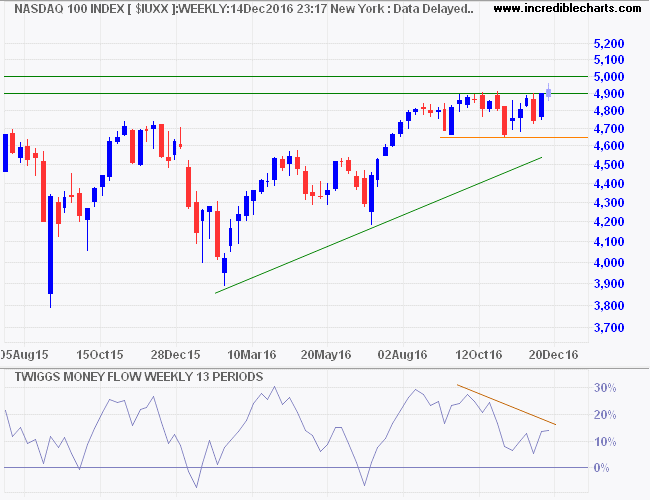

Tech-heavy Nasdaq 100 broke through its all-time high at 4900, first reached in the Dotcom bubble of 1999/2000. Follow-through above 5000 would signal another primary advance. Bearish divergence on 13-week Twiggs Money Flow warns of medium-term selling pressure, possibly profit-taking at the long-term high.

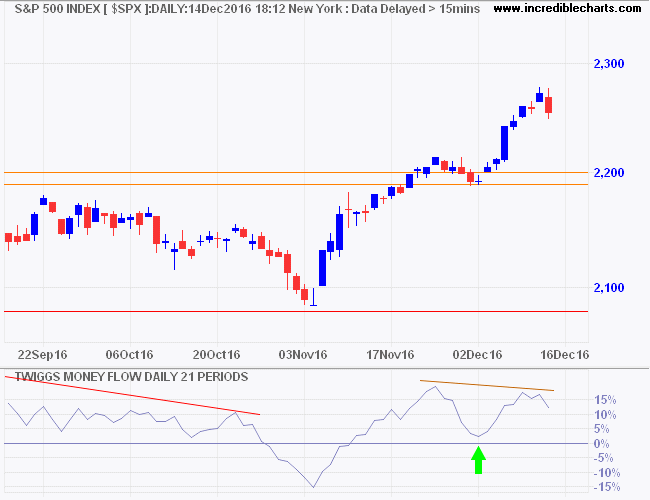

The daily chart of the S&P 500 also shows bearish divergence, but on 21-day Twiggs Money Flow, indicating only short-term selling pressure; reversal below zero would warn of a correction. Target for the advance is 2300*.

* Target medium-term: 2100 + ( 2200 - 2000 ) = 2300

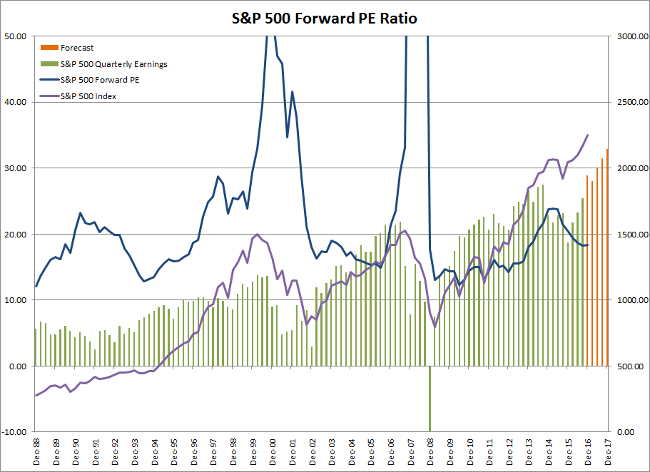

The chart below plots Forward PE (price-earnings ratio) against S&P 500 quarterly earnings. Apologies for the spaghetti chart but each line is important:

- green bars = quarterly earnings

- orange bars = forecast earnings (Dec 2016 to Dec 2017)

- purple line = S&P 500 index

- blue line = forward PE Ratio (Price/Earnings for the next 4 quarters)

The recent peak in Forward PE was due to falling earnings. Price retreated at a slower rate than earnings as the setback was not expected to last. Forward PE has since declined as earnings recovered at a faster rate than the index. But now PE seems to be bottoming as the index accelerates. Reversal of the Forward PE to above 20 would be cause for concern, indicating stocks are highly priced and growing even more expensive, as the index is advancing at a faster pace than earnings.

Remember that the last five bars are only forecasts and actual results may vary. The only time that the market has seen a sustained period with a forward PE greater than 20 was during the Dotcom bubble. Not an experience worth repeating.

Investing is a popularity contest, and the most dangerous thing is to buy something at the peak of its popularity.

~ Howard Marks

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.