ASX 200 breaks support

By Colin Twiggs

October 26, 2016 2:00 a.m. EDT (5:00 pm AEST)

Disclaimer

I am not a licensed investment adviser.

Everything contained in this web site, related newsletters, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers, viewers and course attendees (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

The decision to invest or trade is for the Reader alone. I expressly disclaim all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.

Australia

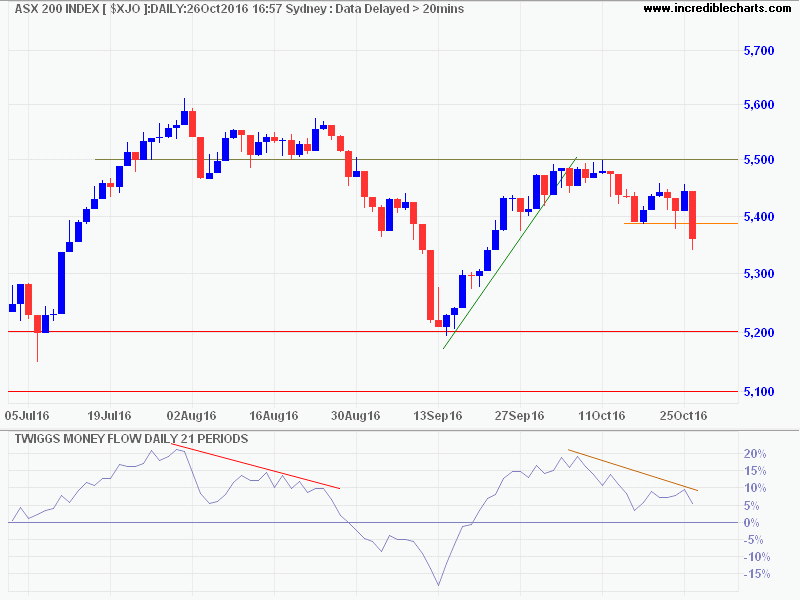

The ASX 200 broke support at 5400 today, signaling another test of primary support at 5200. Declining Twiggs Money Flow warns of selling pressure. Recovery above 5500 is unlikely at present. Breach of 5200 would signal a primary down-trend.

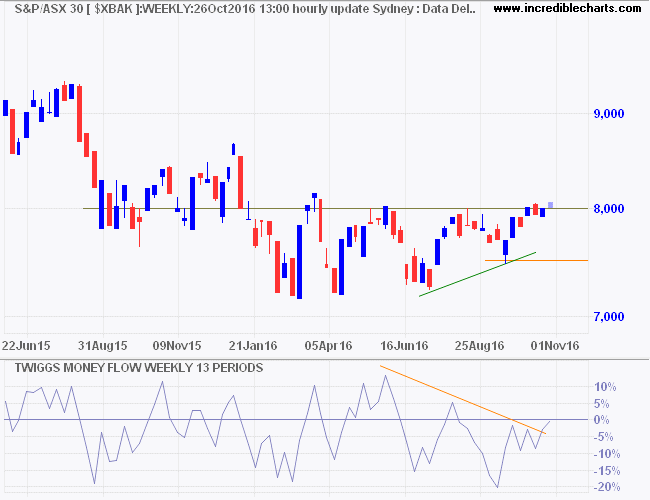

The ASX 300 Banks Index broke through resistance at 8000. Twiggs Money Flow is still negative but recovery above zero now looks likely. Breakout would signal an advance to 8700 but I remain cautious and would wait for a retracement to respect the new support level.

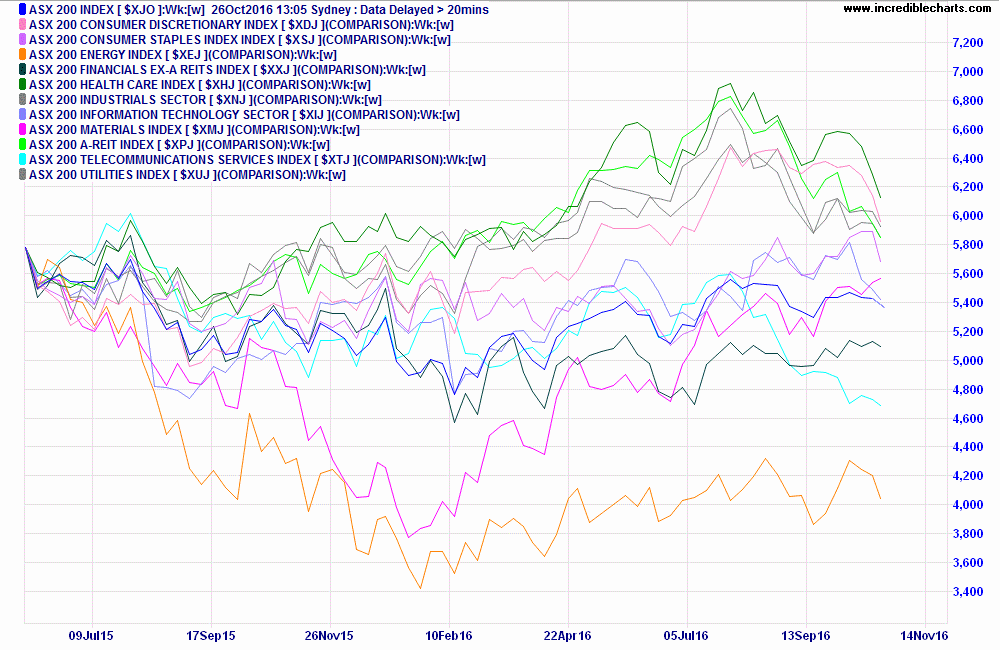

If we look at the ASX 200 Sectors Chart — select File >> Open Project >> [ASX 200 Sectors] — Financials (ex-REITS) (dark green) have held steady against the index over the past two months. Poorest performers are Health Care, REITS, Consumer Discretionary, Utilities, Industrials and Telcos. Materials, followed by Staples, are the best performers.

Financials and Materials both seem vulnerable to a property bubble. Just in different parts of the world: Financials in Australia, Materials in China.

When liberty exceeds intelligence, it begets chaos, which begets dictatorship.

~ Will Durant

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.