Credit bubbles and their consequences

By Colin Twiggs

September 13, 2016 9:30 p.m. EDT/11:30 a.m. AEST

Disclaimer

I am not a licensed investment adviser.

Everything contained in this web site, related newsletters, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers, viewers and course attendees (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

The decision to invest or trade is for the Reader alone. I expressly disclaim all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.

Interesting paper from the San Francisco Fed by Oscar Jorda, VP Economic Research at the Fed, Moritz Schularick, professor of economics at the University of Bonn, and Alan M. Taylor, professor of economics and finance at the University of California, Davis. They discuss the difficulty in identifying asset bubbles and the relationship of asset bubbles to credit.

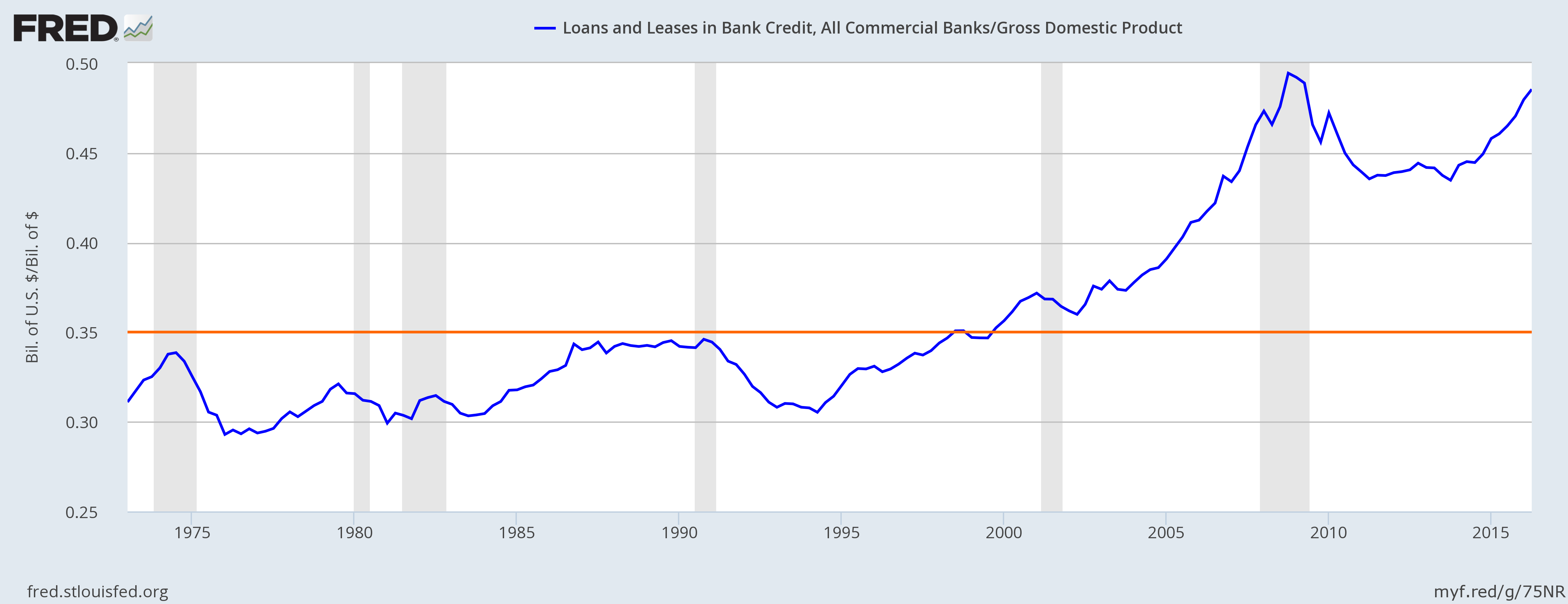

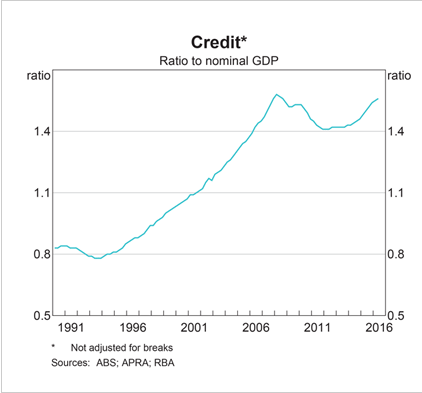

A defining feature of advanced economies in the post-World War II era is the rise of credit documented in Jorda, Schularick, and Taylor (2016). This is visible in Figure 1, which displays the cross-country average ratio to GDP of unsecured and mortgage lending since 1870. Following a period of relative stability, both lending ratios grew rapidly after the war, with mortgages taking off in the mid-1980s....

Most buyers use mortgages to buy homes, but few savers use borrowed funds to invest in the stock market. Thus, one might expect equity price busts to be less dangerous than collapses in house prices: A crash in the price of assets financed with external (rather than internal) funds is likely to have deeper effects on the economy. As collateral values evaporate, some agents will delever to reduce their debt burden, in turn causing a further collapse in asset prices and in aggregate demand. The more widespread this type of leverage is, the more extensive the damage to the economy. Integrating the role of credit into the analysis of asset price bubbles is therefore critical.

Anna Schwartz spoke on the issue in a 2008 interview with the Wall St Journal. Then 92 years old, the co-author with Milton Friedman of A Monetary History of the United States (1963) nailed the cause of asset bubbles:

If you investigate individually the manias that the market has so dubbed over the years, in every case, it was expansive monetary policy that generated the boom in an asset. The particular asset varied from one boom to another. But the basic underlying propagator was too-easy monetary policy and too-low interest rates .....

The problem is not asset bubbles, whether they be in stocks, housing or Dutch tulips. That is merely a symptom of a deeper malaise: too easy monetary policy. The real threat is the underlying credit expansion that caused the problem in the first place.

And while asset bubbles may be difficult to measure, credit bubbles are easy to identify. If credit grows at a faster rate than GDP, that is a credit expansion. The ratio of credit to GDP should be maintained in a narrow, horizontal band.

Easy to monitor and easy to correct, if you are looking in the right place. But central banks are good at looking elsewhere — and closing the gate long after the horse has bolted. A similar problem is evident in Australia.

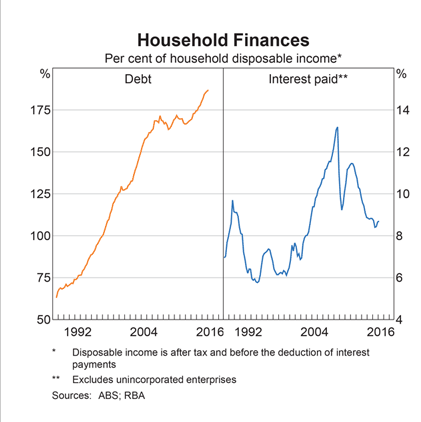

Even worse if we look at household credit to disposable income (on the left below).

Unfortunately the horse has bolted and attempting to contract the level of debt would cause a deflationary spiral with devastating consequences. The only way to restore sanity is to hold debt steady at current (nominal) levels and allow growth and inflation to gradually reduce the GDP ratio to more stable levels.

The Great Depression was not some Act of God or the result of some deep-rooted contradictions of capitalism, but the direct result of a series of misjudgements by economic policy makers, some made back in the 1920s, others after the first crises set in — by any measure the most dramatic sequence of collective blunders ever made by financial officials. More than anything else, therefore, the Great Depression was caused by a failure of intellectual will, a lack of understanding about how the economy operated.

~ Lords of Finance by Liaquat Ahamed

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.