US weekly earnings slow

By Colin Twiggs

September 7, 2016 9:30 p.m. EDT/11:30 a.m. AEST

Disclaimer

I am not a licensed investment adviser.

Everything contained in this web site, related newsletters, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers, viewers and course attendees (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

The decision to invest or trade is for the Reader alone. I expressly disclaim all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.

I pointed out several weeks ago that US GDP growth was slowing but was not too concerned because jobs numbers continue to improve. Now I am starting to see further signs that the economy is slowing.

The Institute for Supply Management updated their Non-Manufacturing Index on September 6th:

In August, the NMI® registered 51.4 percent, a decrease of 4.1 percentage points when compared to July's reading of 55.5 percent, indicating continued growth in the non-manufacturing sector for the 79th consecutive month. A reading above 50 percent indicates the non-manufacturing sector economy is generally expanding; below 50 percent indicates the non-manufacturing sector is generally contracting......

But there is weakness in Manufacturing, as the ISM reported last week :

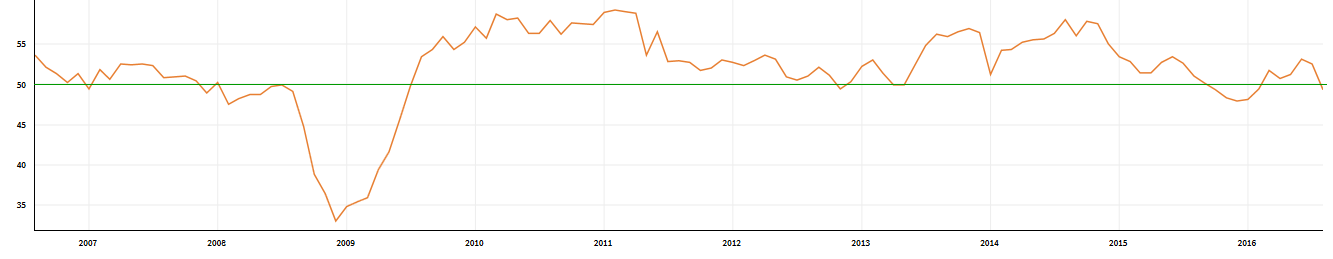

Manufacturing contracted in August as the PMI® registered 49.4 percent, a decrease of 3.2 percentage points from the July reading of 52.6 percent, indicating contraction in manufacturing for the first time since February 2016 when the PMI registered 49.5. A reading above 50 percent indicates that the manufacturing economy is generally expanding; below 50 percent indicates that it is generally contracting.....

A 10-year graph of Manufacturing PMI shows that whipsaws around the 50 level are fairly common and not cause for alarm. A decline below the December 2015 low of 48.0, however, would be cause for concern.

Source: quandl.com

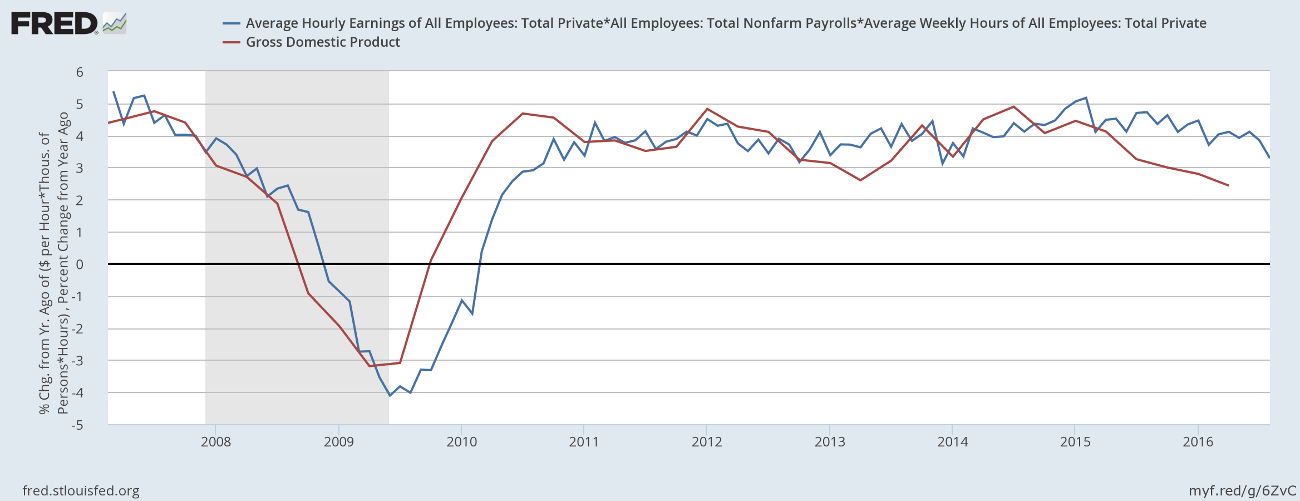

Of greater concern is the declining growth of estimated weekly employee earnings which closely follows GDP. Weekly employee earnings — estimated by multiplying Total Non-farm Payrolls by Average Weekly Hours (Total Private) and Average Hourly Earnings — have held around the 4.0 percent level since early 2014 but are now tracking the decline of GDP. Further falls in Nominal GDP, below 2.43% p.a. from the second quarter, now appear likely.

Source: FRED/ US Bureau of Labor Statistics

Firmness, both in sufferance and exertion, is a character which I would wish to possess. I have always despised the whining yelp of complaint and the cowardly, feeble resolve.

~ Robert Burns

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.