The real problem: Private Investment

By Colin Twiggs

August 1st, 2016 12:30 a.m. EDT/2:30 p.m. AEST

Advice herein is provided for the general information of readers and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no reader should act on the basis of any information contained herein without first having consulted a suitably qualified financial advisor.

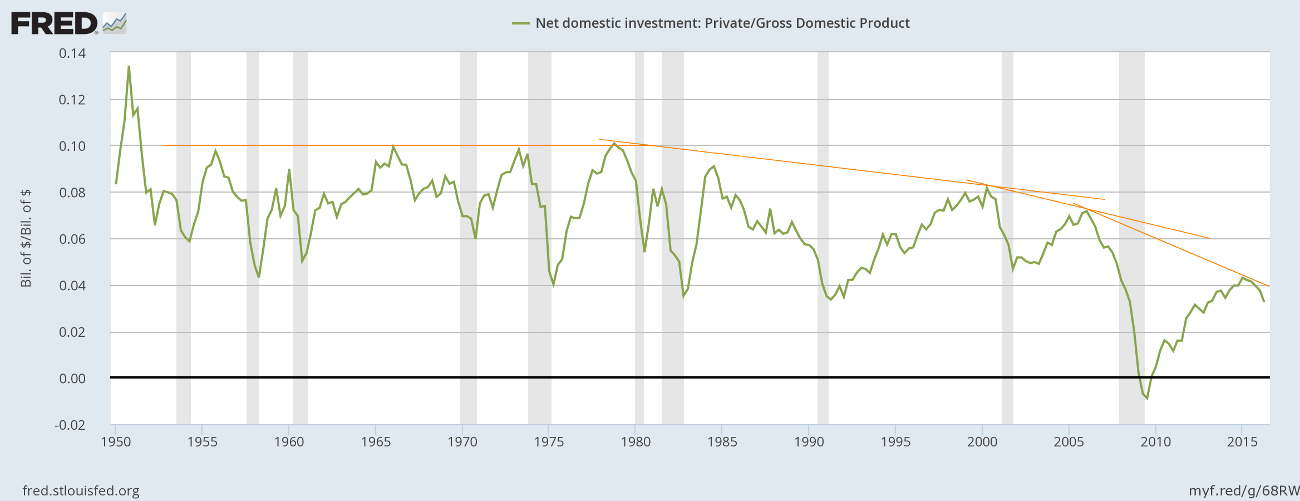

Want to know the real cause of low GDP growth? Look no further than Private Investment.

Private Investment ran with peaks around 10 percent of GDP and troughs around 4 percent throughout the 1960s, 70s and most of the 80s. Since then Private Investment has declined to the point that the latest peak is close to 4 percent.

It is highly unlikely that the US will be able to sustain GDP growth if the rate of investment continues to decline. GDP growth is a factor of population growth and productivity growth. Productivity growth is not primarily caused by people working harder but by working more efficiently, with better tools and equipment. Using an earthmover rather than a wheelbarrow and shovel for example. Falling investment means fewer new tools and efficiencies.

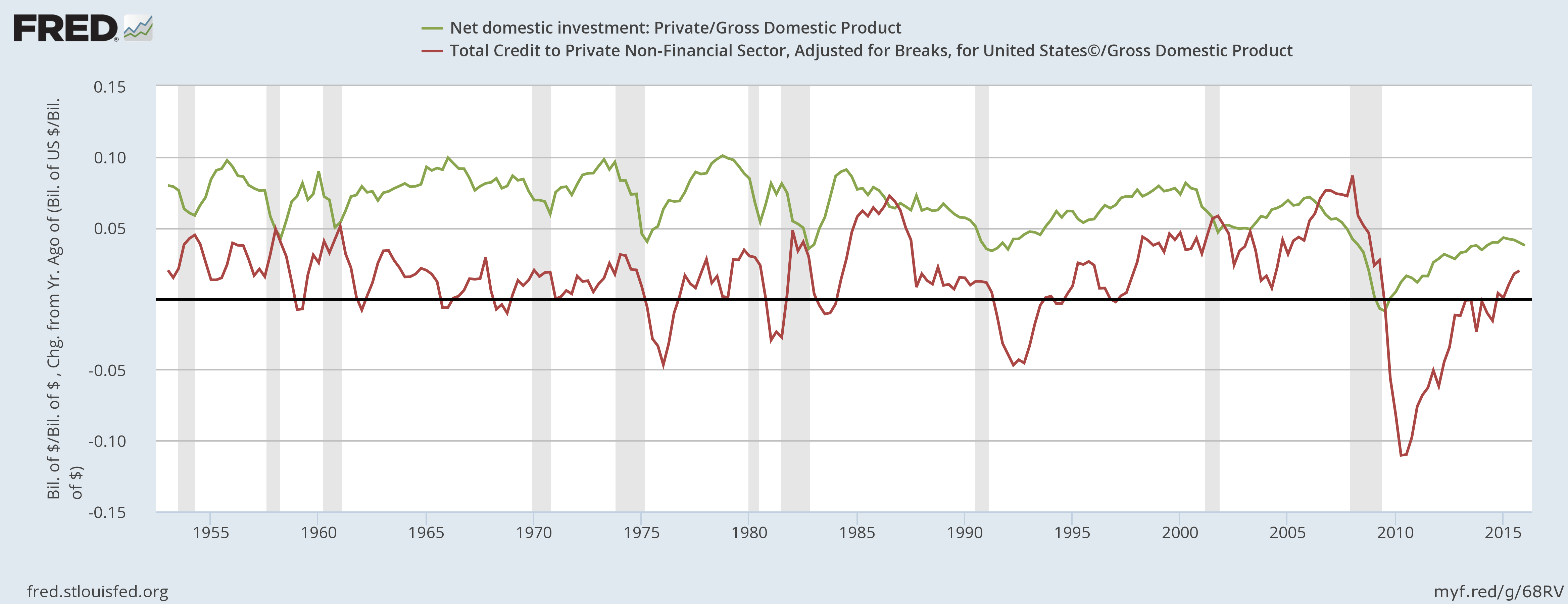

The second graph plots the annual increase in private debt against GDP. You would think that this figure would fall — in line with falling rates of investment. Quite the opposite. Private debt growth is rising. While annual debt growth is nowhere near the red flag of 5 percent of GDP, if it crosses above the rate of private investment — as in 2006 to 2009 — I would consider that a harbinger of another crash.

Reality is the leading cause of stress amongst those in touch with it...

~ Lily Tomlin.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.