S&P 500 earnings on the mend

By Colin Twiggs

July 29, 2016 9:30 p.m. EDT (11:30 a.m. AEST)

Advice herein is provided for the general information of readers and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no reader should act on the basis of any information contained herein without first having consulted a suitably qualified financial advisor.

Please note

I have resigned as a director of Porter Capital Management Pty Ltd ("Porter Capital") and Porter Private Clients Pty Ltd ("Porter Private") as I find this interferes with my primary business (Incredible Charts). In future, I will no longer publish newsletters under the banner of Research & Investment, nor investment updates. Alternative arrangements will be made to accommodate existing subscribers.

I do not work under an AFSL and would like to remind readers that any advice in these newsletters and on the website is provided for their general information and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no reader should act on the basis of any information contained herein without first having consulted a suitably qualified financial advisor.

Global

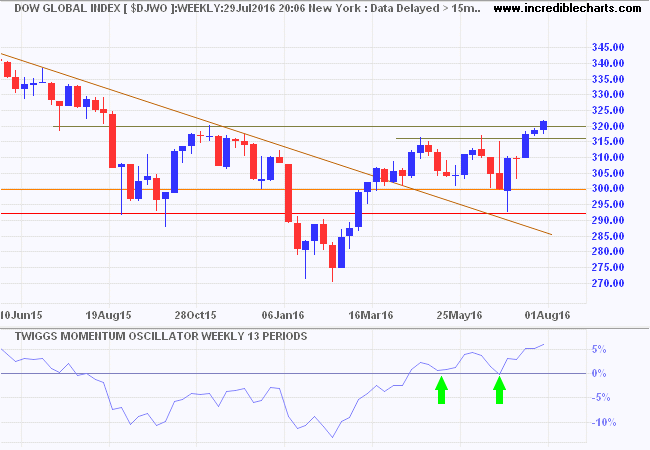

Dow Jones Global Index followed through above the October 2015 high of 320, adding further confirmation of the primary up-trend, after the recent breakout. Momentum troughs above zero also signal trend strength.

North America

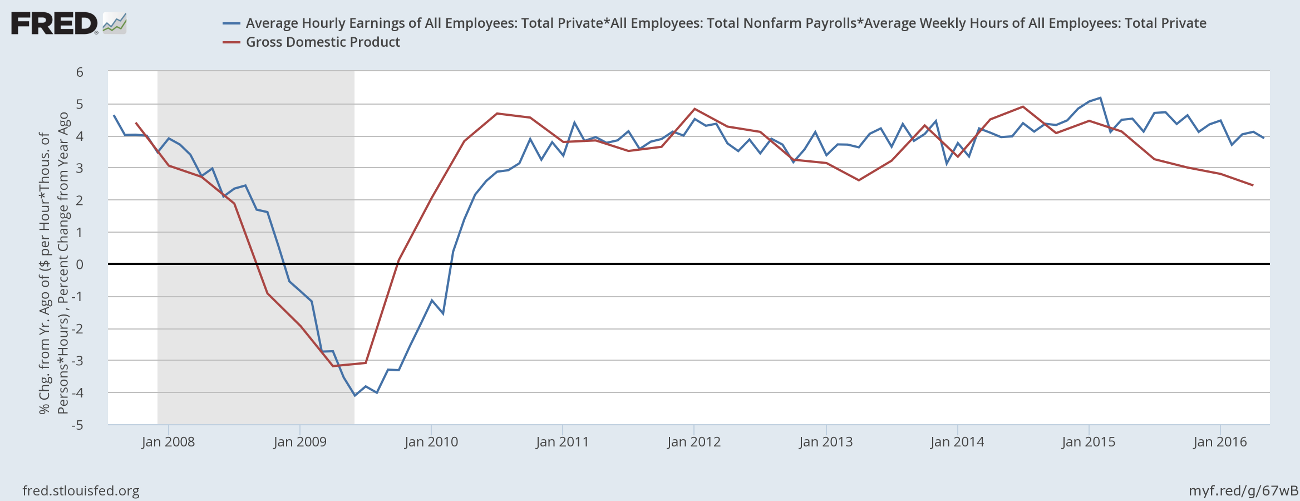

US real gross domestic product increased at a low annual rate of 1.2 percent in the second quarter of 2016, according to the advance estimate released by the Bureau of Economic Analysis. In the first quarter, real GDP increased 0.8 percent (revised down from 1.1 percent).

Nominal GDP (before adjusting for inflation) declined to 2.44 percent, the lowest since 2010. But its surrogate — Total Nonfarm Payrolls x Average Weekly Hours x Average Hourly Earnings — continues to grow at 4.0 percent; so I am not too concerned.

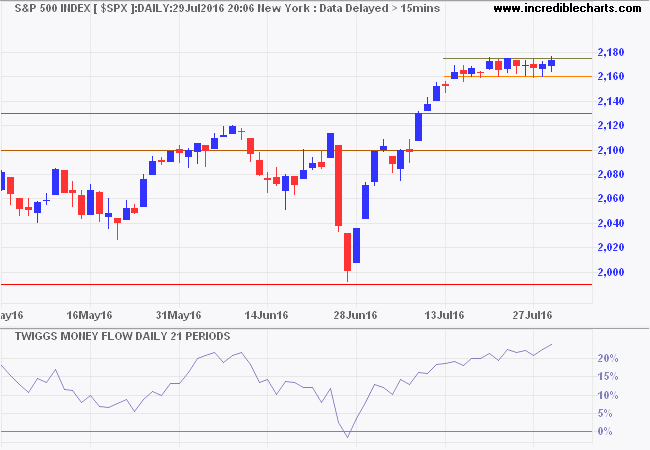

As Reported earnings for the S&P 500, second quarter, are predicted to rise to $24.09 (66.4% of companies have reported). This is higher than the $22.80 for the Q2 in 2015 but lower than the $27.14 of 2014. So earnings are on the mend but have not fully recovered.

The S&P 500 has consolidated in a narrow flag/rectangle over the last week. Narrow consolidations are normally a continuation signal but I am wary of retracement to test the new support level (at 2130) before the index advances much further.

* Target calculation: 2100 + ( 2100 - 1800 ) = 2400

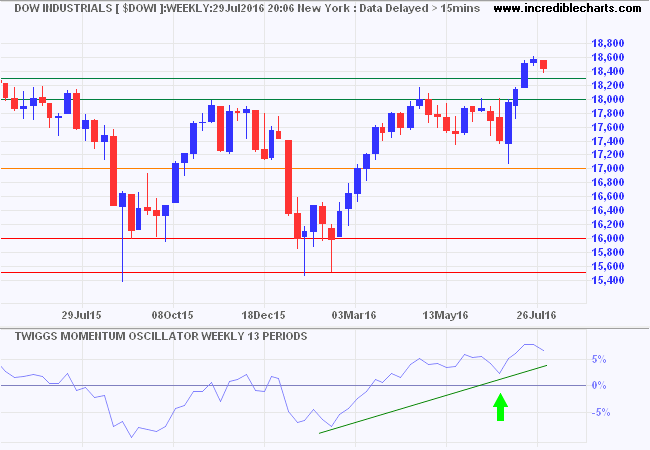

Gentle retracement of the Dow Jones Industrial Average suggests that respect of support at 18300 is likely. Respect would confirm the primary up-trend. Rising Money Flow indicates buying pressure.

* Target calculation: 18000 + ( 18000 - 16000 ) = 20000

VIX continues to indicate low market risk, while the longer term St Louis Fed Financial Stress Index — a composite indicator incorporating interest rates and yield spreads — indicates low stress in financial markets. Values below zero are considered a bullish sign.

Europe

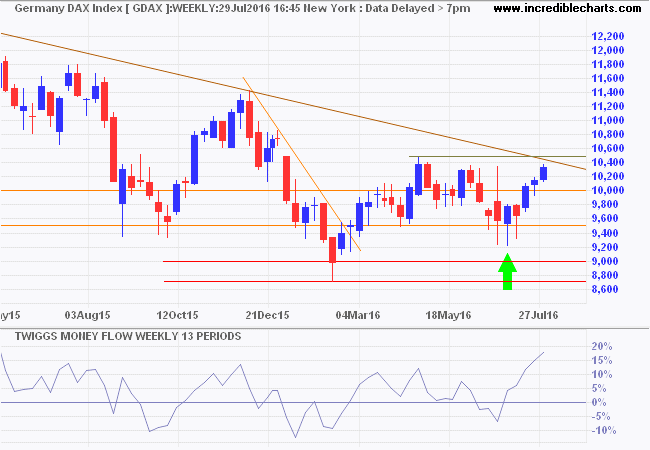

Germany's DAX is heading for a test of resistance at 10500. Breakout would confirm a primary up-trend.

* Target calculation: 10500 + ( 10500 - 9500 ) = 11500

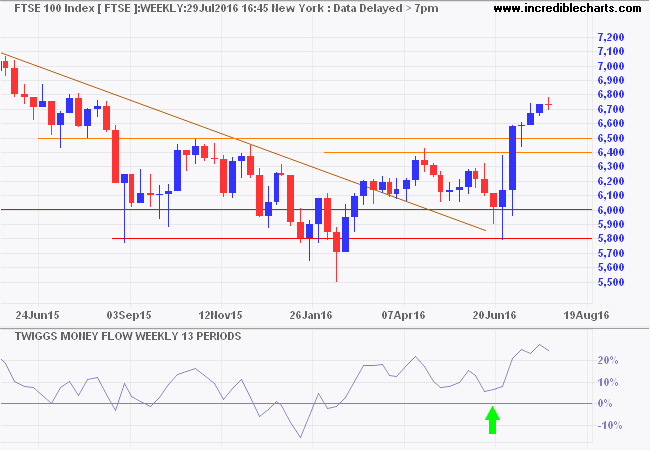

The Footsie is already in a primary up-trend. Expect retracement to test the new support level at 6500. Respect would confirm the primary trend.

* Target calculation: 6500 + ( 6500 - 6000 ) = 7000

Asia

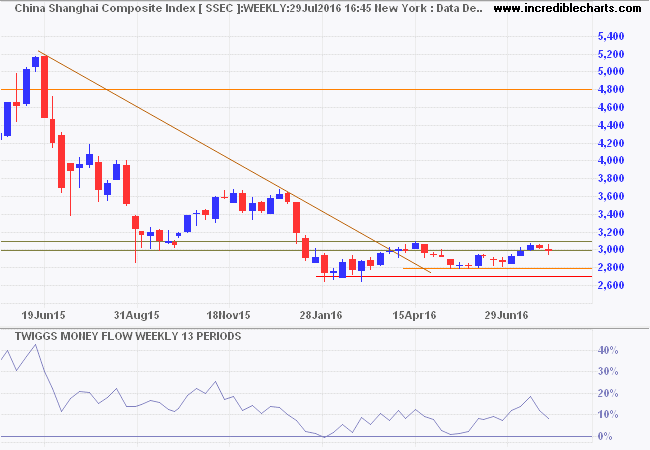

The Shanghai Composite Index retreated from resistance at 3100. Reversal below 3000 would warn of another test of primary support.

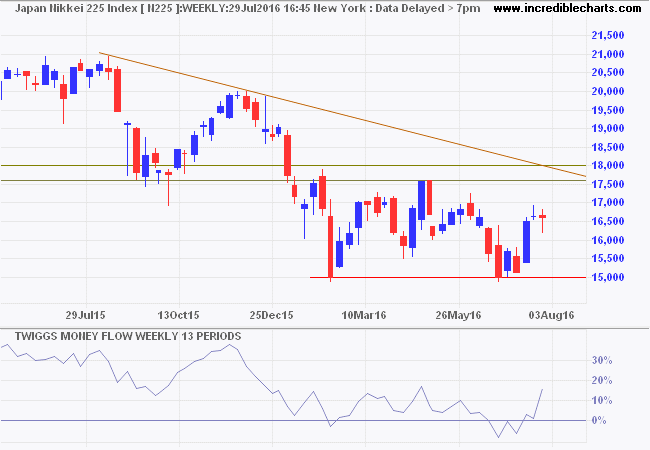

Japan's Nikkei 225 Index has twice respected primary support at 15000. Breakout above 17500 seems would complete a double-bottom reversal.

* Target calculation: 15000 - ( 18000 - 15000 ) = 12000

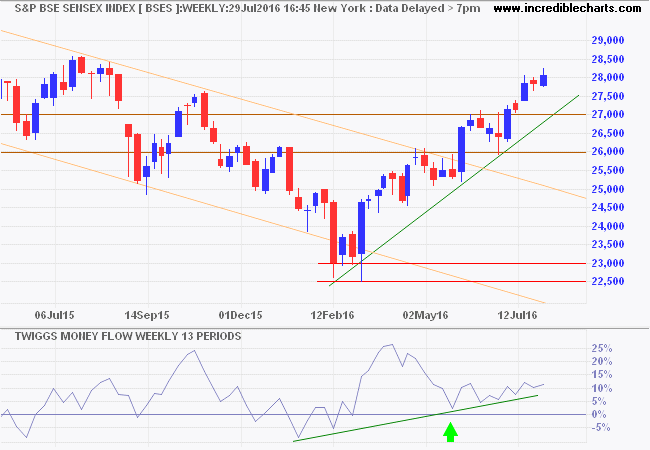

India's Sensex rallied to 28000. Penetration of the rising trendline would warn of a correction. A correction is needed to establish a higher primary support level before the rally becomes over-extended.

Australia

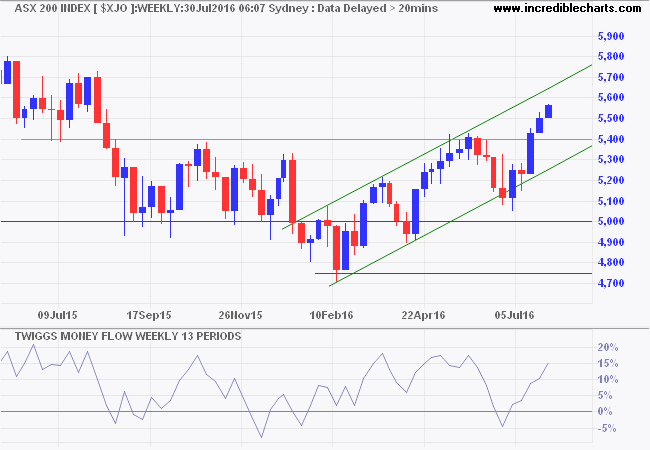

The ASX 200 is headed for a test of the upper trend channel, at 5700*, after breaking resistance at 5400. Subsequent retracement that respects support at 5400 would strengthen the primary up-trend.

* Target calculation: 5400 + ( 5400 - 5100 ) = 5700

An investment in knowledge always pays the best interest.

~ Benjamin Franklin

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.