China currency crisis drives gold

Advice herein is provided for the general information of readers and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no reader should act on the basis of any information contained herein without first having consulted a suitably qualified financial advisor.

By Colin Twiggs

March 21st, 2016 2:00 a.m. EDT (5:00 p.m. AEDT)

China's looming currency crisis

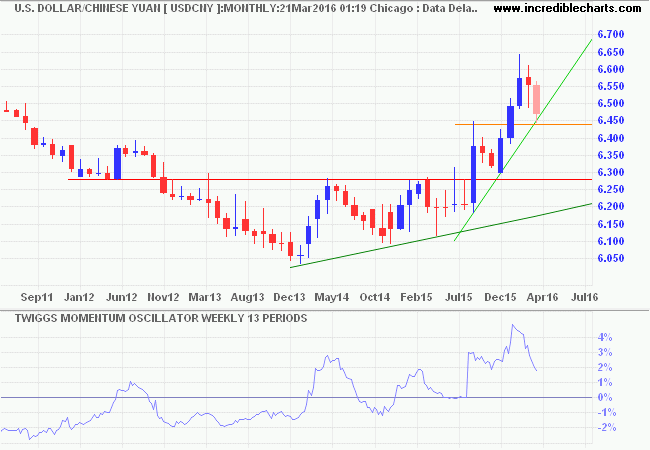

The Yuan strengthened against the Dollar, breaking support at 6.50 (USDCNY) as Chinese authorities attempt to squeeze short-sellers. But the primary trend is unchanged and warns of further weakness. From Anne Stevenson-Yang and Kevin Dougherty at WSJ:

From Anne Stevenson-Yang and Kevin Dougherty at WSJ:

After initial declines in the Chinese market to start the year, the past few weeks have seen signs of what some would call a rebound. Lending in China rose by 67% in January, iron-ore prices initially rallied by 64% and housing sales in the top four markets surged.....

Chinese authorities have been trying to bring back the old, quasisuperstitious belief in Beijing's omnipotence. But the political desperation behind these efforts betrays a different story: that an impending currency crisis is a signal of the dream's undoing. That's why in China getting money out of the country is now the major preoccupation of both families and corporations.

One way to stem the crisis would be through depreciation. That would be sound policy for the people of China, but it's a dreaded last resort for a leadership that wants, more than jobs for its people, to bolster buying power and save political face overseas. Yet history shows that holding the line on the currency is a losing strategy. Tightened liquidity causes more pain to the economy and simply delays the inevitable.

In other countries, currency crises usually followed a sudden and irreversible loss of confidence. The Asian Tigers were booming and then fell apart rapidly. Same in Russia. China faces the added difficulty of having little institutional memory and few tools to manage the economy in a time of capital scarcity. And there is no sign that capital-outflow pressure will ease.

From David Llewellyn-Smith at Macrobusiness:

The macro logic here is impeccable and Ms Ms. Stevenson-Yang knows China better than most. I actually think that Chinese officials already understand this and the current back and forth on yuan policy is them searching for a way to do it in a manageable glide slope rather than crash.

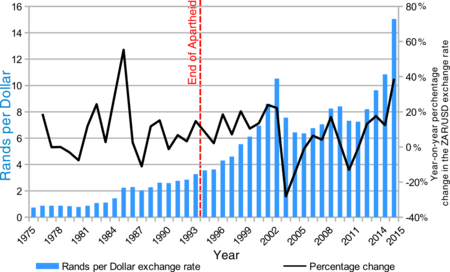

China faces a currency crisis. I lived through one in South Africa in the 1980s and recognize the signs: purchase of offshore homes, local companies bidding for offshore acquisitions, over-invoicing, local residents using ingenious methods to avoid capital controls.....

This graph of the US Dollar/South African Rand exchange rate from Wikipedia covers the early alarm in the 1980s, when the Rand fell from parity to 2:1 against the greenback, through to the current "Zuma-gate" when the Rand hit 15 to the Dollar in late 2015:

Capital controls are too late. The horse has bolted. Trying to prevent Chinese residents from moving their capital to a safer climate is as effective as herding cats. The only way depreciation can work is "shock and awe": a massive once-off devaluation of the Yuan. Gradual weakening of the currency will simply reinforce the panic.

I shudder to imagine the effects a dramatic fall in the Yuan would have on global capital markets. Chinese companies would be forced to default of USD-denominated debt. Trading partners, including the US and Europe, forced to respond with competing devaluations to avoid the contagion. I hope that Chinese officials have been persuaded this is not an option.

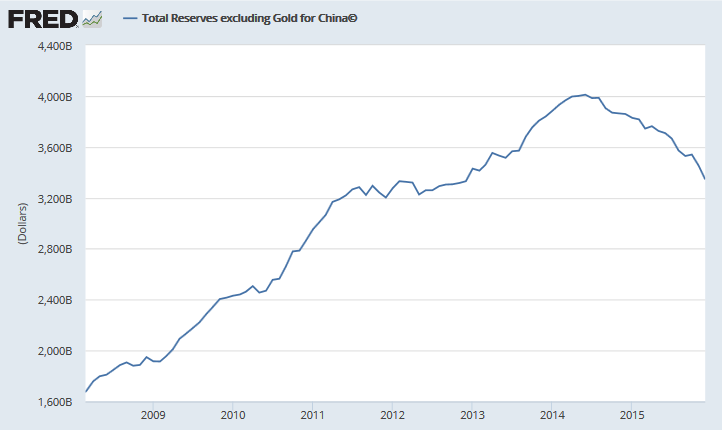

....Which leaves capital controls, and eating through China's $3 trillion plus of foreign reserves to support the Yuan, as the least-worst option. Or is that simply kicking the can down the road?

Hat tip to David Llewellyn-Smith at Macrobusiness.

Crude

Nymex Light Crude futures (June 2016) are testing resistance at $43/barrel. Penetration of the descending trendline indicates that a bottom is forming. Respect of resistance would warn of a decline to test primary support at $30 to $32/barrel. The primary trend remains down but a higher trough would suggest a reversal.

Gold pauses

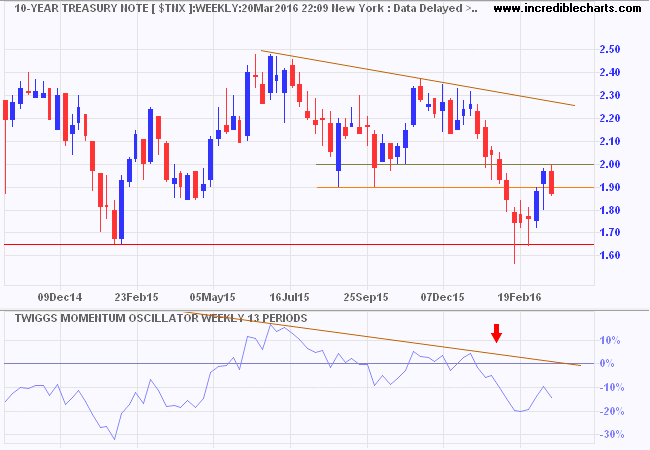

Long-term interest rates remain weak, with 10-year Treasury yields reversal below 1.90 percent warning of another test of primary support at 1.5 to 1.65 percent. Fed softening of their tightening bias reinforces this. Declining 13-week Twiggs Momentum warns of further weakness.

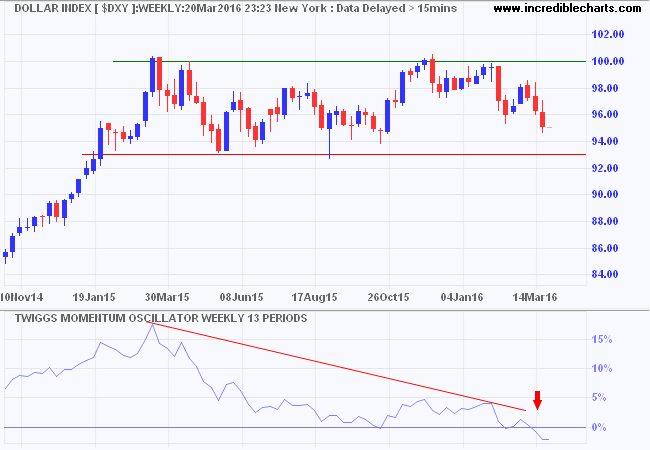

The Dollar Index is trending lower, headed for a test of primary support at 93. Declining 13-week Twiggs Momentum, below zero, warns of a primary down-trend.

Dollar weakness is being driven by China's sell-off of foreign reserves, primarily Dollars, to support the Yuan. This is likely to continue for as long as China maintains its Dollar peg.

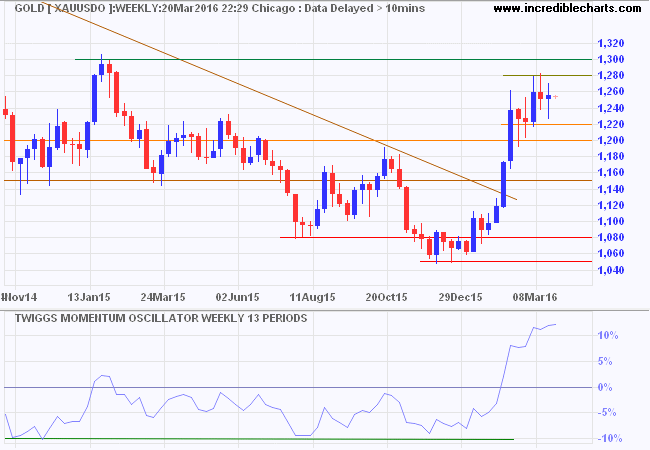

Gold is now a China play, driven by expectations of a depreciating Yuan. Low interest rates and inflation are now secondary influences. Consolidation between $1200 and $1280 is likely to continue for as long as the Yuan strengthens against the Dollar. Any weakness of the Yuan would be likely to drive gold through resistance at $1300/ounce, signaling another advance.

* Target calculation: 1200 + ( 1200 - 1100 ) = 1300

All that is gold does not glitter,

Not all those who wander are lost;

The old that is strong does not wither,

Deep roots are not reached by the frost.~ J.R.R. Tolkien: The Fellowship of the Ring

Disclaimer

Porter Private Clients Pty Ltd, trading as Research & Investment ("R&I"), is a Corporate Authorized Representative (AR Number 384 397) of Andika Pty Ltd which holds an Australian Financial Services Licence (AFSL 297069).

The information on this web site and in the newsletters is general in nature and does not consider your personal circumstances. Please contact your professional financial adviser for advice tailored to your needs.

R&I has made every effort to ensure the reliability of the views and recommendations expressed in the reports published on its websites and newsletters. Our research is based upon information known to us or which was obtained from sources which we believe to be reliable and accurate.

No guarantee as to the capital value of investments, nor future returns are made by R&I. Neither R&I nor its employees make any representation, warranty or guarantee that the information provided is complete, accurate, current or reliable.

You are under no obligation to use these services and should always compare financial services/products to find one which best meets your personal objectives, financial situation or needs.

To the extent permitted by law, R&I and its employees, agents and authorised representatives exclude all liability for any loss or damage (including indirect, special or consequential loss or damage) arising from the use of, or reliance on, any information. If the law prohibits the exclusion of such liability, such liability shall be limited, to the extent permitted by law, to the resupply of the said information or the cost of the said resupply.

Important Warning About Simulated Results

Research & Investment (R&I) specialise in developing, testing and researching investment strategies and systems. Within the R&I web site and newsletters, you will find information about investment strategies and their performance. It is important that you understand that results from R&I research are simulated and not actual results.

No representation is made that any investor will or is likely to achieve profits or losses similar to those shown.

Simulated performance results are generally prepared with the benefit of hindsight and do not involve financial risk. No modeling can completely account for the impact of financial risk in actual investment. Account size, brokerage and slippage may also diverge from simulated results. Numerous other factors related to the markets in general or to the implementation of any specific investment system cannot be fully accounted for in the preparation of simulated performance results and may adversely affect actual investment results.

To the extent permitted by law, R&I and its employees, agents and authorised representatives exclude all liability for any loss or damage (including indirect, special or consequential loss or damage) arising from the use of, or reliance on, any information offered by R&I whether or not caused by any negligent act or omission.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.