Cement and electricity — not there yet

By Colin Twiggs

November 19th, 2015 5:00 p.m. AEDT (1:00 a.m. EST)

Advice herein is provided for the general information of readers and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no reader should act on the basis of any information contained herein without first having consulted a suitably qualified financial advisor.

Buying looks a lot more robust than last week and more US-led gains are likely.

Electricity & Cement Production

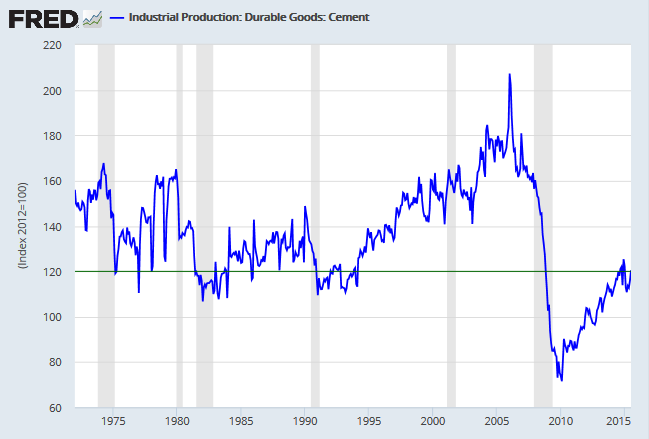

An examination of electricity and cement production shows the US recovery has plenty of scope for further improvement. Cement production recovered from its dramatic fall in 2008 but remains at the bottom end of the normal range of 120 to 160.

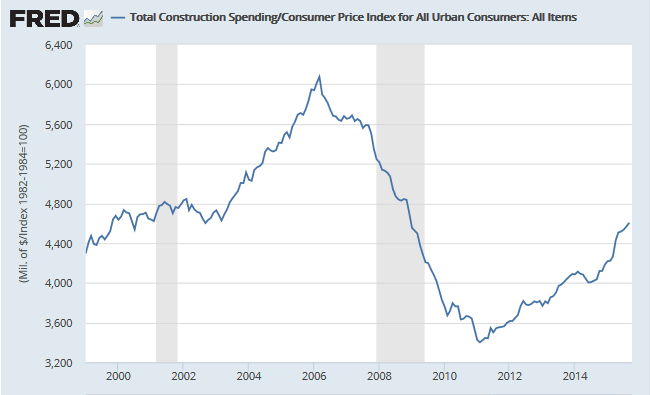

Construction activity is recovering but is a long way below the over-heated levels of 2006. Figures on the graph below are adjusted for CPI.

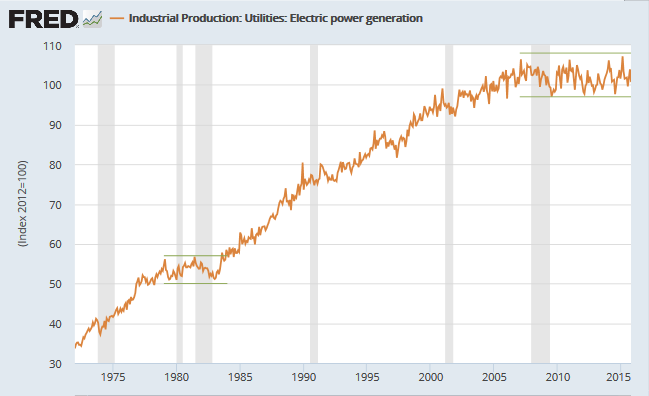

Electricity production remains stalled at 2008 levels. Severity of the Great Recession should ensure that low growth endures for longer than the last period of stagnation in the early 1980s.

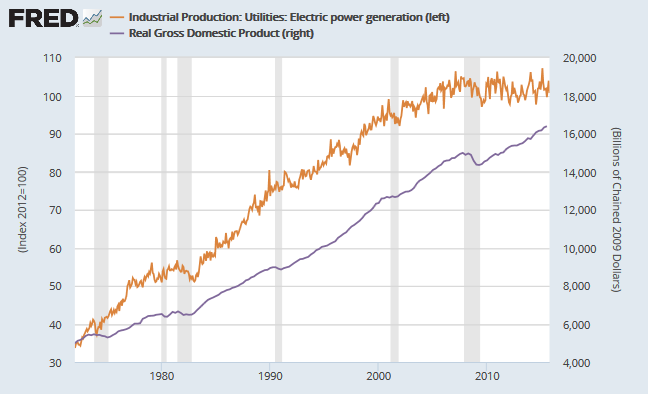

GDP may have resumed its long-term up-trend but it would be reassuring to see this supported by growing electricity output. Only when growth is restored can we say the economy is fully mended.

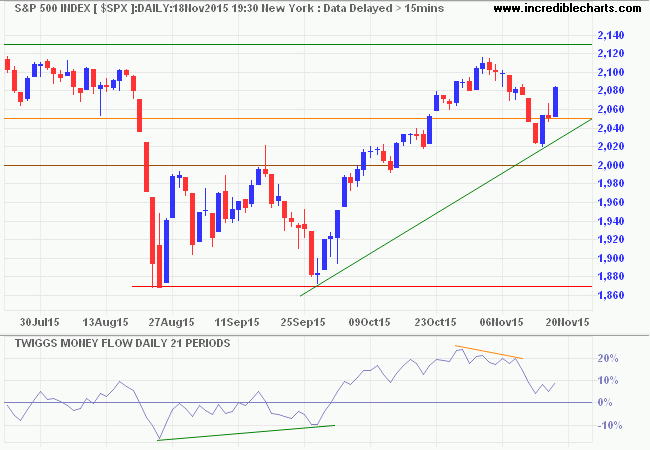

North America

The S&P 500 posted two strong blue candles suggesting that the correction is now over. Expect resistance at the previous high of 2130. A 21-day Twiggs Money Flow trough above zero would indicate healthy buying pressure. Breakout above 2130 would signal a fresh advance, with a target of 2400*. Reversal below 2000 is unlikely, but would warn of another test of primary support at 1870.

* Target calculation: 2130 + ( 2130 - 1870 ) = 2390

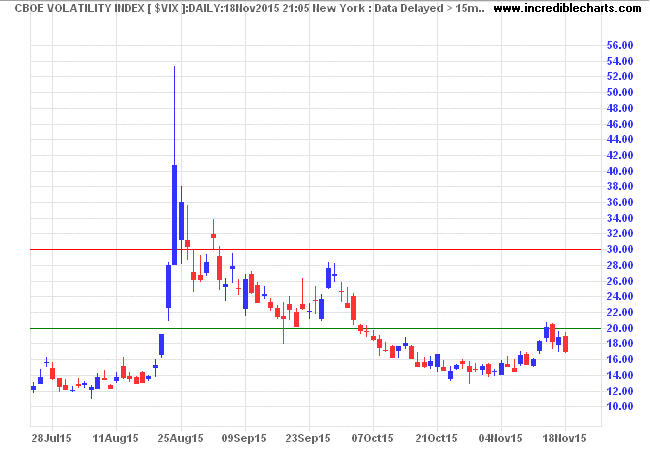

A CBOE Volatility Index (VIX) peak at 20 indicates market risk is returning to normal.

NYSE short sales remain subdued.

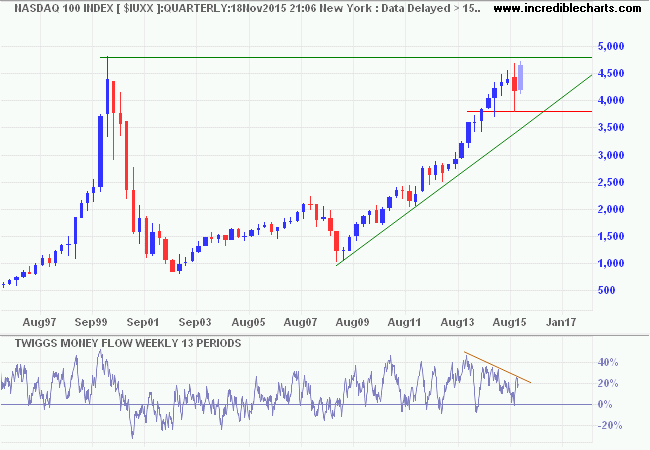

The Nasdaq 100 is testing its March 2000 high at 4800. Bearish divergence on 13-week Twiggs Money Flow continues to indicate selling pressure but the pattern appears secondary in nature and recovery above the declining trendline would suggest a breakout, offering a target of 5800*.

* Target calculation: 4800 + ( 4800 - 3800 ) = 5800

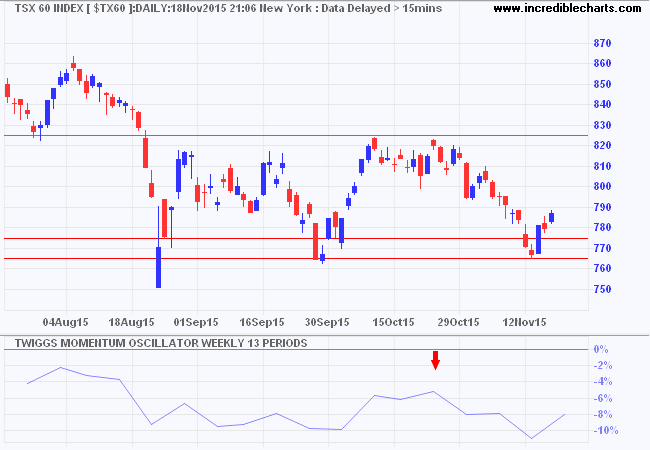

Canada's TSX 60 respected support at 765, suggesting another attempt at 825. The 13-week Twiggs Momentum peak below zero (-5%) remains a strong bear signal. Failure of support at 765 would confirm the primary down-trend.

* Target calculation: 775 - ( 825 - 775 ) = 725

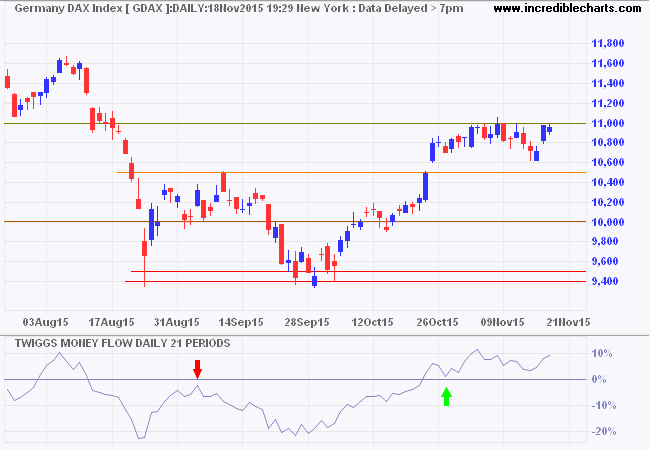

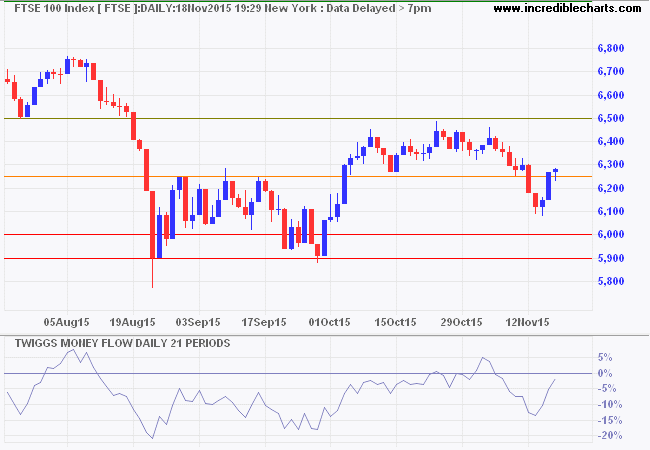

Europe

Germany's DAX continues to test resistance at 11000. Troughs on 21-day Twiggs Money Flow above zero indicate medium-term buying pressure. Breakout above 11000 and the descending trendline would suggest another test of the previous high at 12400. Respect is unlikely, but would warn of another test of primary support at 9400/9500.

The Footsie is a lot weaker, only finding support at 6100. 21-Day Twiggs Money Flow oscillating below zero indicates persistent selling pressure. Reversal below 6250 would warn of another test of primary support at 6000. Breakout above 6500 is unlikely, but would suggest another test of 7000.

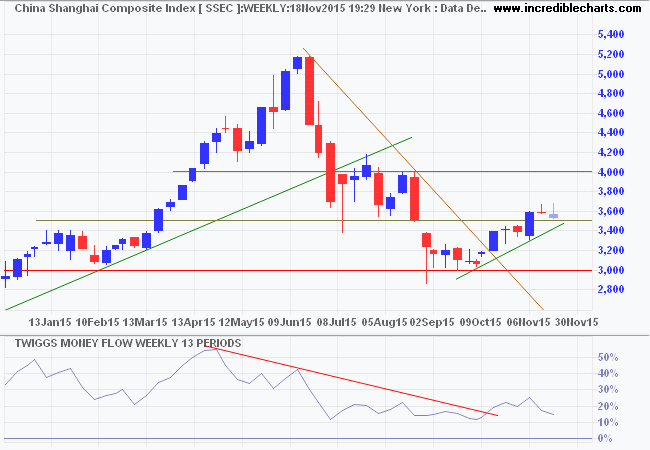

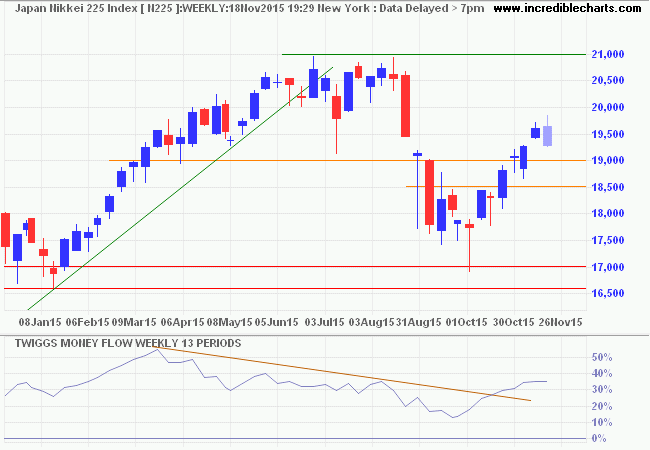

Asia

The Shanghai Composite Index is testing its new support level at 3500. Declining 13-week Twiggs Money Flow indicates moderate selling pressure. Breach of 3500 would signal another test of 3000.

Japan's Nikkei 225 respected support at 19000, confirming another test of resistance at 21000. Rising 13-week Twiggs Money Flow indicates buying pressure.

* Target calculation: 19000 + ( 19000 - 17000 ) = 21000

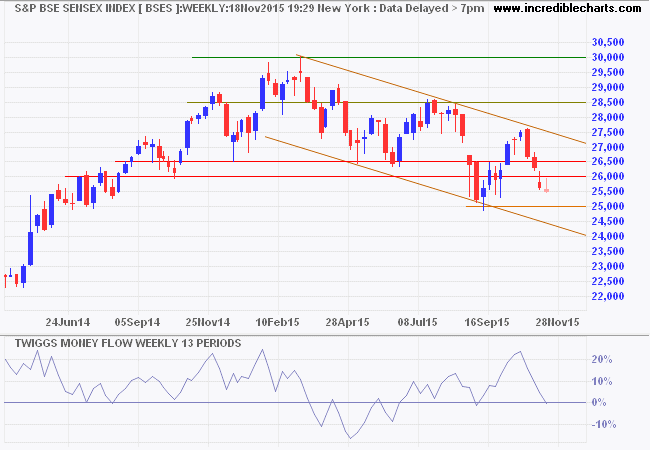

India's Sensex broke the band of primary support at 26000/26500 but is edging lower in a trend channel, rather than a dramatic fall. Reversal of 13-week Twiggs Money Flow below zero would warn of rising selling pressure; a trough at zero would suggest buying pressure. Recovery above the upper channel at 27500 is unlikely at present, but would warn of a bear trap.

* Target calculation: 25000 - ( 27500 - 25000 ) = 22500

Australia

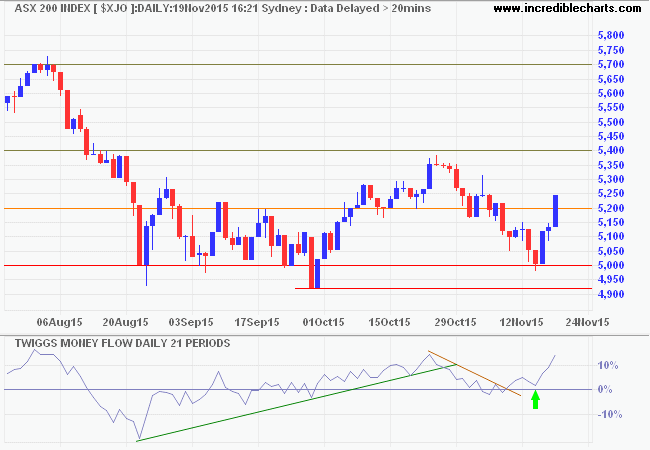

The ASX 200 respected primary support at 5000, suggesting another test of 5400. A 21-day Twiggs Money Flow trough above zero indicates medium-term buying pressure. Breach of 5000 is unlikely at present, but would warn of a (long-term) decline to 4000*.

* Target calculation: 5000 - ( 6000 - 5000 ) = 4000

Under a cabinet constitution at a sudden emergency this people can choose a ruler for the occasion. It is quite possible and even likely that he would not be ruler before the occasion. The great qualities, the imperious will, the rapid energy, the eager nature fit for a great crisis are not required—are impediments—in common times. A Lord Liverpool is better in everyday politics than a Chatham—a Louis Philippe far better than a Napoleon. By the structure of the world we want, at the sudden occurrence of a grave tempest, to change the helmsman—to replace the pilot of the calm by the pilot of the storm.

~ Walter Bagehot, The English Constitution (1867)

Disclaimer

Porter Private Clients Pty Ltd, trading as Research & Investment ("R&I"), is a Corporate Authorized Representative (AR Number 384 397) of Andika Pty Ltd which holds an Australian Financial Services Licence (AFSL 297069).

The information on this web site and in the newsletters is general in nature and does not consider your personal circumstances. Please contact your professional financial adviser for advice tailored to your needs.

R&I has made every effort to ensure the reliability of the views and recommendations expressed in the reports published on its websites and newsletters. Our research is based upon information known to us or which was obtained from sources which we believe to be reliable and accurate.

No guarantee as to the capital value of investments, nor future returns are made by R&I. Neither R&I nor its employees make any representation, warranty or guarantee that the information provided is complete, accurate, current or reliable.

You are under no obligation to use these services and should always compare financial services/products to find one which best meets your personal objectives, financial situation or needs.

To the extent permitted by law, R&I and its employees, agents and authorised representatives exclude all liability for any loss or damage (including indirect, special or consequential loss or damage) arising from the use of, or reliance on, any information. If the law prohibits the exclusion of such liability, such liability shall be limited, to the extent permitted by law, to the resupply of the said information or the cost of the said resupply.

Important Warning About Simulated Results

Research & Investment (R&I) specialise in developing, testing and researching investment strategies and systems. Within the R&I web site and newsletters, you will find information about investment strategies and their performance. It is important that you understand that results from R&I research are simulated and not actual results.

No representation is made that any investor will or is likely to achieve profits or losses similar to those shown.

Simulated performance results are generally prepared with the benefit of hindsight and do not involve financial risk. No modeling can completely account for the impact of financial risk in actual investment. Account size, brokerage and slippage may also diverge from simulated results. Numerous other factors related to the markets in general or to the implementation of any specific investment system cannot be fully accounted for in the preparation of simulated performance results and may adversely affect actual investment results.

To the extent permitted by law, R&I and its employees, agents and authorised representatives exclude all liability for any loss or damage (including indirect, special or consequential loss or damage) arising from the use of, or reliance on, any information offered by R&I whether or not caused by any negligent act or omission.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.