Australian stocks: Buy in July?

By Colin Twiggs

July 6th, 2015 5:00 p.m. AET (3:00 a.m. EDT)

Advice herein is provided for the general information of readers and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no reader should act on the basis of any information contained herein without first having consulted a suitably qualified financial advisor.

Australian stocks typically encounter tax loss selling in June (before end of the financial year), followed by a rally in July/August that often carries through into the next calendar year. Sale of poor performing stocks before EOFY withdraws money from the market and effectively lowers all stock prices. After the year end, investors start to accumulate stocks again, lifting the market.

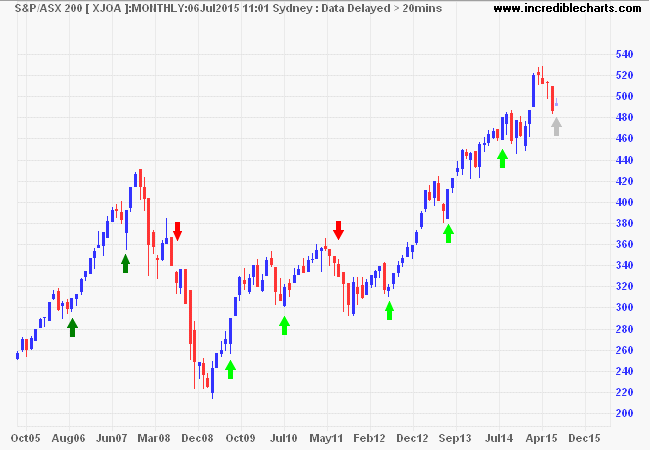

A monthly chart of the ASX 200 Accumulation Index since 2006 shows 2 years where the rally started in August (dark green), 5 years where the rally started in July (light green), and 2 years (red) where the EOFY rally disappointed, continuing a down-trend.

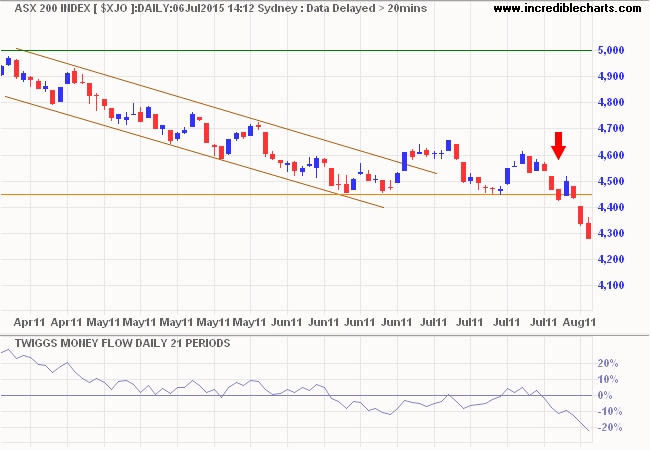

This year is complicated by turmoil in Greece and China. July 2011 also had its Greek drama. Prime Minister George Papandreou survived a confidence vote but was eventually replaced by Lucas Papademos, former governor of the Bank of Greece and vice-president of the European Central Bank. S&P also downgraded US government debt at the start of August 2011.

What does July 2015 have in store for us?

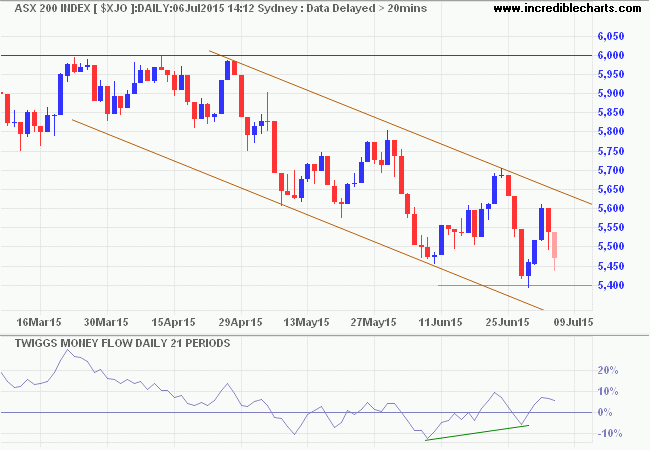

I don't have a crystal ball, but breakout above the trend channel on the ASX 200 daily chart would indicate the correction is over, suggesting another advance. Rising 21-day twiggs Money Flow indicates mild buying pressure.

But it would be prudent to wait for confirmation, in case it turns into a bull trap like 2011.

In order to govern, the question is not to follow a more or less valid theory but to build with whatever materials are at hand. The inevitable must be accepted and turned to advantage.

~ Napoleon Bonaparte

Disclaimer

Research & Investment Pty Ltd is a Corporate Authorized Representative (AR Number 384 397) of Andika Pty Ltd which holds an Australian Financial Services Licence (AFSL 297069).

The information on this web site and in the newsletters is general in nature and does not consider your personal circumstances. Please contact your professional financial adviser for advice tailored to your needs.

Research & Investment Pty Ltd ("R&I") has made every effort to ensure the reliability of the views and recommendations expressed in the reports published on its websites and newsletters. Our research is based upon information known to us or which was obtained from sources which we believe to be reliable and accurate.

No guarantee as to the capital value of investments, nor future returns are made by R&I. Neither R&I nor its employees make any representation, warranty or guarantee that the information provided is complete, accurate, current or reliable.

You are under no obligation to use these services and should always compare financial services/products to find one which best meets your personal objectives, financial situation or needs.

To the extent permitted by law, R&I and its employees, agents and authorised representatives exclude all liability for any loss or damage (including indirect, special or consequential loss or damage) arising from the use of, or reliance on, any information. If the law prohibits the exclusion of such liability, such liability shall be limited, to the extent permitted by law, to the resupply of the said information or the cost of the said resupply.

Important Warning About Simulated Results

Research & Investment (R&I) specialise in developing, testing and researching investment strategies and systems. Within the R&I web site and newsletters, you will find information about investment strategies and their performance. It is important that you understand that results from R&I research are simulated and not actual results.

No representation is made that any investor will or is likely to achieve profits or losses similar to those shown.

Simulated performance results are generally prepared with the benefit of hindsight and do not involve financial risk. No modeling can completely account for the impact of financial risk in actual investment. Account size, brokerage and slippage may also diverge from simulated results. Numerous other factors related to the markets in general or to the implementation of any specific investment system cannot be fully accounted for in the preparation of simulated performance results and may adversely affect actual investment results.

To the extent permitted by law, R&I and its employees, agents and authorised representatives exclude all liability for any loss or damage (including indirect, special or consequential loss or damage) arising from the use of, or reliance on, any information offered by R&I whether or not caused by any negligent act or omission.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.