Are US stocks really over-valued?

By Colin Twiggs

June 25th, 2015 3:30 p.m. AET (1:30 a.m. EDT)

Advice herein is provided for the general information of readers and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no reader should act on the basis of any information contained herein without first having consulted a suitably qualified financial advisor.

Stock Market Capitalization

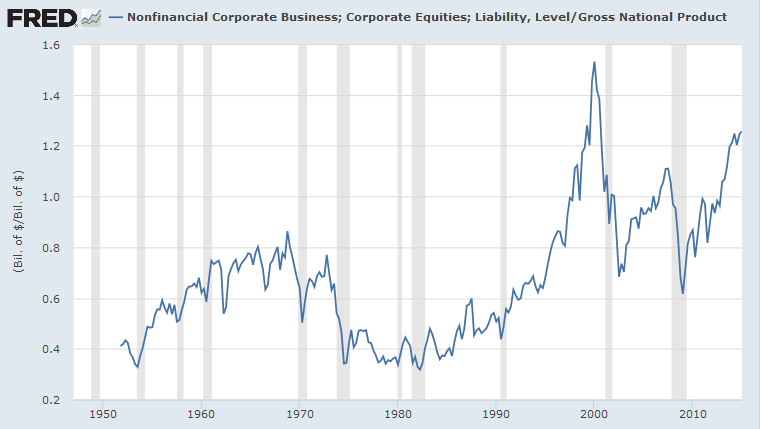

Let us start with Warren Buffet's favorite market valuation ratio: stock market capitalization to GDP. I have modified this slightly, replacing GDP with GNP, because the former excludes offshore earnings — a significant factor for multinationals.

The ratio of stock market capitalization to GNP now exceeds the highs of 2005/2006, suggesting that stocks are over-valued — approaching the heady days of the Dotcom era.

Corporate Profits

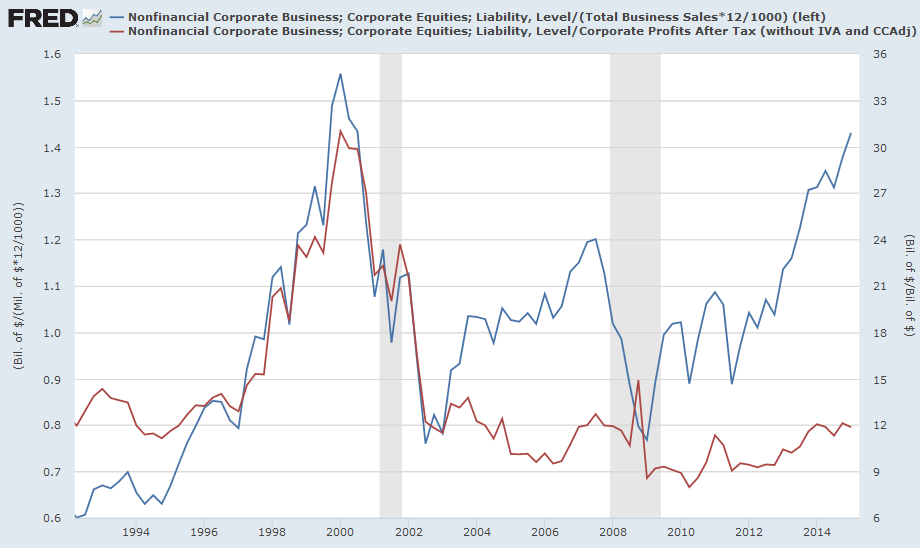

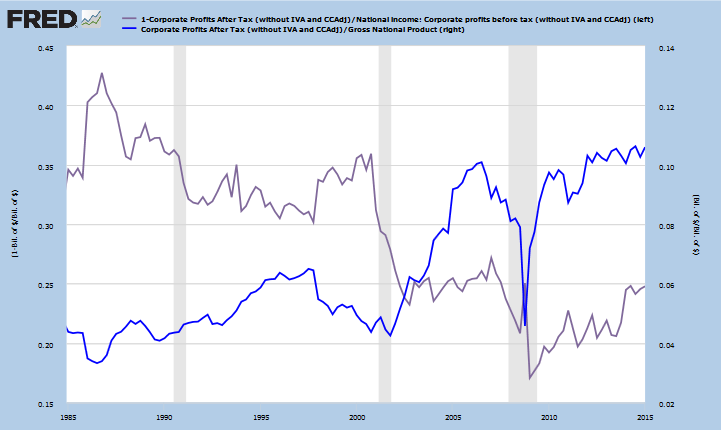

If we dig a bit deeper, however, while the ratio of market cap to sales is also high, market cap to corporate profits remains low.

Clearly profit margins have widened, with corporate profits increasing at a faster rate than sales. The critical question: is this sustainable?

Sustainability of Profits

At some point profit margins must narrow in response to rising costs. Increases in aggregate demand may lift employment and sales, but also drive up labor costs.

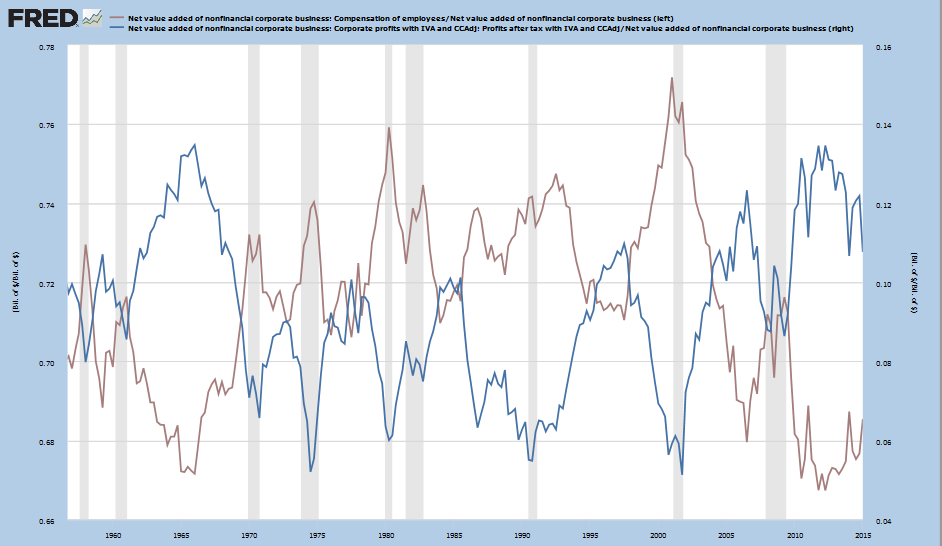

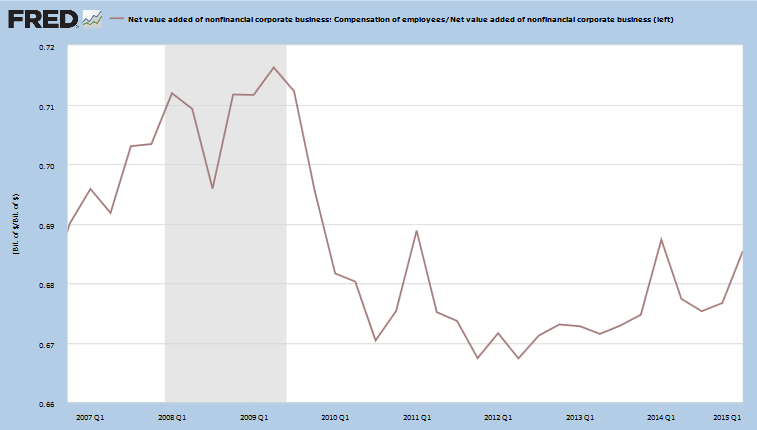

The brown line above depicts labor costs as a percentage of net value added, compared to corporate profits (blue) as a percentage of net value added. There is a clear inverse relationship: when labor costs rise, profit margins fall (and vice versa). At first the effect of narrower margins is masked by rising sales, but eventually aggregate profits contract when sales growth slows (gray stripes indicate past recessions).

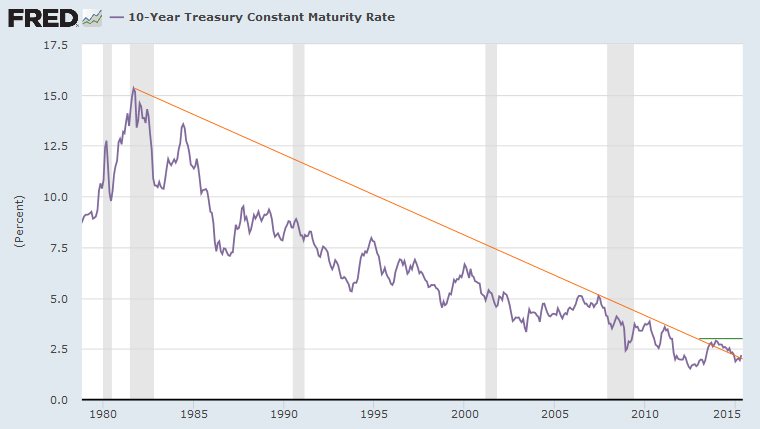

Interest Rates and Taxes

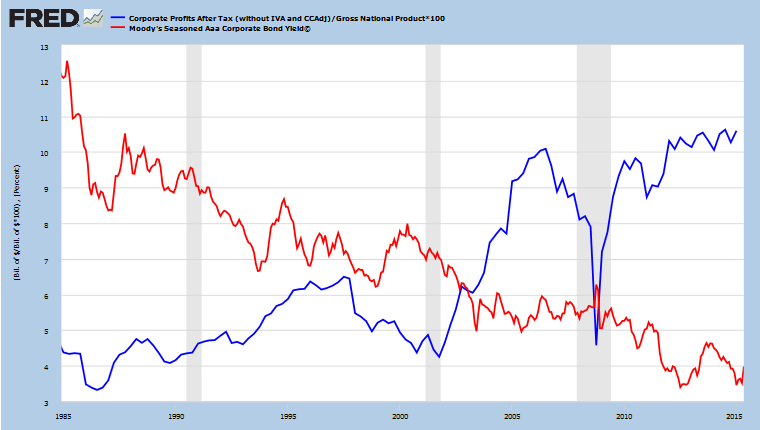

Other contributing factors to high corporate profits are interest rates and taxes. Corporate profits (% of GNP) have soared over the last 30 years as bond yields have fallen. The benefit is two-fold, with lower interest rates reducing the cost of corporate debt and lower finance costs boosting sales of consumer durables.

Lower effective corporate tax rates (gray) have also contributed to the surge in profits as a percentage of GNP.

The most enduring of these three factors (labor costs, interest rates, and tax rates) is likely to be taxes. Corporate tax rates have fallen in most jurisdictions and US rates are high by comparison. Even if a long-overdue overhaul of corporate taxation is achieved in the next decade (don't hold your breath), the overall tax rate is likely to remain low.

If Not Now, When?

The other two factors (labor costs and interest rates) may not be sustainable in the long-term but it will take time for them to normalize.

Treasury yields are rising, with the 10-year at 2.37 percent. Breakout above 3.0 percent still appears some way off, but would confirm the end of the 35-year secular down-trend.

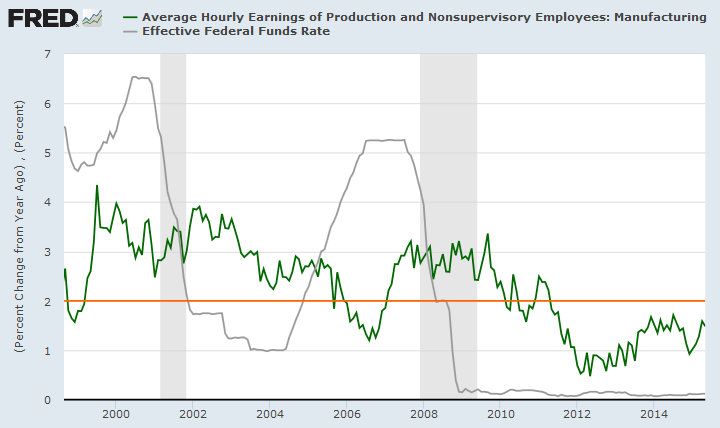

Interest rates are likely to remain low until rising labor costs force the Fed to adopt a restrictive stance.

Labor markets have tightened to some extent, as indicated by the higher trough on the right of the above graph. But this is likely to be slowed by the low participation rate, with potential employees returning to the workforce, and a strong dollar enhancing the attraction of cheap labor in emerging markets.

Hourly earnings growth in the manufacturing sector remains comfortably below the Fed's 2.0 percent inflation target. Any breakout above this level, however, would be cause for concern. Not only would the Fed be likely to raise interest rates, but profit margins are likely to shrink.

For the present

None of the macroeconomic and volatility filters that we monitor indicate elevated market risk. I expect them to rise over the next two to three years as the labor market tightens and interest rates increase, but for the present we maintain full exposure to equities.

Nothing in the world can take the place of persistence. Talent will not; nothing is more common than unsuccessful men with talent. Genius will not; unrewarded genius is almost a proverb. Education will not; the world is full of educated derelicts. Persistence and determination alone are omnipotent.

~ Calvin Coolidge, 30th President of the United States

Disclaimer

Research & Investment Pty Ltd is a Corporate Authorized Representative (AR Number 384 397) of Andika Pty Ltd which holds an Australian Financial Services Licence (AFSL 297069).

The information on this web site and in the newsletters is general in nature and does not consider your personal circumstances. Please contact your professional financial adviser for advice tailored to your needs.

Research & Investment Pty Ltd ("R&I") has made every effort to ensure the reliability of the views and recommendations expressed in the reports published on its websites and newsletters. Our research is based upon information known to us or which was obtained from sources which we believe to be reliable and accurate.

No guarantee as to the capital value of investments, nor future returns are made by R&I. Neither R&I nor its employees make any representation, warranty or guarantee that the information provided is complete, accurate, current or reliable.

You are under no obligation to use these services and should always compare financial services/products to find one which best meets your personal objectives, financial situation or needs.

To the extent permitted by law, R&I and its employees, agents and authorised representatives exclude all liability for any loss or damage (including indirect, special or consequential loss or damage) arising from the use of, or reliance on, any information. If the law prohibits the exclusion of such liability, such liability shall be limited, to the extent permitted by law, to the resupply of the said information or the cost of the said resupply.

Important Warning About Simulated Results

Research & Investment (R&I) specialise in developing, testing and researching investment strategies and systems. Within the R&I web site and newsletters, you will find information about investment strategies and their performance. It is important that you understand that results from R&I research are simulated and not actual results.

No representation is made that any investor will or is likely to achieve profits or losses similar to those shown.

Simulated performance results are generally prepared with the benefit of hindsight and do not involve financial risk. No modeling can completely account for the impact of financial risk in actual investment. Account size, brokerage and slippage may also diverge from simulated results. Numerous other factors related to the markets in general or to the implementation of any specific investment system cannot be fully accounted for in the preparation of simulated performance results and may adversely affect actual investment results.

To the extent permitted by law, R&I and its employees, agents and authorised representatives exclude all liability for any loss or damage (including indirect, special or consequential loss or damage) arising from the use of, or reliance on, any information offered by R&I whether or not caused by any negligent act or omission.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.