A quiet week in the markets

By Colin Twiggs

November 16th, 2014 4:30 p.m. AEDT (12:30 a.m. ET)

Advice herein is provided for the general information of readers and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no reader should act on the basis of any information contained herein without first having consulted a suitably qualified financial advisor.

- US stocks continue their bull-trend

- European stocks strengthen

- China likewise

- ASX retraces to test support

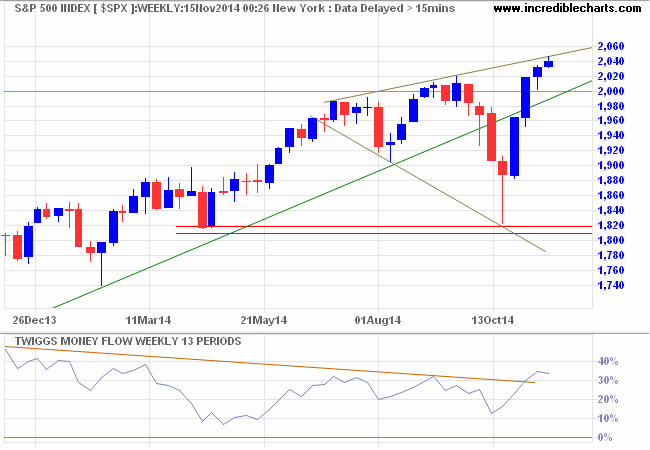

The S&P 500 is testing the upper border of a broadening wedge formation. Retracement that respects support at 2000 would enhance the bull signal and offer a target of 2280*. Rising 13-week Twiggs Money Flow indicates buyers are in control. Reversal below 2000 and the rising trendline is unlikely, but would signal another correction.

* Target calculation: 2040 + ( 2040 - 1820 ) = 2280

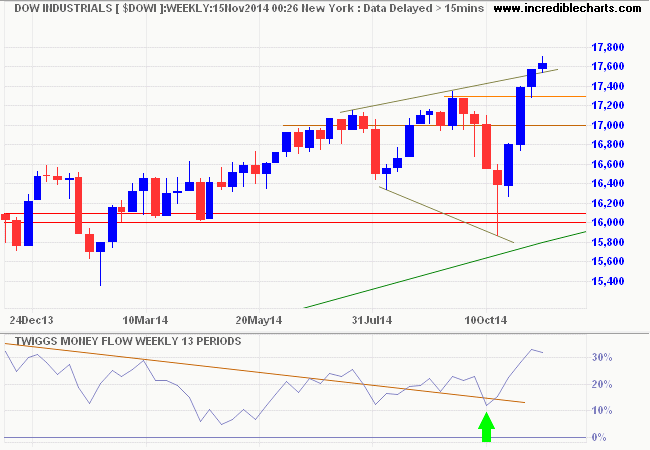

Dow Jones Industrial Average has already broken above a similar broadening wedge formation, offering a long-term target of 19000*.

* Target calculation: 17500 + ( 17500 - 16000 ) = 19000

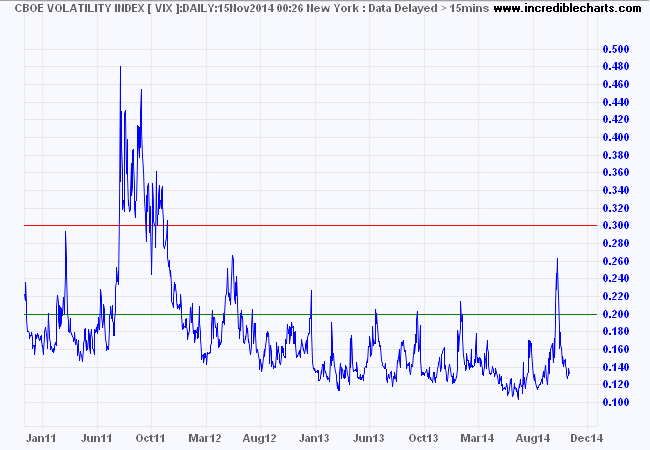

CBOE Volatility Index (VIX) continues to reflect low risk typical of a bull market.

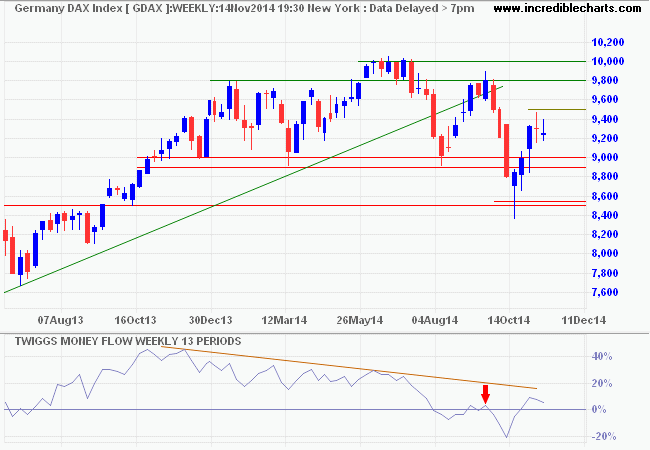

Germany's DAX is testing resistance at 9400/9500, but 13-week Twiggs Money Flow remains weak. Reversal of TMF below zero would warn of another correction. Reversal below 9000 would confirm a primary down-trend. Follow-through above 9500 is less likely, but would suggest another test of 10000.

* Target calculation: 9000 - ( 10000 - 9000 ) = 8000

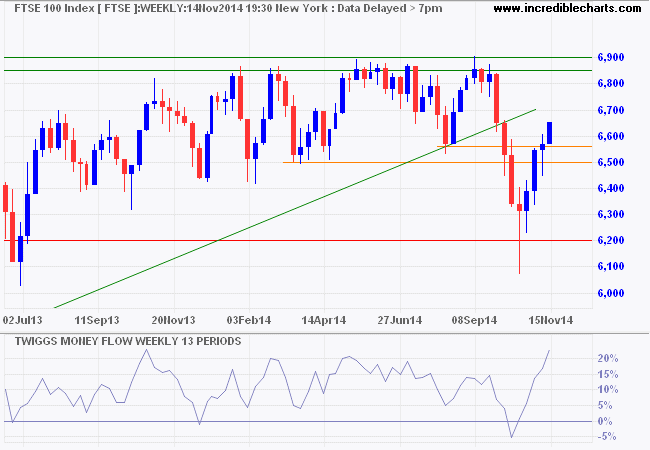

The Footsie proved more robust, breaking resistance, at 6500/6560 to signal a test of 6900. 13-Week Twiggs Money Flow is rising strongly, signaling buyers are in control.

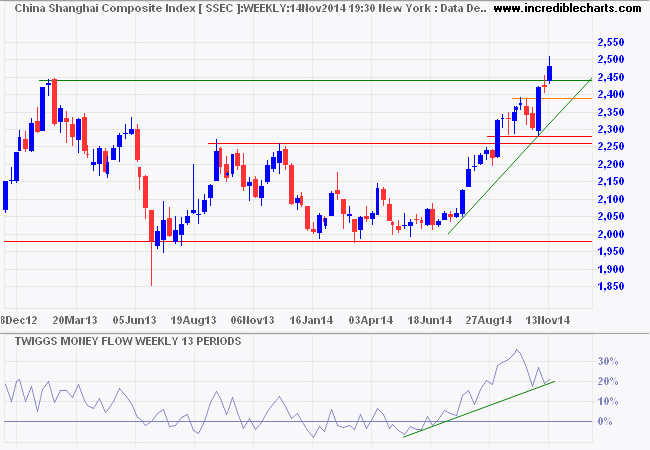

China's Shanghai Composite Index broke resistance at its 2013 high of 2440, signaling an advance. 13-Week Twiggs Money Flow reversal below its rising trendline, however, would warn of (medium-term) selling pressure.

* Target calculation: 2400 + ( 2400 - 2300 ) = 2500

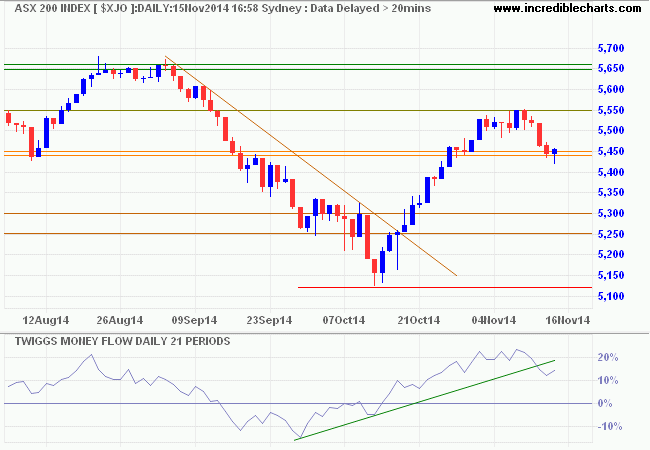

The ASX 200 retraced to test support at 5440/5450. Respect would signal another test of the August high at 5650/5660. Failure of support would indicate a test of 5250/5300 and a weaker up-trend. Reversal below 5250 remains unlikely, but would warn of another test of primary support. A 21-day Twiggs Money Flow trough above zero would signal long-term butying pressure.

* Target calculation: 5650 + ( 5650 - 5300 ) = 6000

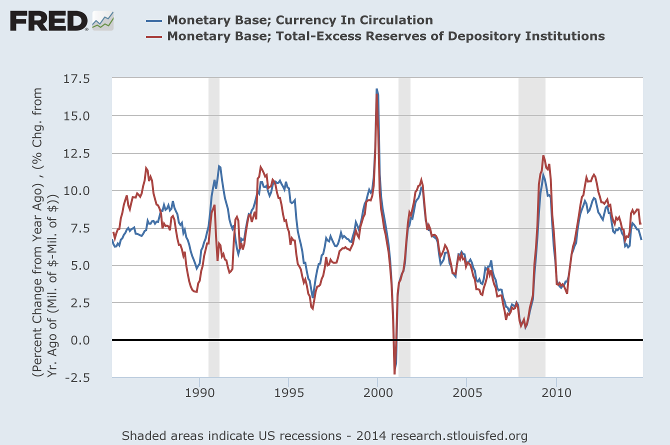

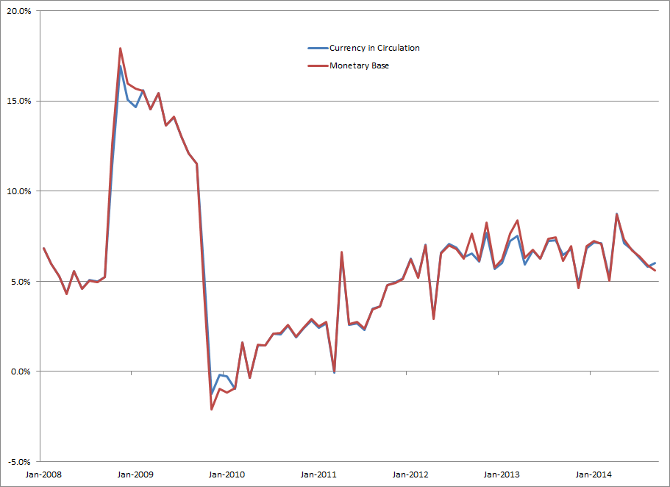

Monetary Base and deflation

The Monetary Base consists of currency in circulation and commercial bank deposits at the Federal Reserve. Currency in circulation includes notes and coins both in circulation and held in the vaults of commercial banks. Commercial bank deposits at the Fed can be further broken down into required reserves and excess reserves. Excess reserves on deposit have soared — since late 2008 when the Fed started paying interest on reserves — to a level of $2.6 Trillion.

By varying the interest rate payable on excess reserves the Fed can manipulate the amount of currency in circulation. It is no longer reliant solely on Treasury and MBS purchases and sales to increase or decrease the money supply: these are merely one tool in the monetary tool-kit. So announcing that QE (security purchases) have ended does not mean that currency in circulation and the working monetary base (excluding excess reserves) will stop growing or will contract. That would cause deflationary pressure similar to the European experience. Growth, instead, is likely to continue provided that excess reserves are drawn down to compensate for cessation of QE.

Deflationary pressures are unlikely to surface provided currency in circulation and the working monetary base continue to grow at above 5% a year. Only if real GDP grew at a faster pace (a problem we would like to have) would we encounter a problem.

Australia has similarly been keeping on the right side of 5% growth since early 2012. Provided this continues we should keep out of trouble.

That's all from me for today. Take care.

There is no truth. There is only perception.

~ Gustave Flaubert

Disclaimer

Research & Investment Pty Ltd is a Corporate Authorized Representative (AR Number 384 397) of Andika Pty Ltd which holds an Australian Financial Services Licence (AFSL 297069).

The information on this web site and in the newsletters is general in nature and does not consider your personal circumstances. Please contact your professional financial adviser for advice tailored to your needs.

Research & Investment Pty Ltd ("R&I") has made every effort to ensure the reliability of the views and recommendations expressed in the reports published on its websites and newsletters. Our research is based upon information known to us or which was obtained from sources which we believe to be reliable and accurate.

No guarantee as to the capital value of investments, nor future returns are made by R&I. Neither R&I nor its employees make any representation, warranty or guarantee that the information provided is complete, accurate, current or reliable.

You are under no obligation to use these services and should always compare financial services/products to find one which best meets your personal objectives, financial situation or needs.

To the extent permitted by law, R&I and its employees, agents and authorised representatives exclude all liability for any loss or damage (including indirect, special or consequential loss or damage) arising from the use of, or reliance on, any information. If the law prohibits the exclusion of such liability, such liability shall be limited, to the extent permitted by law, to the resupply of the said information or the cost of the said resupply.

Important Warning About Simulated Results

Research & Investment (R&I) specialise in developing, testing and researching investment strategies and systems. Within the R&I web site and newsletters, you will find information about investment strategies and their performance. It is important that you understand that results from R&I research are simulated and not actual results.

No representation is made that any investor will or is likely to achieve profits or losses similar to those shown.

Simulated performance results are generally prepared with the benefit of hindsight and do not involve financial risk. No modeling can completely account for the impact of financial risk in actual investment. Account size, brokerage and slippage may also diverge from simulated results. Numerous other factors related to the markets in general or to the implementation of any specific investment system cannot be fully accounted for in the preparation of simulated performance results and may adversely affect actual investment results.

To the extent permitted by law, R&I and its employees, agents and authorised representatives exclude all liability for any loss or damage (including indirect, special or consequential loss or damage) arising from the use of, or reliance on, any information offered by R&I whether or not caused by any negligent act or omission.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.