Quantitative Easing: The end is nigh?

By Colin Twiggs

October 2nd, 2014 3:30 a.m. EDT (5:30 p:m AEST)

Advice herein is provided for the general information of readers and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no reader should act on the basis of any information contained herein without first having consulted a suitably qualified financial advisor.

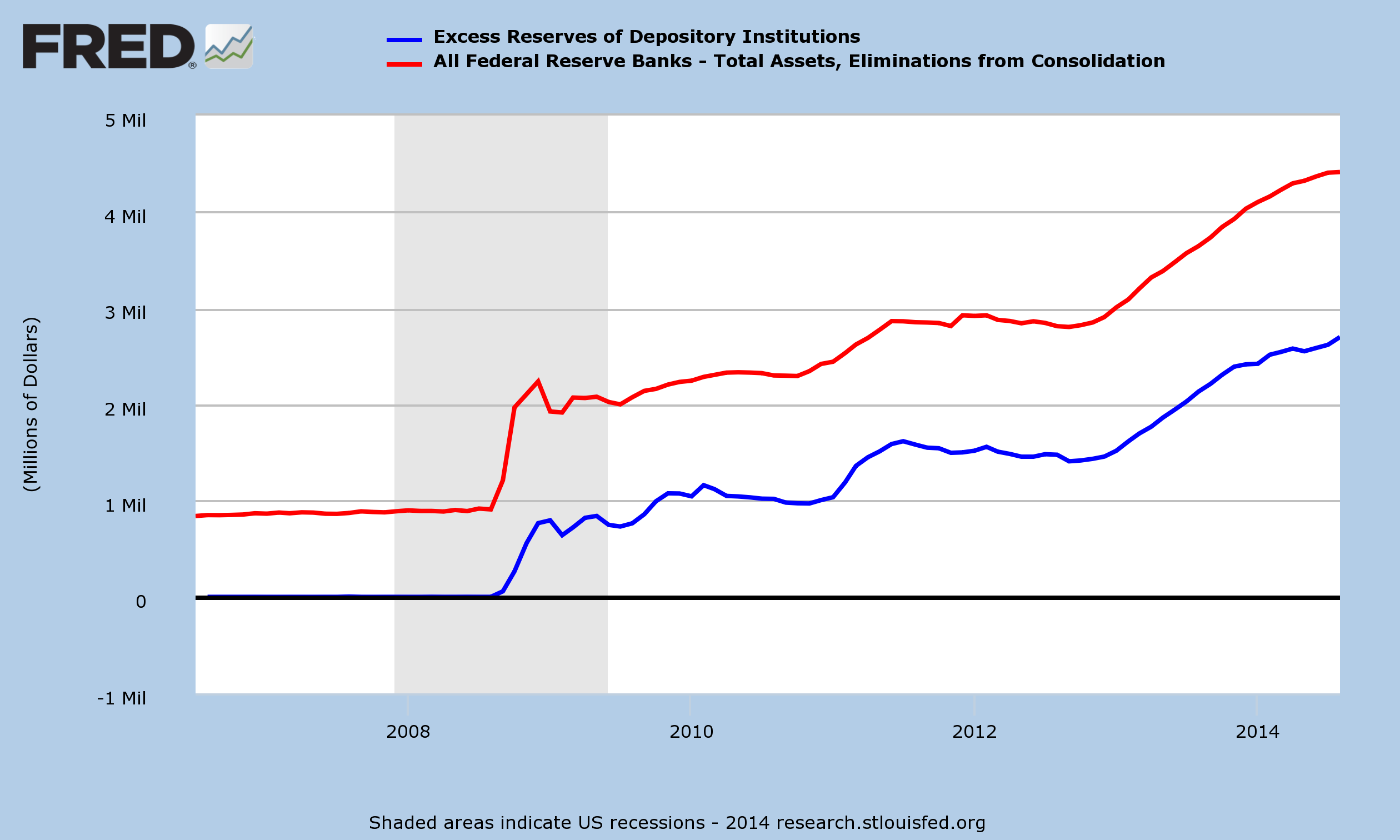

I have read a number of predictions recently as to how stocks will collapse into a bear market when quantitative easing ends. The red line on the graph below shows how the Fed expanded its balance sheet by $3.5 trillion between 2008 and 2014, injecting new money into the system through acquisition of Treasuries and other government-backed securities.

Many are not aware that $2.7 trillion of that flowed straight back to the Fed, deposited by banks as excess reserves. So the net flow of new money into the system was actually a lot lower: around $0.8 trillion.

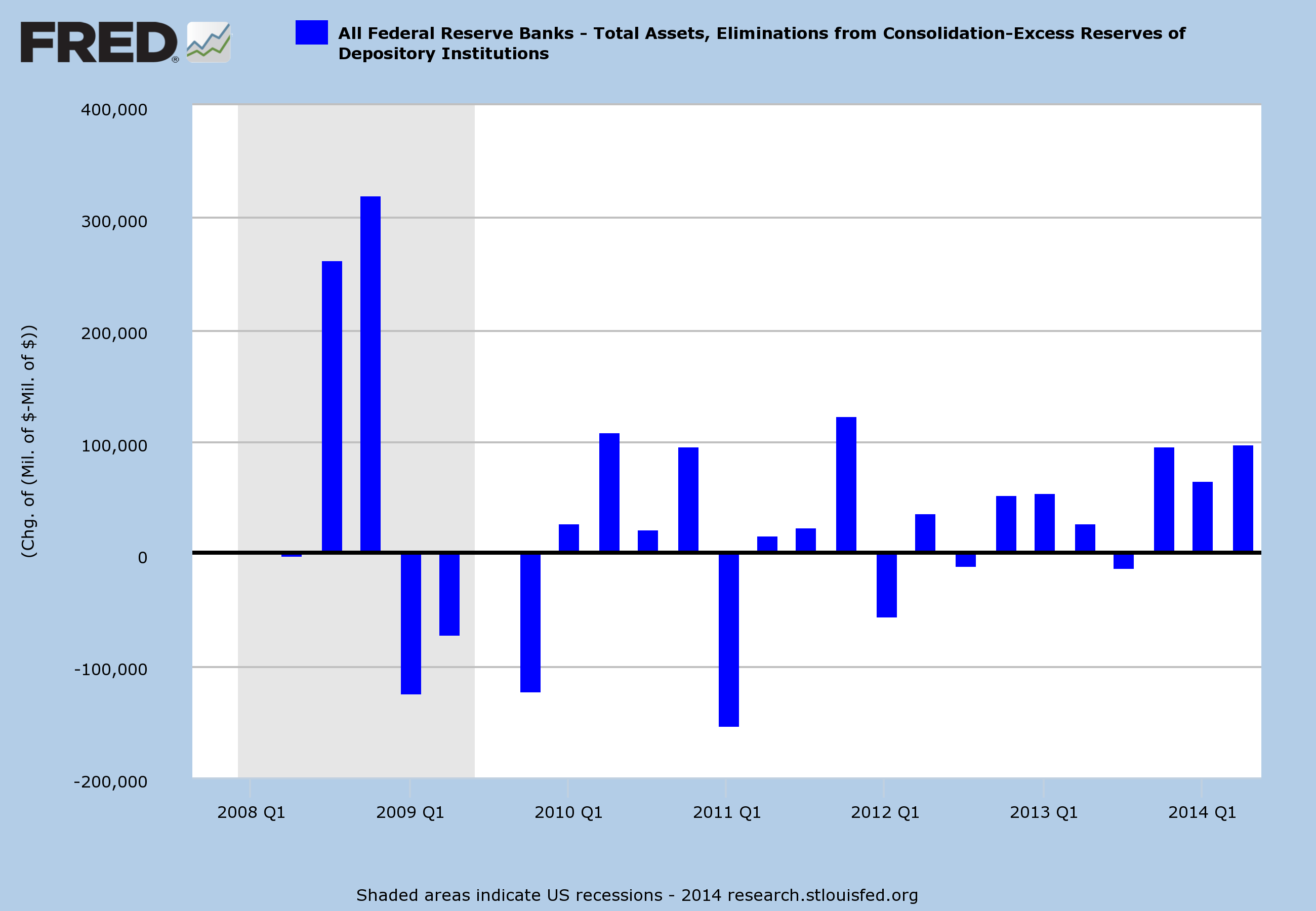

The Fed has indicated they will end bond purchases in October 2014, which means that the red line will level off at close to $4.5 trillion. If excess reserve deposits continue to grow, that would cause a net outflow of money from the system. But that is highly unlikely. Excess Reserves have been growing at a slower rate than Fed Assets for the last three quarters, as the graph of Fed Assets minus Excess Reserves shows. If that trend continues, there will be a net injection of money even though asset purchases have halted.

Interest paid on excess reserves is a powerful weapon in the hands of the FOMC. The Fed can accelerate the flow of money into the market by reducing the interest rate, forcing banks to withdraw funds on deposit in search of better returns outside the Fed. Alternatively, raising interest paid above the current 0.25% p.a. on excess reserves would have the opposite effect, attracting more deposits and slowing the flow of money into the market.

The Fed is likely to use these tools to maintain a positive flow into the market until the labor market has healed. As Janet Yellen said at Jackson Hole:

"It likely will be appropriate to maintain the current target range for the federal funds rate for a considerable time after our current asset purchase program ends."

That's Fedspeak for "Read my lips: there will be no interest rate hikes."

More....

They say there are two sides to everything. But there is only one side to the stock market; and it is not the bull side or the bear side, but the right side. It took me longer to get that general principle fixed firmly in my mind than it did most of the more technical phases of the game of stock speculation.

~ Jesse Livermore

Disclaimer

Research & Investment Pty Ltd is a Corporate Authorized Representative (AR Number 384 397) of Andika Pty Ltd which holds an Australian Financial Services Licence (AFSL 297069).

The information on this web site and in the newsletters is general in nature and does not consider your personal circumstances. Please contact your professional financial adviser for advice tailored to your needs.

Research & Investment Pty Ltd ("R&I") has made every effort to ensure the reliability of the views and recommendations expressed in the reports published on its websites and newsletters. Our research is based upon information known to us or which was obtained from sources which we believe to be reliable and accurate.

No guarantee as to the capital value of investments, nor future returns are made by R&I. Neither R&I nor its employees make any representation, warranty or guarantee that the information provided is complete, accurate, current or reliable.

You are under no obligation to use these services and should always compare financial services/products to find one which best meets your personal objectives, financial situation or needs.

To the extent permitted by law, R&I and its employees, agents and authorised representatives exclude all liability for any loss or damage (including indirect, special or consequential loss or damage) arising from the use of, or reliance on, any information. If the law prohibits the exclusion of such liability, such liability shall be limited, to the extent permitted by law, to the resupply of the said information or the cost of the said resupply.

Important Warning About Simulated Results

Research & Investment (R&I) specialise in developing, testing and researching investment strategies and systems. Within the R&I web site and newsletters, you will find information about investment strategies and their performance. It is important that you understand that results from R&I research are simulated and not actual results.

No representation is made that any investor will or is likely to achieve profits or losses similar to those shown.

Simulated performance results are generally prepared with the benefit of hindsight and do not involve financial risk. No modeling can completely account for the impact of financial risk in actual investment. Account size, brokerage and slippage may also diverge from simulated results. Numerous other factors related to the markets in general or to the implementation of any specific investment system cannot be fully accounted for in the preparation of simulated performance results and may adversely affect actual investment results.

To the extent permitted by law, R&I and its employees, agents and authorised representatives exclude all liability for any loss or damage (including indirect, special or consequential loss or damage) arising from the use of, or reliance on, any information offered by R&I whether or not caused by any negligent act or omission.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.