Gold losing its luster

By Colin Twiggs

April 1st, 2013 2:00 a.m. EDT (5:00 p:m AEDT)

These extracts from my trading diary are for educational purposes. Any advice contained therein is provided for the general information of readers and does not have regard to any particular person's investment objectives, financial situation or needs and must not be construed as advice to buy, sell, hold or otherwise deal with any securities or other investments. Accordingly, no reader should act on the basis of any information contained therein without first having consulted a suitably qualified financial advisor. Full terms and conditions can be found at Terms of Use.

Please note the recent changes to our Privacy Policy.

Inflation

Inflation pressures are easing and Elliot Clarke summarizes Westpac's outlook for US inflation as follows:

This week we decompose the Personal Consumption Expenditure (PCE) deflator to assess what inflation pressures currently exist and how they are likely to develop. The conclusion is that the inflation picture argues for an extended period of extremely accommodative policy settings and it may even serve to delay the timing of the initial interest rate increase well beyond the timeframe currently envisaged by markets.

Soft treasury yields, a weak dollar and weaker gold price tend to support this view.

Interest Rates and the Dollar

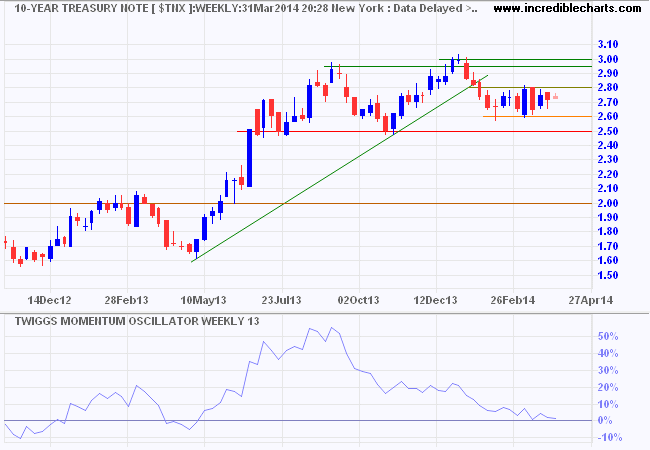

The yield on ten-year Treasury Notes is ranging in a narrow band between 2.60 percent and 2.80 percent. Breakout above 2.80 would indicate an advance to 3.50 percent* — confirmed if there is follow-through above 3.00 percent — but declining 13-week Twiggs Momentum continues to warn of weakness. Breach of primary support at 2.50 percent is as likely and would signal a primary down-trend.

* Target calculation: 3.00 + ( 3.00 - 2.50 ) = 3.50

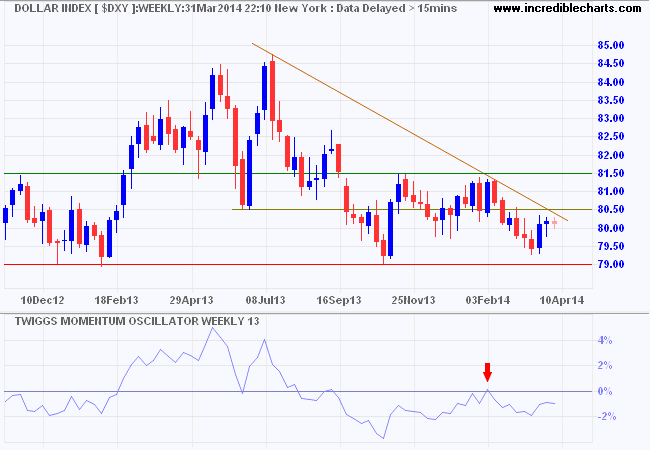

The Dollar Index is testing medium-term resistance at 80.50. Breakout would suggest that a bottom is forming, but only recovery above 81.50 would signal a trend change. 13-Week Twiggs Momentum oscillating below zero, however, is typical of a primary down-trend. Breach of primary support at 79.00 would signal a decline to 76.50*.

* Target calculation: 79.0 - ( 81.5 - 79.0 ) = 76.5

Gold and Silver

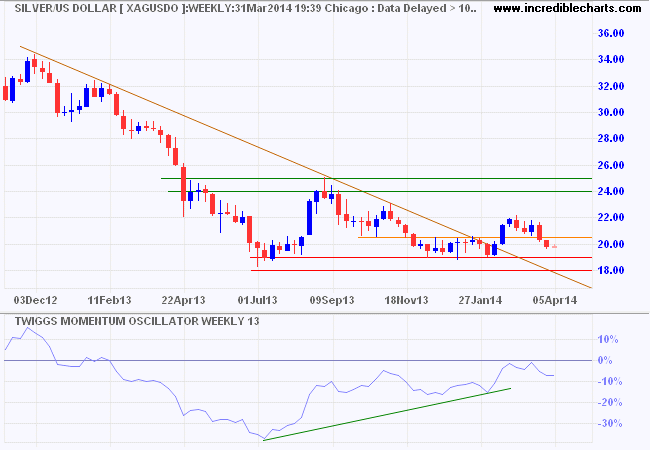

Silver failed to imitate gold's performance in the first quarter and is headed for a test of primary support at $19/ounce. 13-Week Twiggs Momentum likewise failed to cross to above zero, suggesting continuation of the primary down-trend. Breach of primary support would offer a target of $16, while respect of support would test resistance at $22/ounce.

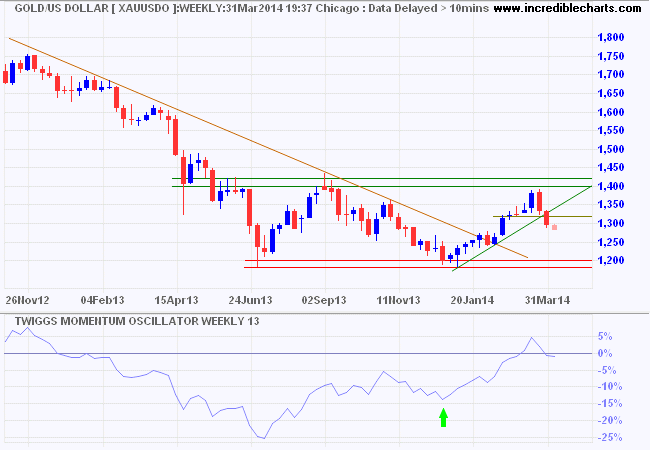

Spot gold is undergoing a strong correction, having breached the rising trendline and support at $1320/ounce. The remains bullish, but breach of primary support by Silver or continued decline of 13-week Twiggs Momentum below zero would negate this. Failure of primary support at $1200 is unlikely, but would offer a target of $1000/ounce*.

* Target calculation: 1200 - ( 1400 - 1200 ) = 1000

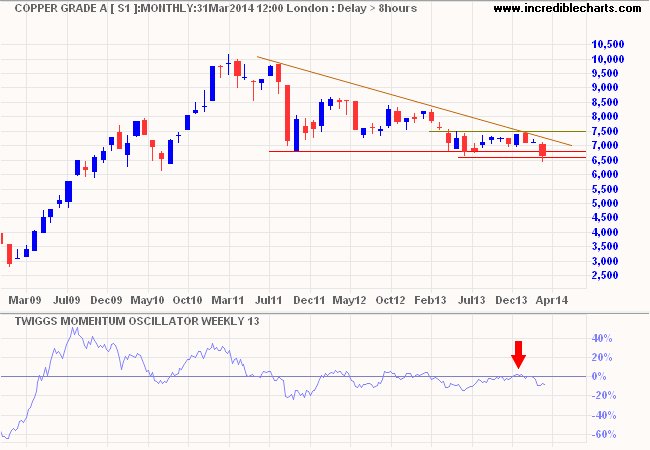

Copper

Copper is a commodity rather than a precious metal, but is also used as a store of value. At present, copper is testing long-term support at $6800/tonne. Follow-through below $6600 would signal continuation of the primary down-trend to $6000/tonne*. Recovery above the descending trendline (at $7000) is unlikely, but would suggest that a bottom is forming.

* Target calculation: 6750 - ( 7500 - 6750 ) = 6000

A fool may be known by six things: anger without cause; speech without profit; change without progress; inquiry without object; putting trust in a stranger; and mistaking foes for friends.

~ Arabian Proverb

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.