S&P 500 advance

By Colin Twiggs

March 10th, 2014 4:00 am ET (7:00 pm AEDT)

These extracts from my trading diary are for educational purposes. Any advice contained therein is provided for the general information of readers and does not have regard to any particular person's investment objectives, financial situation or needs and must not be construed as advice to buy, sell, hold or otherwise deal with any securities or other investments. Accordingly, no reader should act on the basis of any information contained therein without first having consulted a suitably qualified financial advisor. Full terms and conditions can be found at Terms of Use.

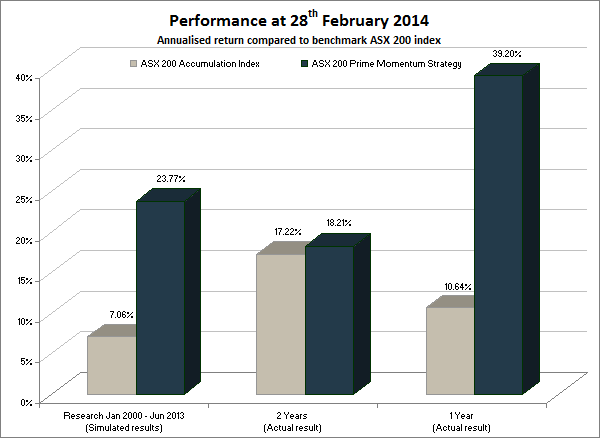

Research & Investment: Performance update

Our ASX200 Prime Momentum strategy returned +39.20%* for the 12 months ended 28th February 2014, outperforming the benchmark ASX200 Accumulation Index by +28.56%.

The S&P 500 strategy has only been running since November 2013, but returned 9.35%* for the four months, outperforming the S&P 500 Total Return Index by 2.68%.

* Results are unaudited and subject to revision.

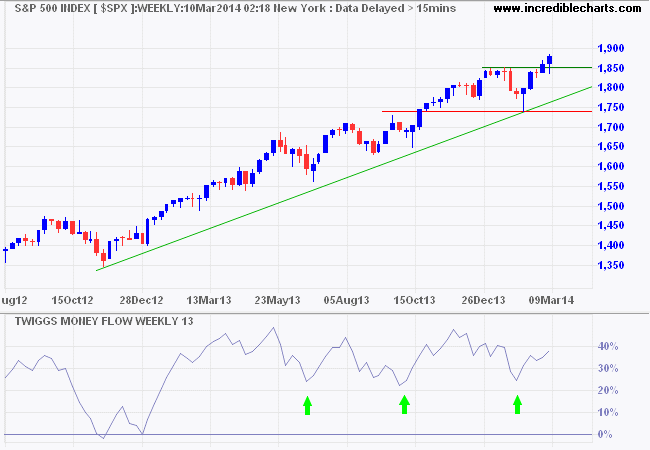

S&P 500 advance

The S&P 500 found support at 1850, signaling an advance to 1950*. Repeated troughs high above zero on 13-week Twiggs Money Flow indicate strong long-term buying pressure

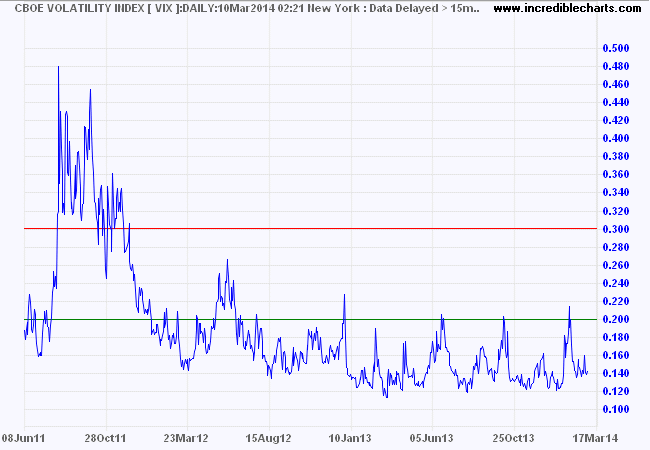

CBOE Volatility Index (VIX) below 15 continues to reflect low market risk typical of a bull market.

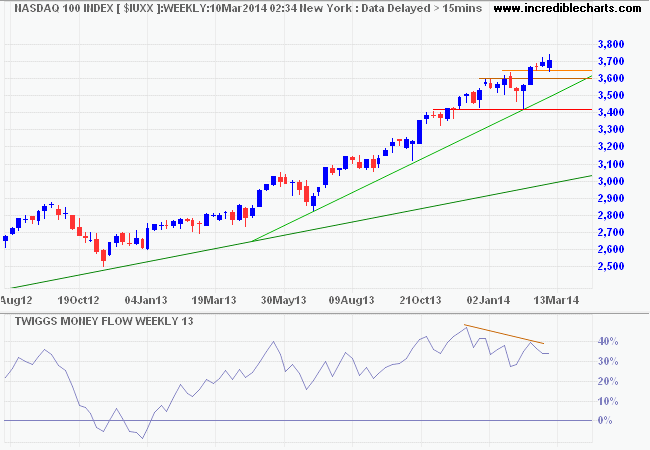

The Nasdaq 100 respected support at 3600, but bearish divergence on 13-week Twiggs Money Flow warns of medium-term selling pressure. Failure of support would warn of another correction. Follow-through above 3700, however, would offer a target of 3800*.

* Target calculation: 3600 + ( 3600 - 3400 ) = 3800

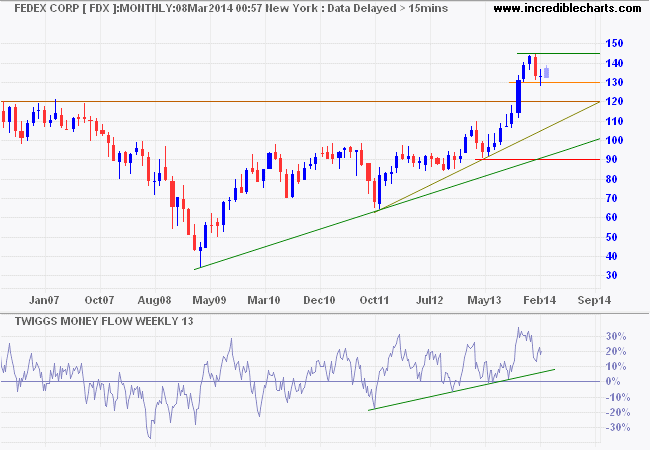

Bellwether Transport stock Fedex found support at $130 on the monthly chart. Breakout above $145 would offer a target of $170*. Rising 13-week Twiggs Money Flow indicates buying pressure. A bullish sign for the broader economy. Reversal below $130 is unlikely, but would warn of a decline to $120.

* Target calculation: 145 + ( 145 - 120 ) = 170

I never try to predict or anticipate. I only try to react to what the market is telling me by its behavior.

~ Jesse Livermore

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.