Economy: The hole in US employment

By Colin Twiggs

February 11th, 2014 10:30 p.m. ET (2:30 p:m AEDT)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

US employment is topical after two months of poor jobs figures. Employers added 113,000 new jobs, against an expected 185,000, last month and a low 75,000 in December. Rather than focus on monthly data, let's take a long-term view.

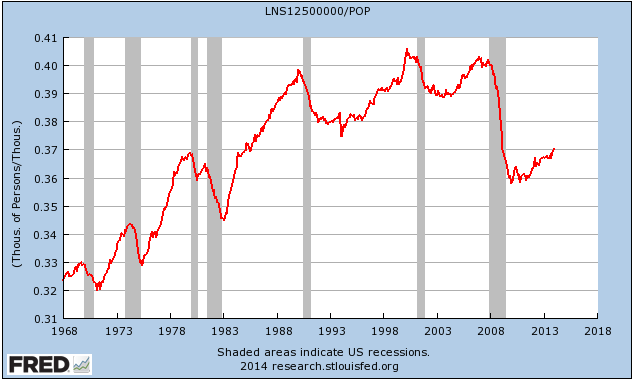

The number of full-time employed as a percentage of total population [red line below] fell dramatically during the GFC, with about 1 in 10 employees losing their jobs. Since then, roughly 1 out of 4 full-time jobs lost has been restored, while the other 3 are still missing (population growth fell from 1.0% to around 0.7% post-GFC, limiting the distortion).

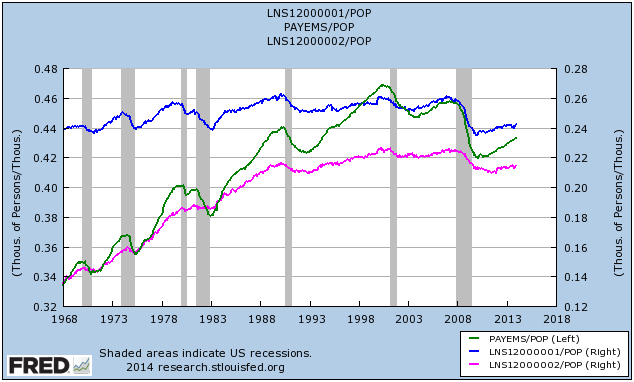

Comparing employment levels to the 1980s is little consolation because this is skewed by the rising participation rate of women in the work-force. The pink line below shows how the number of women employed grew from under 14% of total population in the late 1960s to more than 22% prior to the GFC. The effect on total employment [green line] was dramatic, while employment of men [blue line] oscillated between 24% and 26%.

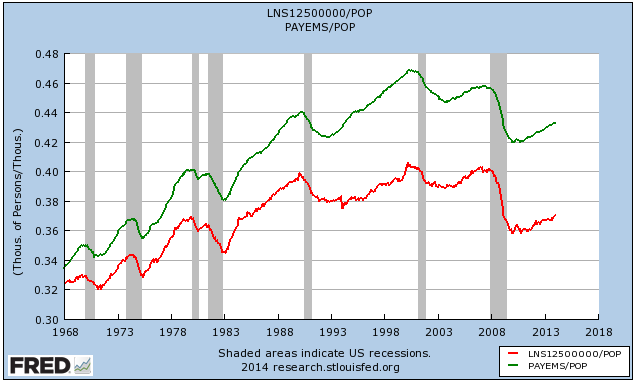

Part-time employment — the difference between total employment [green] and full-time employed [red] below — has leveled off since 2000 at roughly 6% of the total population. So loss of full-time positions has not been compensated by a rise in casual work. Both have been affected.

The "good news" is that a soft labor market will lead to low wages growth for a considerable period, boosting corporate profits.

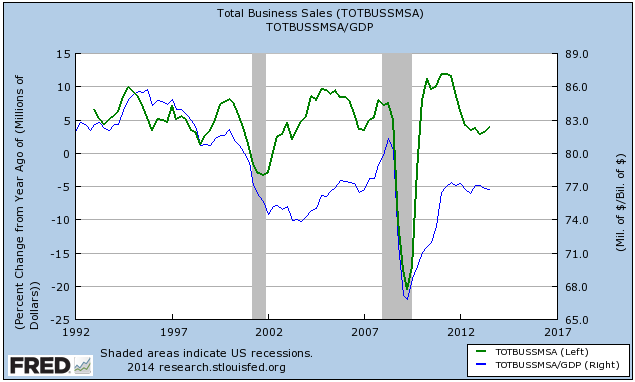

The bad news is that low employment levels will depress sales growth [green line]....

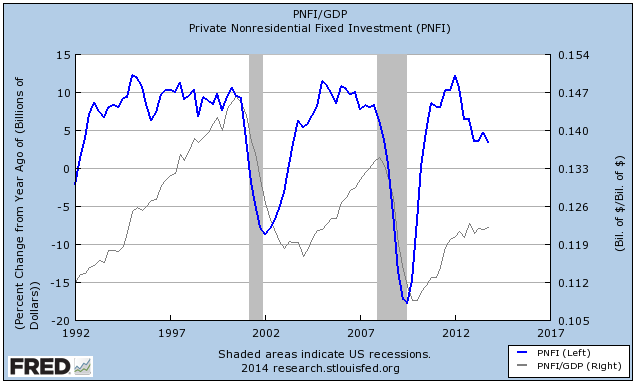

And discourage new investment.....

Which would harm GDP growth.

Whether the succeeding generation is to be more virtuous than their predecessors, I cannot say ; but I am sure they will have more worldly wisdom, and enough, I hope, to know that honesty is the first chapter in the book of wisdom.

~ Thomas Jefferson: Letter to Nathaniel Macon January 12th, 1819.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.