What's New: Twiggs Momentum – Research Results

By Colin Twiggs

November 14th, 2013 4:30 am ET (8:30 pm AEDT)

Further to my recent part-acquisition of Porter Capital Management, I would like to share with you our progress in developing new investment strategies.

Quarterly Performance

Firstly, Porter Capital's ASX200 Prime Momentum strategy achieved a 38.43% gain for the 12 months ended 31st October 2013, out-stripping the total-return index by 12.95% (performance is measured after brokerage costs but before fees and taxes which vary according to portfolio size and commencement date).

Twiggs Momentum

We have also completed testing of strategies using Twiggs Momentum to identify top-performing stocks. Twiggs Momentum is a specialized momentum indicator developed by me and used extensively in my Trading Diary. Test results way exceeded our expectations.

Market Filters

Just as important, we have expanded our use of macroeconomic and volatility filters to help preserve capital during sustained bear markets.

I have long been opposed to mechanical trading/investment systems on the grounds that no one system is suited to all market conditions. To overcome this, Dr Bruce Vanstone and I developed a new approach employing filters to identify when market risk is elevated, so the portfolio can be moved to cash and/or government bonds.

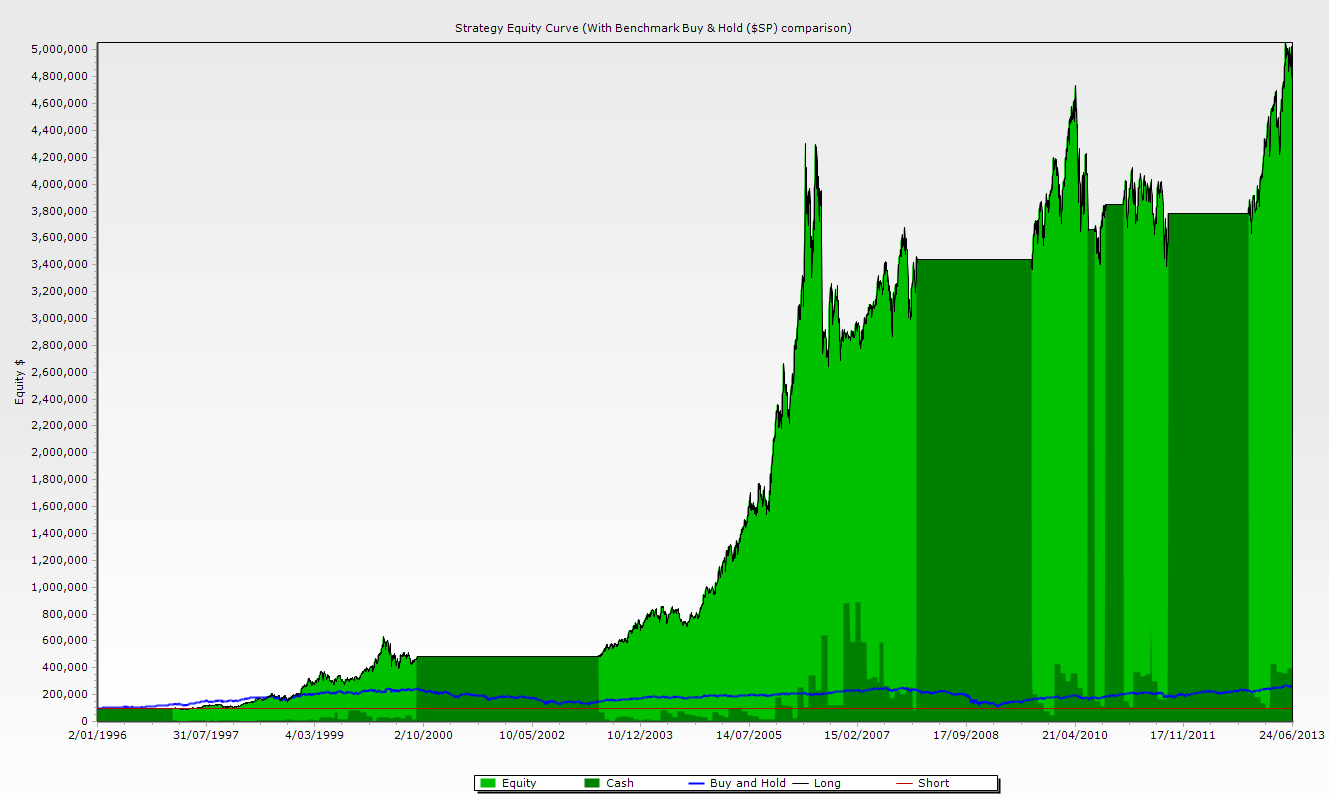

S&P 500

Historical simulation of $100,000 invested in S&P 500 stocks since January 1996 using our Twiggs Momentum strategy returned an average of 24.89% p.a. Dark green areas represent the move to cash when market risk is elevated. The blue line represents the benchmark S&P 500 index.

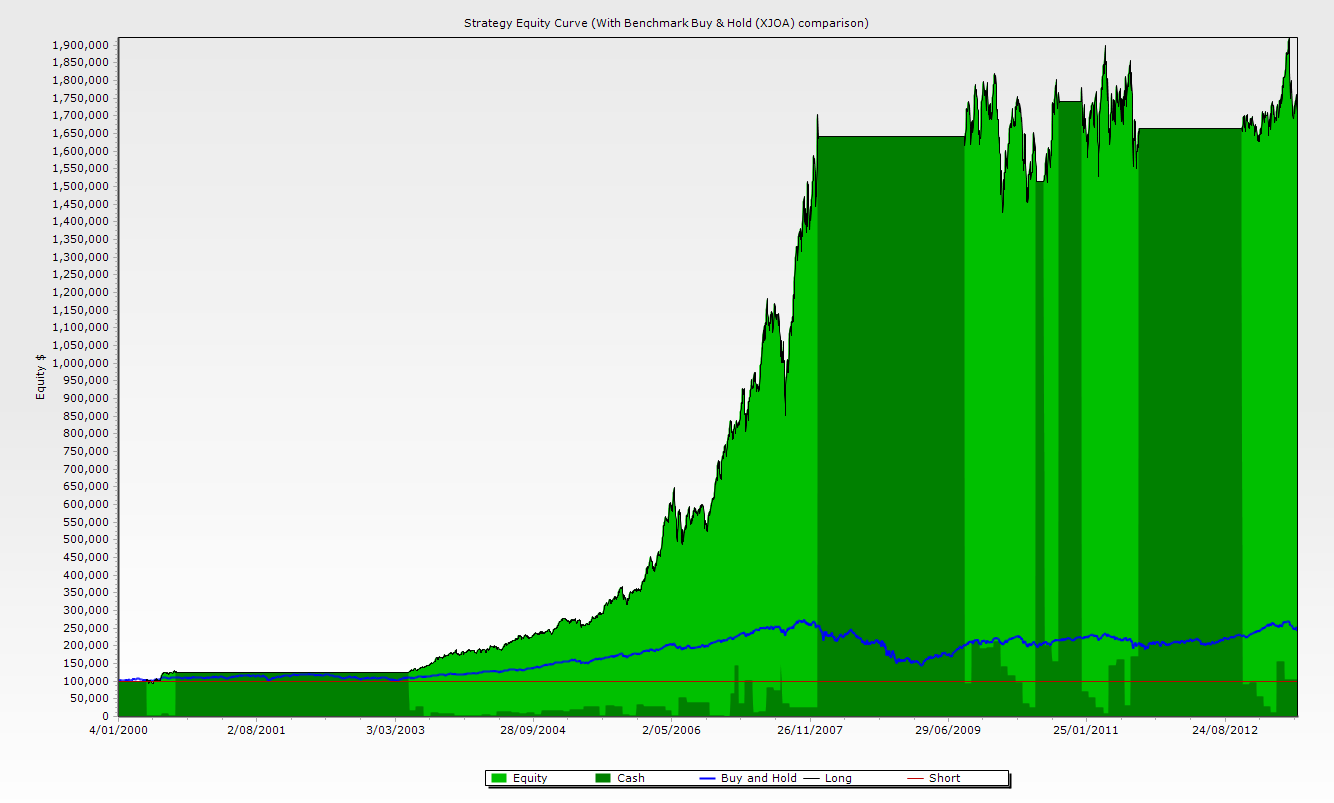

ASX 200

Historical simulation of $100,000 invested in ASX 200 stocks since January 2000 using Twiggs Momentum strategy returned an average of 23.77% p.a. Dark green areas represent the move to cash when market risk is elevated. The blue line represents the benchmark ASX 200 Accumulation Index.

The Momentum Effect

Since its initial discovery by DeBondt & Thaler in 1985, the momentum effect has been documented and researched in many markets worldwide: stocks which have outperformed in the recent past tend to continue to perform strongly.

Investment Research & Systems

All strategies are developed and rigorously tested by Dr Bruce Vanstone, head of investment research, and myself to ensure their suitability for local market conditions. And all systems are rule-based to ensure decision-making is disciplined, unemotional and objective.

Porter Capital

Porter Capital manage funds for high net worth investors and independent financial advisers. We currently manage funds in individual accounts across two adviser platforms, Hub 24 and Mason Stevens, offering investors five key benefits:

- Beneficial ownership of your underlying investments;

- Online access (24x7) to your portfolio;

- Brokerage at wholesale rates;

- Comprehensive tax reporting; and

- Portfolio and risk management by a team of market specialists.

Momentum is an active strategy suitable for lower tax vehicles such as self-managed or self-directed superannuation, pension or retirement funds. The strategy complements and diversifies other equity strategies, smoothing overall portfolio returns. Within this context, the ASX200 Prime Momentum strategy enhances Core and Satellite equity exposure where the objective is diversification of style and strategy.

A Word of Caution

Results that look too good to be true, normally are. No market filter can provide 100% protection against market down-turns, and simulations carried out on data history are no guarantee of future performance. Diversification, across markets and strategies, is important to spread risk, but you must consider your overall risk profile. Please consult your financial adviser for advice tailored to your specific needs.

We will be visiting major cities in Australia in the next few months and look forward to updating readers on our latest research and performance. For more details, visit our website at Porter Capital Management.

If you do what you've always done, you'll get what you've always gotten.

~ Tony Robbins

Disclaimer

Porter Capital Management Pty Ltd is a Corporate Authorized Representative (AR Number 300245) of Andika Pty Ltd which holds an Australian Financial Services Licence (AFSL 297069).

Porter Capital Management (PCM) has made every effort to ensure the reliability of the views and recommendations expressed in the reports published in this newsletter and on its websites. Our research is based upon information known to us or which was obtained from sources which we believe to be reliable and accurate.

No guarantee as to the capital value of investments, nor future returns are made by PCM. Neither PCM nor its employees make any representation, warranty or guarantee that the information provided is complete, accurate, current or reliable.

You are under no obligation to use these services and should always compare financial services/products to find one which best meets your personal objectives, financial situation or needs.

The information in this newsletter and on this web site is general in nature and does not consider your personal circumstances. Please contact us or your professional financial adviser for advice tailored to your needs.

To the extent permitted by law, PCM and its employees, agents and authorised representatives exclude all liability for any loss or damage (including indirect, special or consequential loss or damage) arising from the use of, or reliance on, any information. If the law prohibits the exclusion of such liability, such liability shall be limited, to the extent permitted by law, to the resupply of the said information or the cost of the said resupply.

Important Warning About Simulated Results

Porter Capital Management (PCM) specialise in developing, testing and researching investment strategies and systems. Within this newsletter and the PCM Web site, you will find information about investment strategies and their performance. It is important that you understand that results from PCM research are simulated and not actual results.

No representation is made that any investor will or is likely to achieve profits or losses similar to those shown.

Simulated performance results are generally prepared with the benefit of hindsight and do not involve financial risk. No modelling can completely account for the impact of financial risk in actual investment. Account size, brokerage and slippage may also diverge from simulated results. Numerous other factors related to the markets in general or to the implementation of any specific investment system cannot be fully accounted for in the preparation of simulated performance results and may adversely affect actual investment results.

To the extent permitted by law, PCM and its employees, agents and authorised representatives exclude all liability for any loss or damage (including indirect, special or consequential loss or damage) arising from the use of, or reliance on, any information offered by PCM whether or not caused by any negligent act or omission.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.