Identifying Market Risk

Further to the recent announcement regarding my equity acquisition in Porter Capital Management, I would like to share with you some of the progress we have made in developing new investment strategies.

Current Performance

Firstly, the existing ASX200 Prime Momentum strategy, running with an improved volatility filter, achieved a 32.5% gain for the 12 months ended 31st August 2013, out-stripping the total-return index by more than 9.0% (performance is measured after brokerage costs but before fees and taxes).

Identifying Market Risk

What I am most excited about, though, is the development of a new filter to identify elevated market risk. Dr Bruce Vanstone (head of Trading Research) and I tested a large number of macroeconomic and volatility indicators until we found a combination that is both responsive without being overly prone to whipsaws. Our aim is to reduce capital draw-downs by moving portfolios to cash and/or government bonds when risks are elevated.

The market filter is ideal for index and income strategies, optimising time in the market and minimising whipsaws, while a lower threshold is used for more volatile momentum strategies. This newsletter will focus on index and income strategies. Momentum strategies will be covered in my next newsletter.

Index & Income Strategies

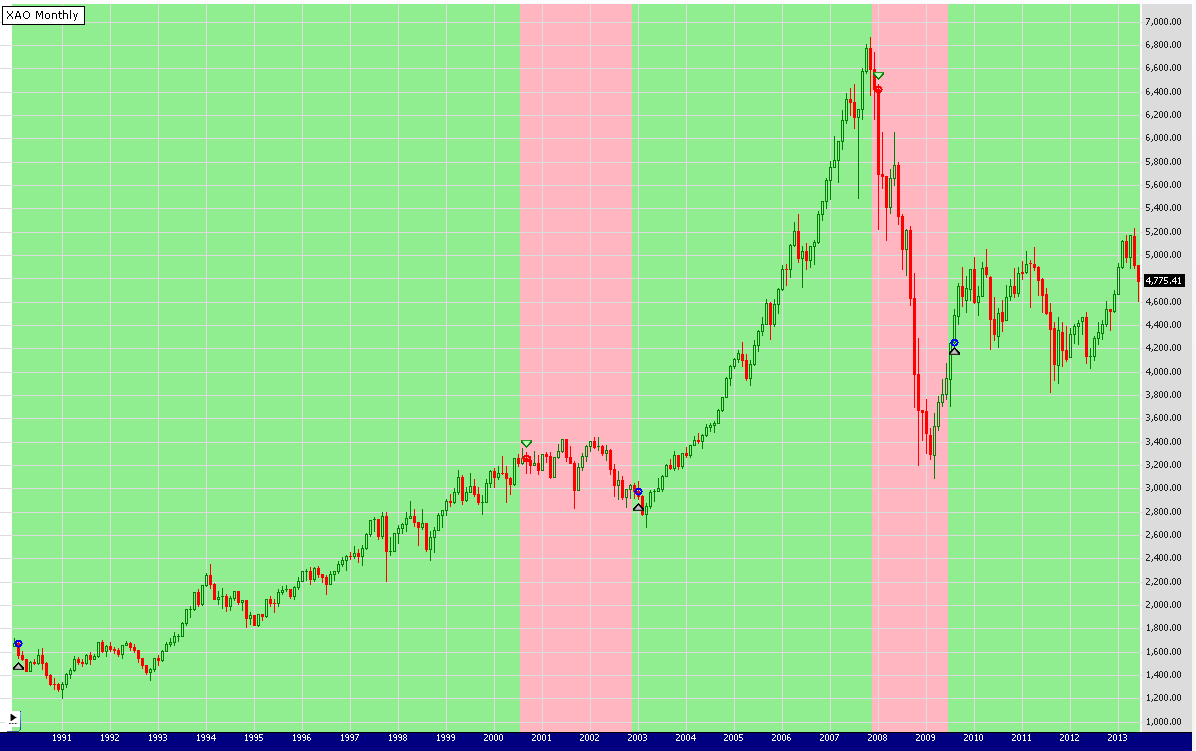

Simulated results for the ASX All Ordinaries Index from 1990 to 2013 identify major periods of elevated risk (marked in pink) over the last two decades, while ignoring secondary fluctuations.

[click on image to enlarge]

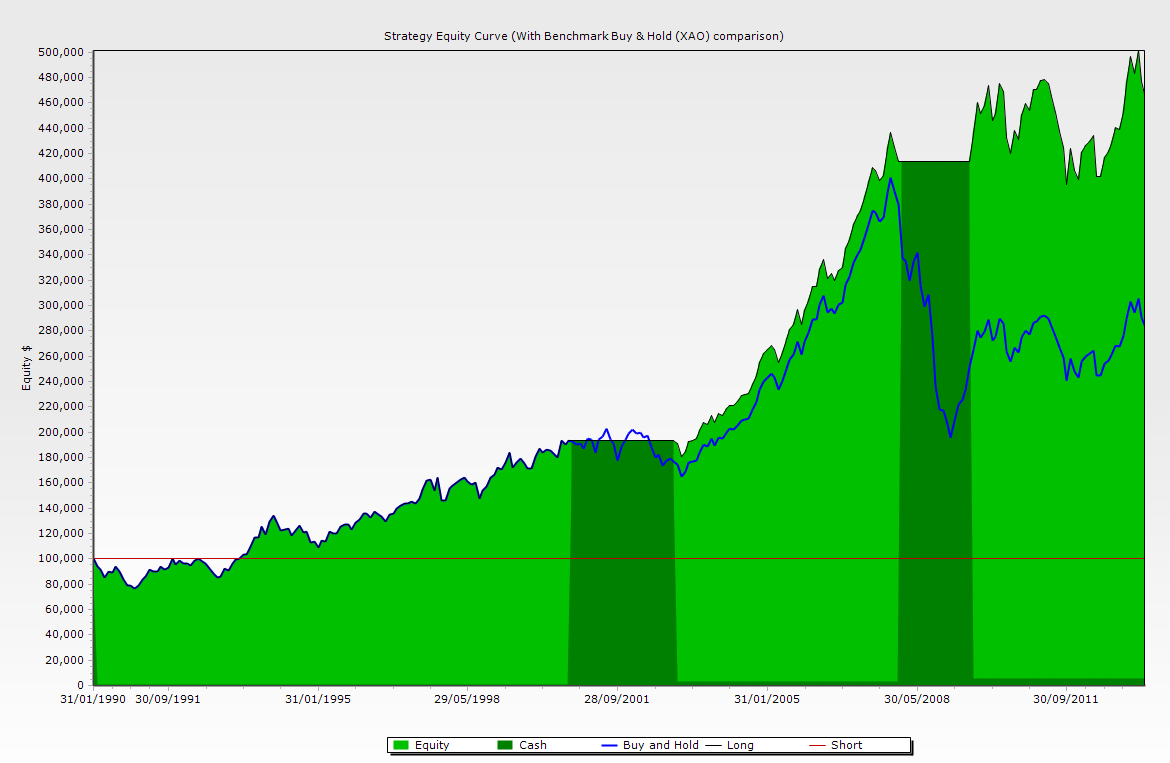

The equity curve below compares a [blue] buy-and-hold strategy for the index to an index investment which is moved to cash during periods of elevated risk. Initial investment is $100,000. Dark green areas indicate cash holdings. Brokerage is taken into account, but not dividends and interest (on cash holdings) which tend to offset each other.

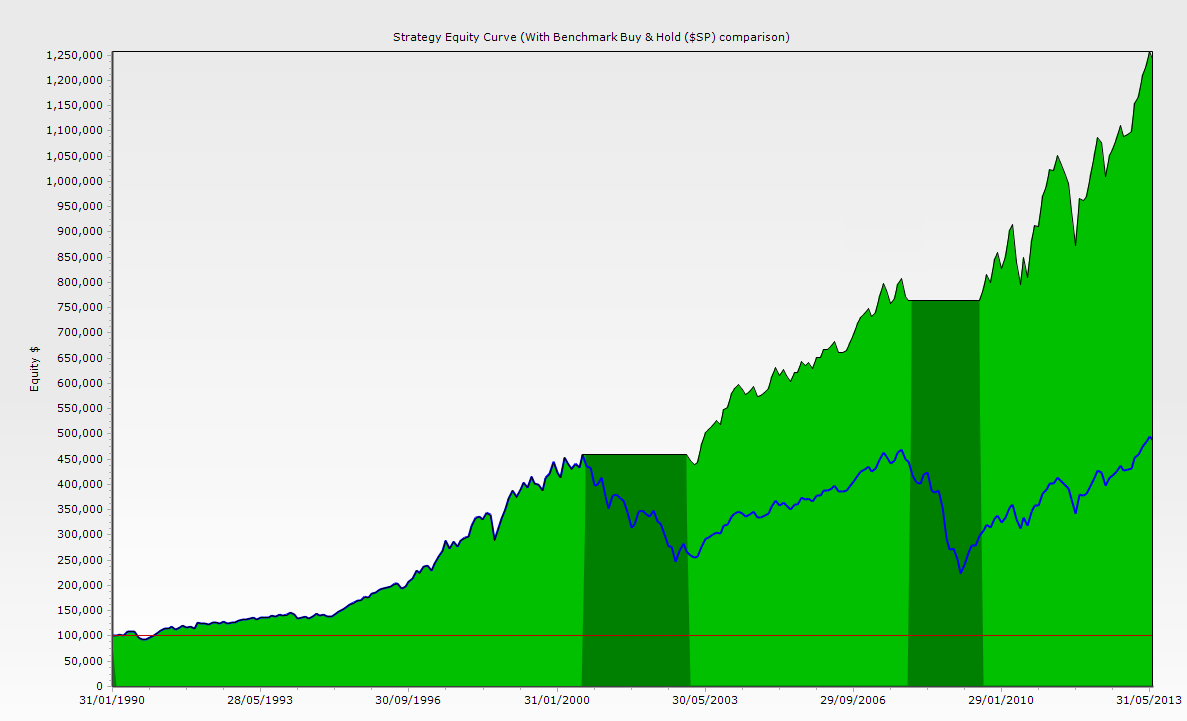

Results for the S&P 500 were particularly impressive.

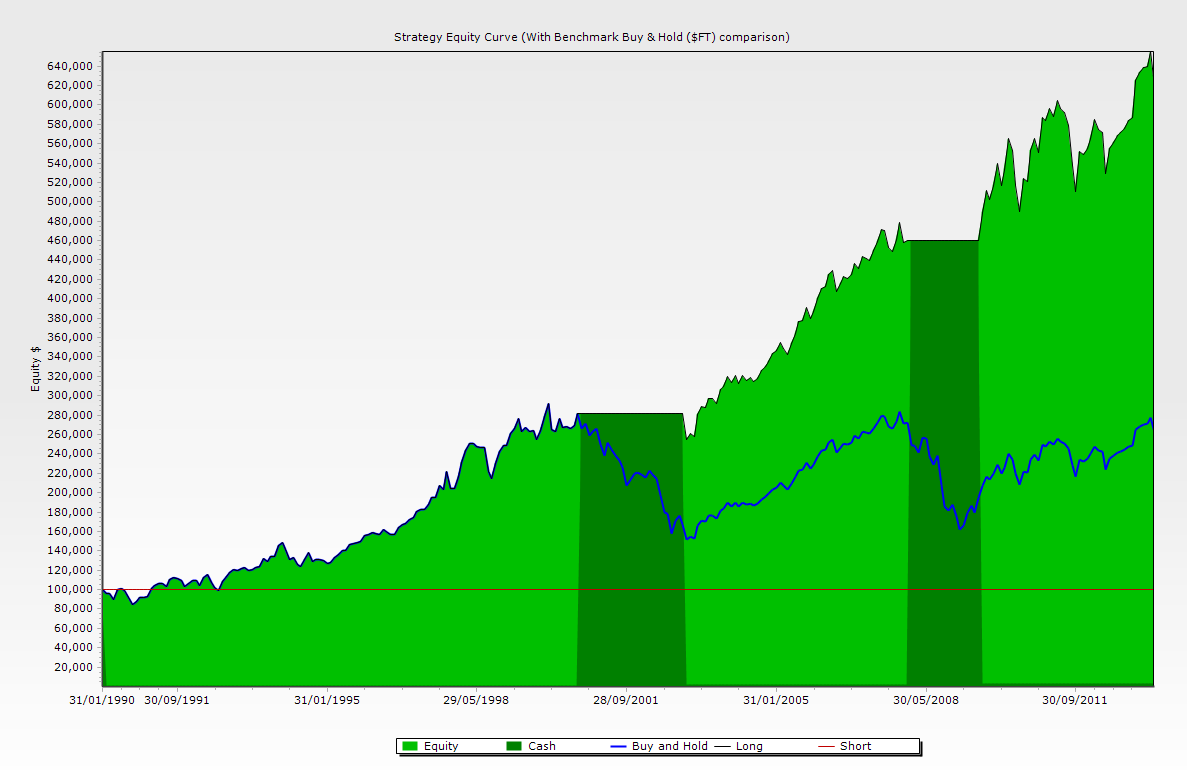

Most exchanges with reasonable correlation to US markets, like the FTSE 100 below, comfortably out-performed a buy-and-hold strategy.

A Word of Caution

Results that look too good to be true, normally are. No market filter can provide 100% protection against market down-turns, and simulations carried out on data history are no guarantee of future performance. Which is why we employ additional defensive measures to protect portfolios.

More to Come

Bruce and I have also tested a new investment strategy using Twiggs Momentum — a proprietary indicator developed by me several years ago — which outperforms conventional Momentum by a significant margin. More details in my next newsletter.

We will be visiting major cities in Australia in the next few months and look forward to updating readers on our latest research and performance. For more details, visit our website at Porter Capital Management.

The expectations of life depend upon diligence; the craftsman that would perfect his work must first sharpen his tools.

~ The Analects of Confucius

Disclaimer

Porter Capital Management Pty Ltd is a Corporate Authorized Representative (AR Number 300245) of Andika Pty Ltd which holds an Australian Financial Services Licence (AFSL 297069).

Porter Capital Management (PCM) has made every effort to ensure the reliability of the views and recommendations expressed in the reports published in this newsletter and on its websites. Our research is based upon information known to us or which was obtained from sources which we believe to be reliable and accurate.

No guarantee as to the capital value of investments, nor future returns are made by PCM. Neither PCM nor its employees make any representation, warranty or guarantee that the information provided is complete, accurate, current or reliable.

You are under no obligation to use these services and should always compare financial services/products to find one which best meets your personal objectives, financial situation or needs.

The information in this newsletter and on this web site is general in nature and does not consider your personal circumstances. Please contact us or your professional financial adviser for advice tailored to your needs.

To the extent permitted by law, PCM and its employees, agents and authorised representatives exclude all liability for any loss or damage (including indirect, special or consequential loss or damage) arising from the use of, or reliance on, any information. If the law prohibits the exclusion of such liability, such liability shall be limited, to the extent permitted by law, to the resupply of the said information or the cost of the said resupply.

Important Warning About Simulated Results

Porter Capital Management (PCM) specialise in developing, testing and researching investment strategies and systems. Within this newsletter and the PCM Web site, you will find information about investment strategies and their performance. It is important that you understand that results from PCM research are simulated and not actual results.

No representation is made that any investor will or is likely to achieve profits or losses similar to those shown.

Simulated performance results are generally prepared with the benefit of hindsight and do not involve financial risk. No modelling can completely account for the impact of financial risk in actual investment. Account size, brokerage and slippage may also diverge from simulated results. Numerous other factors related to the markets in general or to the implementation of any specific investment system cannot be fully accounted for in the preparation of simulated performance results and may adversely affect actual investment results.

To the extent permitted by law, PCM and its employees, agents and authorised representatives exclude all liability for any loss or damage (including indirect, special or consequential loss or damage) arising from the use of, or reliance on, any information offered by PCM whether or not caused by any negligent act or omission.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.