Forex: Euro tests resistance, Aussie breaks support

By Colin Twiggs

August 5th, 2012 1:00 a.m. EDT (3:00 p:m AET)

These extracts from my trading diary are for educational purposes. Any advice contained therein is provided for the general information of readers and does not have regard to any particular person's investment objectives, financial situation or needs and must not be construed as advice to buy, sell, hold or otherwise deal with any securities or other investments. Accordingly, no reader should act on the basis of any information contained therein without first having consulted a suitably qualified financial advisor. Full terms and conditions can be found at Terms of Use.

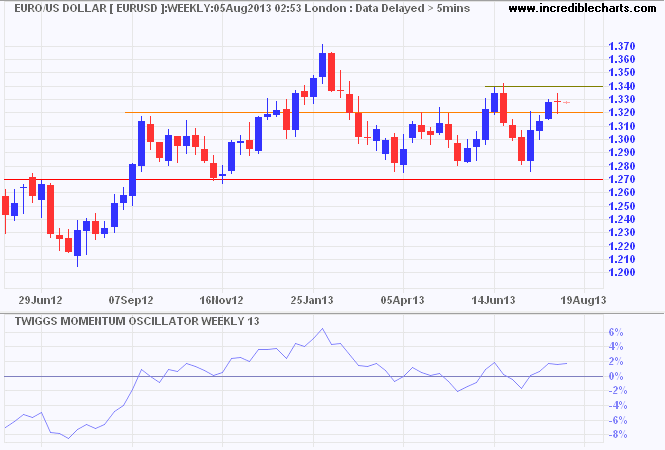

The Euro broke medium-term resistance at $1.32 and is testing the next level at $1.34. Breakout would indicate a primary advance, while respect of resistance (indicated by reversal below $1.32) would warn of another test of primary support at $1.27. Close oscillation of 13-week Twiggs Momentum around the zero line reflects hesitancy.

* Target calculation: 1.34 + ( 1.34 - 1.28 ) = 1.40

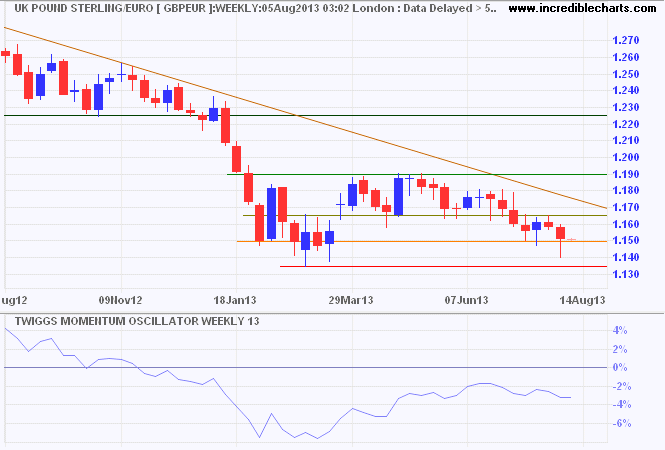

Sterling is testing primary support at €1.135 against the euro. Long tails indicate buying pressure and recovery above €1.165 would suggest that a bottom is forming. Breakout above €1.19 would complete a double bottom with a target of €1.24. Recovery of 13-week Twiggs Momentum above zero would strengthen the signal.

* Target calculation: 1.19 + ( 1.19 - 1.14 ) = 1.24

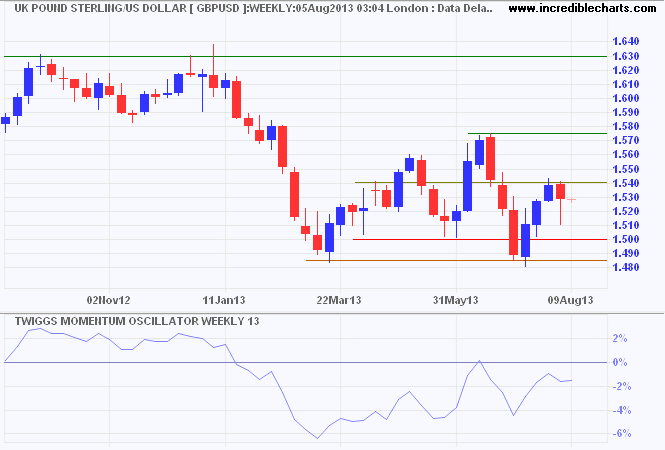

Against the greenback, Sterling is testing medium-term resistance at $1.54. Last week's long tail suggests buying pressure. Breakout would offer a target of $1.575. Respect is less likely, but would indicate another test of primary support at $1.485. Recovery of 13-week Twiggs Momentum above zero would strengthen the bull signal.

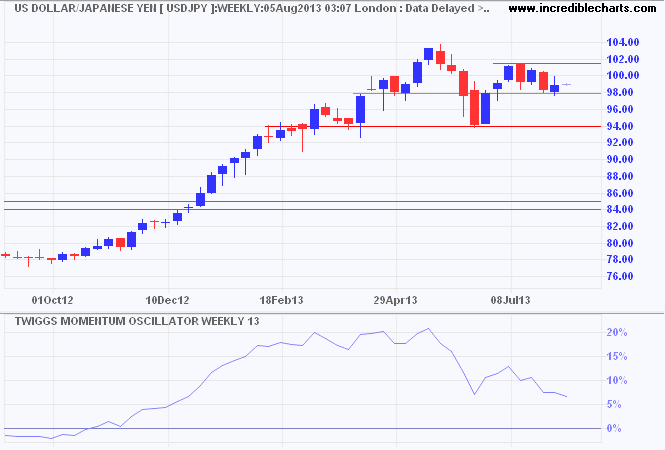

The greenback is oscillating around resistance at ¥100 against the Yen. Follow-through above ¥101.50 would suggest a new advance, while breakout above ¥104 would confirm, offering a target of ¥114*. Reversal below ¥98 remains as likely, however, and would warn of a test primary support at ¥94.

* Target calculation: 104 + ( 104 - 94 ) = 114

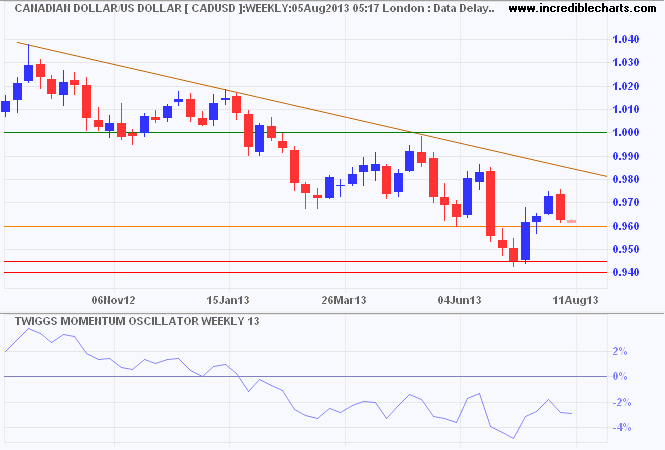

Canada's Loonie continues its primary down-trend against the greenback. Breach of medium-term support at $0.96 would test the primary level at $0.94/$0.945. Failure of primary support would offer a long-term target of $0.84*.

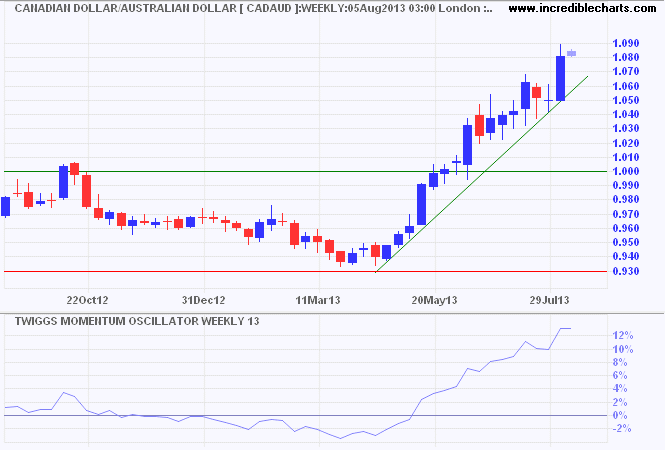

Against the Aussie Dollar, the Loonie remains in a strong up-trend.

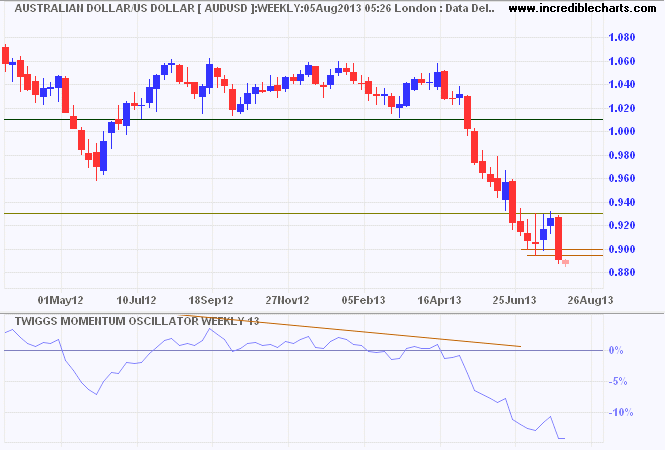

The Aussie Dollar also continues its primary down-trend against the greenback. Breach of medium-term support at $0.90 suggests a decline to $0.87*, but the long-term target is $0.80*.

* Target calculation: 0.90 - ( 0.93 - 0.90 ) = 0.87; 0.95 - ( 1.10 - 0.95 ) = 0.80

Even when they have the potential to become productive members of society, the loss of welfare state benefits if they try to do so is an implicit "tax" on what they would earn that often exceeds the explicit tax on a millionaire. If increasing your income by $10,000 would cause you to lose $15,000 in government benefits, would you do it? In short, the political left's welfare state makes poverty more comfortable, while penalizing attempts to rise out of poverty.

~ Economist Thomas Sowell on how the welfare state obstructs the poor's attempts to uplift themselves.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.