Gold lifts on Dollar's sharp fall

By Colin Twiggs

July 11th, 2013 1:30 a.m. EDT (3:30 p:m AET)

These extracts from my trading diary are for educational purposes. Any advice contained therein is provided for the general information of readers and does not have regard to any particular person's investment objectives, financial situation or needs and must not be construed as advice to buy, sell, hold or otherwise deal with any securities or other investments. Accordingly, no reader should act on the basis of any information contained therein without first having consulted a suitably qualified financial advisor. Full terms and conditions can be found at Terms of Use.

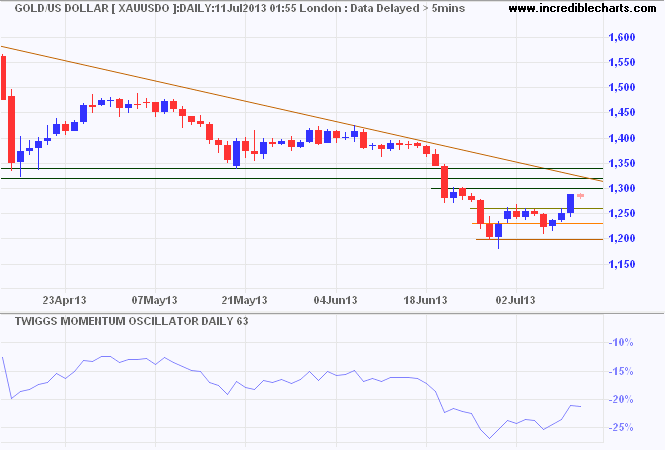

Gold broke medium-term resistance at $1260 as the Dollar Index fell sharply. Expect strong resistance between $1300 and 1340, however, and respect of the descending trendline would indicate another test of $1200. Continuation of the down-trend is likely, and failure of support at $1200 would offer a medium-term target of $1100*.

* Target calculation: 1200 - ( 1300 - 1200 ) = 1100

Dollar Index

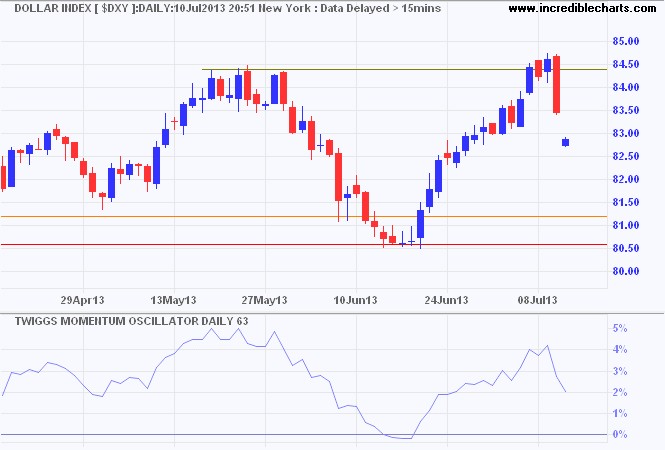

The dollar fell sharply on Wednesday as investors , hoping for greater clarity, received mixed (if not confusing) signals. Nicole Hong at WSJ writes:

Fed Chairman Ben Bernanke said at a conference that the central bank's highly monetary policy [QE] is needed for the foreseeable future. He added that it is likely the Fed won't raise interest rates "for some time," even after the unemployment rate reaches 6.5%.

His remarks came after the release of minutes from the Fed's June meeting earlier Wednesday. The minutes showed Fed officials divided about the timing of a reduction in bond buying, with half of Fed officials believing the central bank should end the stimulus program by the end of this year. Other Fed officials said the labor market hasn't improved enough to begin tapering so soon.

The Dollar Index fell sharply, signaling another test of primary support at 80.50. Breach of support — or reversal of Twiggs Momentum (63-day or 13-week) below zero — would warn of a primary down-trend. While that is unlikely, failure to break resistance at 84.50 suggests a weak up-trend.

Crude Oil

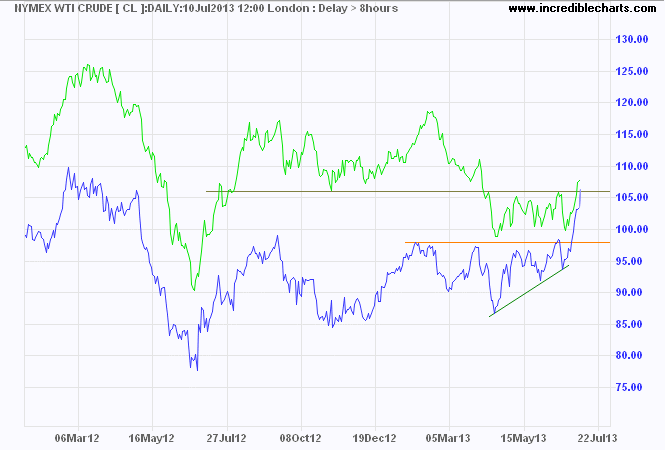

Nymex WTI light crude followed through above $100/barrel, signaling a primary up-trend, while Brent crude recovered above $106/barrel. The spread has narrowed to less than $2/barrel. Rising Nymex crude prices reflect a stronger US economy. Target for the advance is the 2012 high of $110/barrel*.

* Target calculation: 98 + ( 98 - 86 ) = 110

Commodities

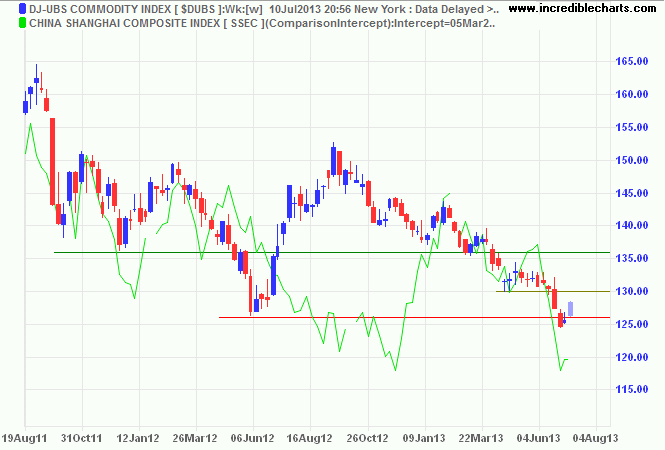

Commodity prices are largely driven by China. Narrow consolidation of the Shanghai Composite index above long-term support at 1950 suggests a decline to test the 2008 low at 1700. That would drag commodities even lower. Dow Jones-UBS Commodity Index similarly recovered above long-term support at 125 and is likely to test 130, but reversal below support would target the 2009 low at 100*. Not good news for Australian resources stocks, even if the impact is cushioned by a falling Aussie Dollar.

* Target calculation: 125 - ( 150 - 125 ) = 100

There is no better [teacher] than adversity. Every defeat, every heartbreak, every loss, contains its own seed, its own lesson on how to improve your performance the next time.

~ Malcolm X

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.