Gold and commodities fall as the dollar rises

By Colin Twiggs

June 27th, 2013 3:00 a.m. EDT (5:00 p:m AET)

These extracts from my trading diary are for educational purposes. Any advice contained therein is provided for the general information of readers and does not have regard to any particular person's investment objectives, financial situation or needs and must not be construed as advice to buy, sell, hold or otherwise deal with any securities or other investments. Accordingly, no reader should act on the basis of any information contained therein without first having consulted a suitably qualified financial advisor. Full terms and conditions can be found at Terms of Use.

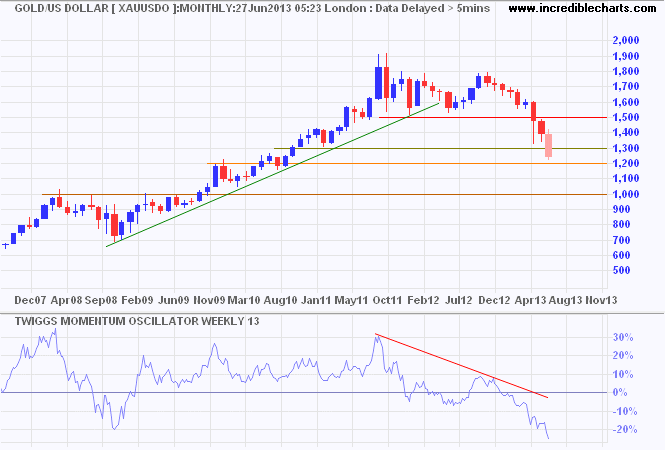

Gold is falling fast, but should find short/medium-term support at $1200/ounce*. Breach of that level would offer a target of $1000.

* Target calculation: 1350 - ( 1500 - 1350 ) = 1200; 1500 - ( 1800 - 1500 ) = 1200

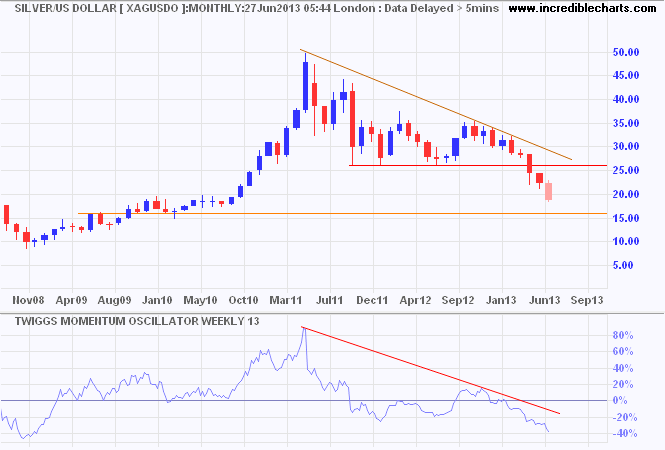

Silver similarly offers a target of $16/ounce*.

* Target calculation: 26 - ( 36 - 26 ) = 16

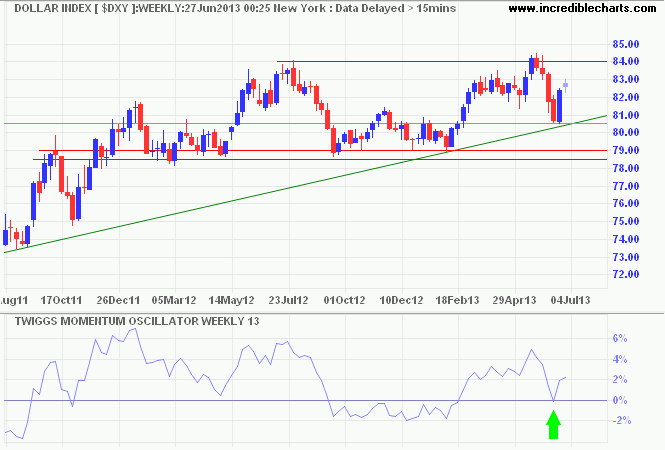

Dollar Index

The Dollar Index respected its primary trendline at 80.50 and is headed for another test of 84. The 13-week Twiggs Momentum trough above zero suggests a strengthening up-trend. Target for a breakout would be the 2010 high at 89*.

* Target calculation: 84 + ( 84 - 79 ) = 89

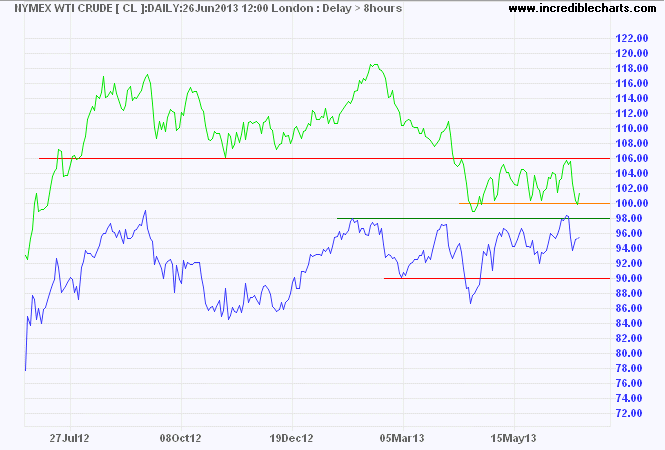

Crude Oil

Crude is range-bound, with Nymex WTI retreating after a false break above resistance at $98/barrel and Brent testing support at $100. The spread has narrowed to $6 and is likely to close further as the US economy recovers faster than Europe. Brent is in a down-trend, while Nymex continues to threaten a primary up-trend, reflecting the stronger US economy.

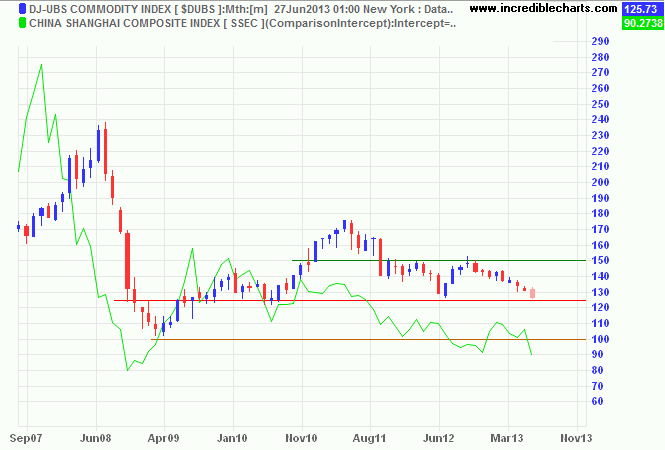

Commodities

The Dow Jones/UBS Commodity Index is falling hard, more in sympathy with gold than with crude, as the dollar strengthens. A rapidly weakening Chinese economy is likely to drag commodity prices even lower. Breakout below long-term support at 125/126 would offer a target of the 2009 low at 100*.

* Target calculation: 125 - ( 150 - 125 ) = 100

If this Government cannot get the adjustment, get manufacturing going again, and keep moderate wage outcomes and a sensible economic policy, then Australia is basically done for. We will end up being a third rate economy.... a banana republic.

~ Former Australian Prime Minister Paul Keating (1986)

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.