Forex: Aussie resistance, Yen falls

By Colin Twiggs

June 12th, 2012 10:30 p.m. EDT (12:30 p:m AET)

These extracts from my trading diary are for educational purposes. Any advice contained therein is provided for the general information of readers and does not have regard to any particular person's investment objectives, financial situation or needs and must not be construed as advice to buy, sell, hold or otherwise deal with any securities or other investments. Accordingly, no reader should act on the basis of any information contained therein without first having consulted a suitably qualified financial advisor. Full terms and conditions can be found at Terms of Use.

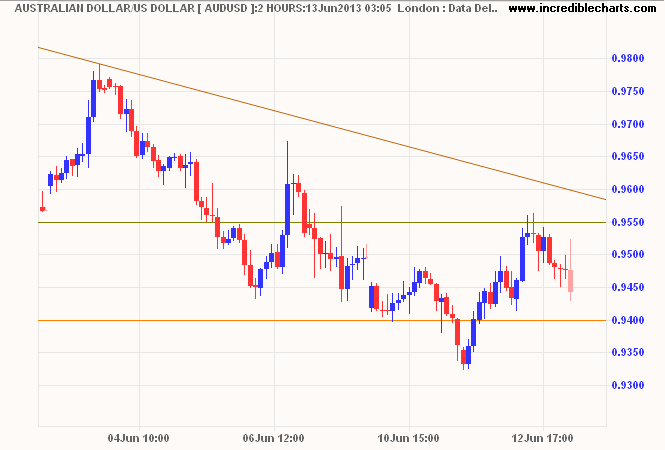

The Aussie Dollar rallied to $0.955 on the 2-hour chart before encountering selling pressure. Expect a test of the 2011 low at $0.94. Breach would indicate another decline. The next target is $0.90*, with a long-term target of $0.80*. Breakout above $0.955 is unlikely, but would re-test resistance at $0.98.

* Target calculations: 0.94 - ( 0.98 - 0.94 ) = 0.90 and 0.95 - ( 1.10 - 0.95 ) = 0.80

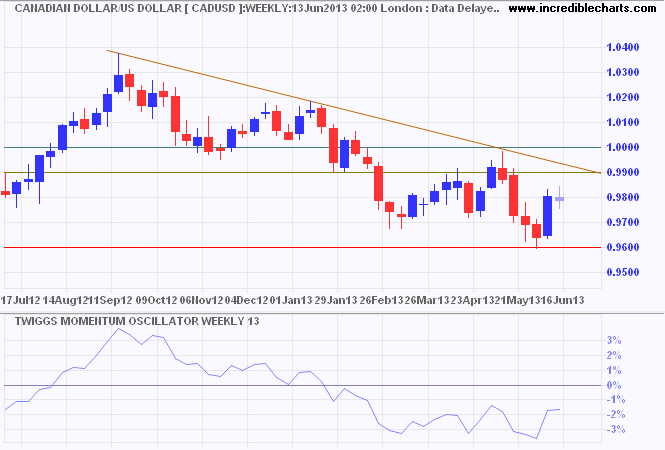

Canada's Loonie, however, respected support at $0.96, heading for another test of resistance at $0.99 or parity. 13-Week Twiggs Momentum below zero suggests continuation of the down-trend. Respect of resistance would indicate another decline, with a target of $0.94*.

* Target calculation: 0.94 - ( 1.06 - 0.94 ) = 0.82

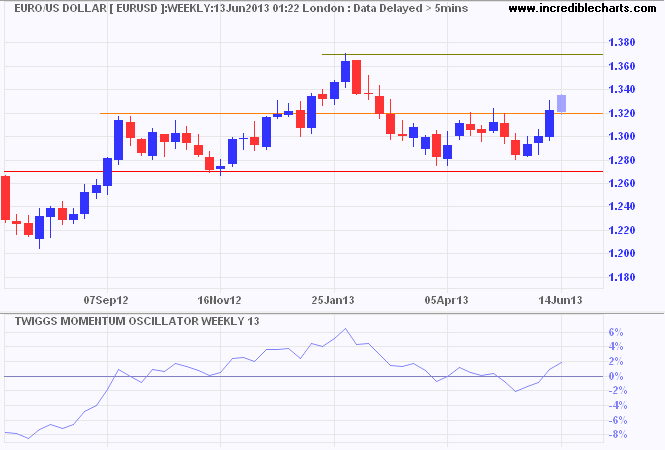

The euro broke resistance at $1.32 and is headed for $1.37*. Breakout is some way off, but would offer a target of $1.47*.

* Target calculation: 1.37 + ( 1.37 - 1.27 ) = 1.47

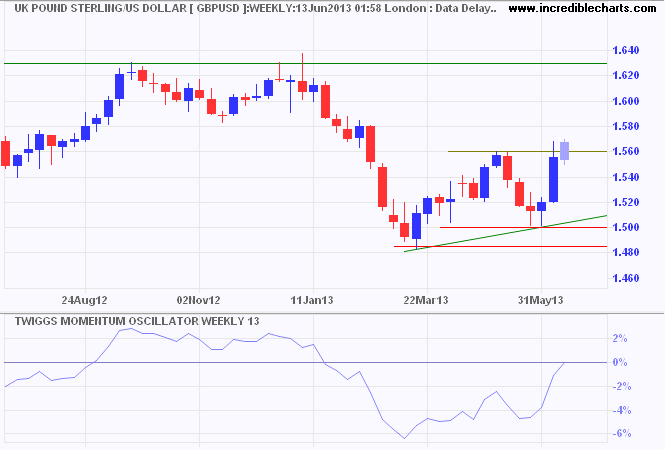

Pound Sterling broke resistance at $1.56, signaling an advance to $1.63*. Recovery of 13-week Twiggs Momentum above zero would strengthen the bull signal.

* Target calculation: 1.56 + ( 1.56 - 1.50 ) = 1.62

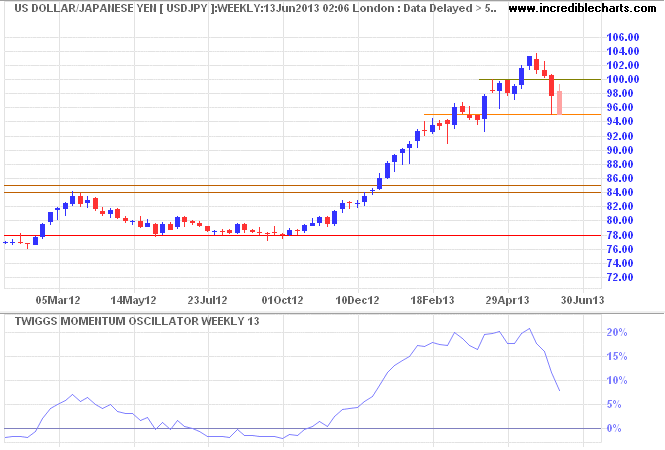

The greenback continues a strong correction against the Yen, but this is a secondary movement and the primary up-trend is unaltered. A 13-week Twiggs Momentum trough above zero would strengthen the signal. Recovery above resistance at ¥100 would signal a fresh advance with a target of ¥113*. Long-term target for the advance is the 2007 high at ¥125*.

* Target calculations: (a) 104 + ( 104 - 95 ) = 113; (b) 100 + ( 100 - 75 ) = 125

Elections are held to delude the populace into believing that they are participating in government.

~ Gerald F Lieberman

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.