Bearish signs for stocks

By Colin Twiggs

June 3rd, 2013 3:00 am EDT (5:00 pm AET)

These extracts from my trading diary are for educational purposes. Any advice contained therein is provided for the general information of readers and does not have regard to any particular person's investment objectives, financial situation or needs and must not be construed as advice to buy, sell, hold or otherwise deal with any securities or other investments. Accordingly, no reader should act on the basis of any information contained therein without first having consulted a suitably qualified financial advisor. Full terms and conditions can be found at Terms of Use.

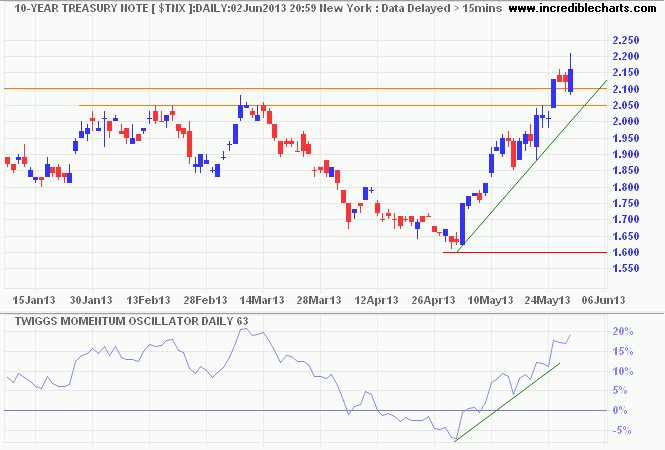

10-Year Treasury yields respected support at 2.05/2.10% with a key reversal (or outside reversal) on Friday, signaling a primary up-trend and possible test of 4.00% in the next few years. The tall shadow on Friday's candle, however, warns of another test of the new support level before the trend gets under way. Only breakout above 4.00% would end the 31-year secular bear-trend.

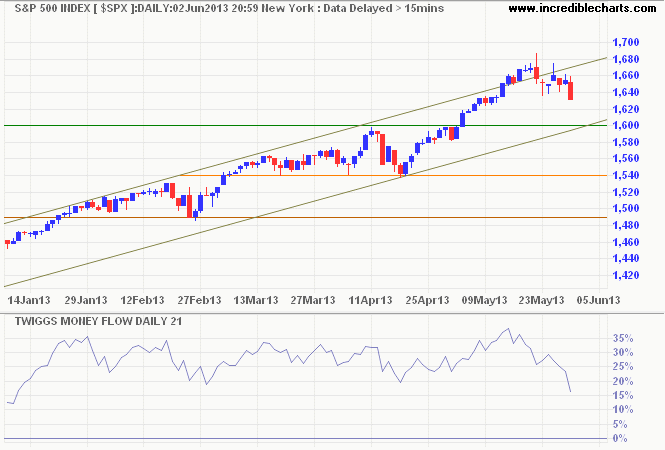

The S&P 500 is headed for a test of the lower trend channel at 1600, declining 21-day Twiggs Money Flow indicating medium-term selling pressure. Breach of support at 1600 would warn of a correction.

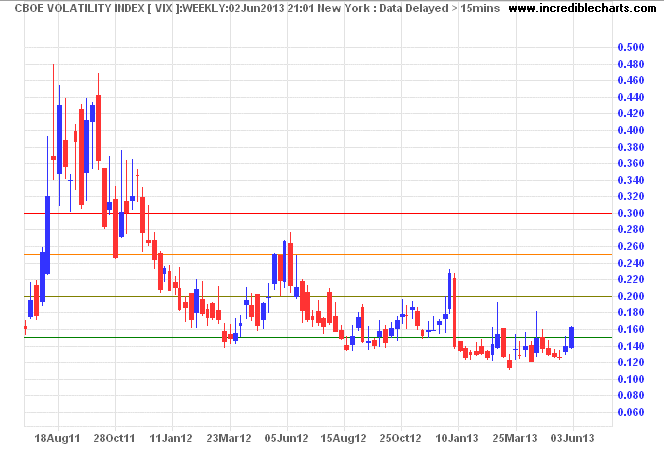

The VIX is rising, but only breakout above 20 would indicate something is amiss.

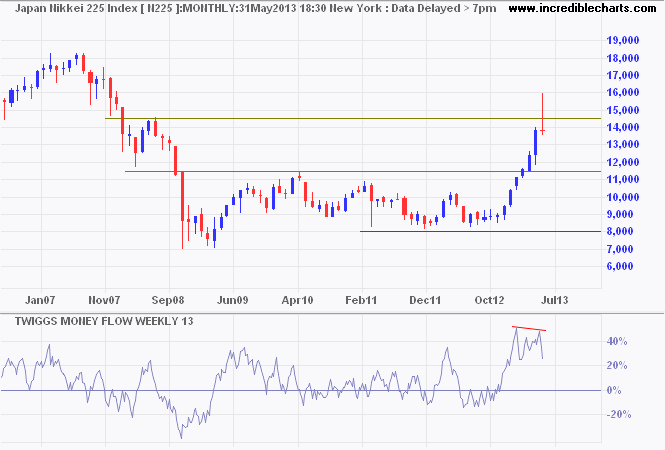

Japan's Nikkei 225 Index ran into huge selling pressure, falling to 13400 by midday Monday. Expect a test of support at 11500, but the primary trend remains upward. Rising industrial production indicates that Abenomics is starting to take effect.

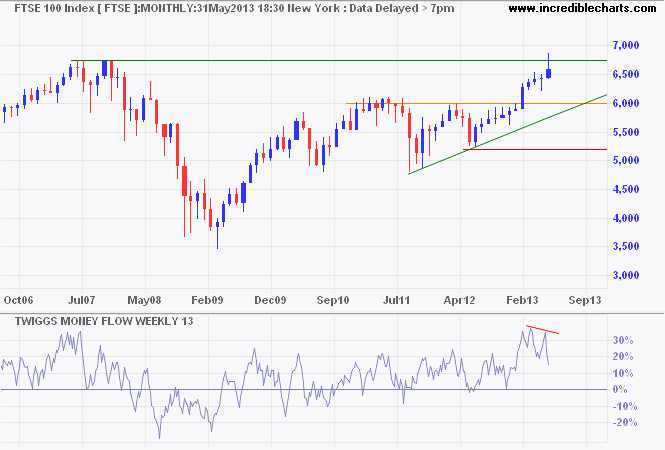

The UK's FTSE 100 also ran into selling pressure — at its 2007 high of 6750 — with bearish divergence on 13-week Twiggs Money Flow. Expect a correction to test 6000, but the primary trend remains upward.

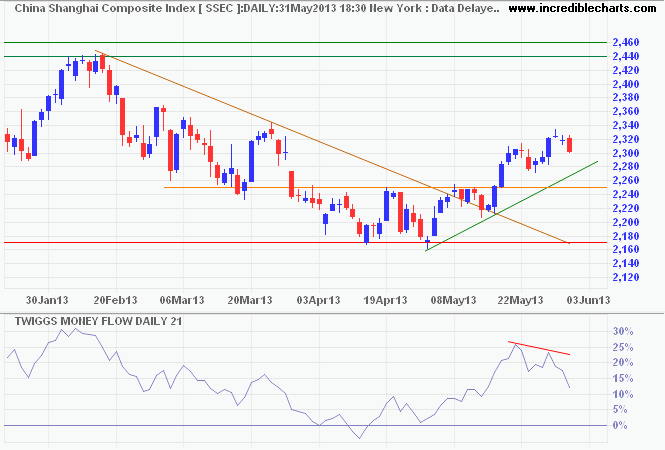

Bearish divergence on the Shanghai Composite Index (21-day Twiggs Money Flow) indicates medium-term selling pressure. Expect another test of primary support at 2170. Penetration of the rising trendline would confirm. Breakout above 2460 would complete an inverted head and shoulders reversal, signaling a primary up-trend, but that appears some way off.

We all know what to do, we just don't know how to get re-elected after we have done it.

~ Jean Claude Juncker, prime minister of Luxembourg

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.