Time to short Gold?

By Colin Twiggs

April 11th, 2013 1:30 a.m. ET (3:30 p:m AET)

These extracts from my trading diary are for educational purposes. Any advice contained therein is provided for the general information of readers and does not have regard to any particular person's investment objectives, financial situation or needs and must not be construed as advice to buy, sell, hold or otherwise deal with any securities or other investments. Accordingly, no reader should act on the basis of any information contained therein without first having consulted a suitably qualified financial advisor. Full terms and conditions can be found at Terms of Use.

Quartz reports that Goldman Sachs recommend investors sell gold short:

Goldman Sachs commodities analysts suggest the selloff in the yellow metal could be about to gain momentum. In a research note Wednesday they write not even the stress over Cyprus could generate much of a rally in gold prices. And they come to the conclusion that "long" enthusiasm over gold prices is ebbing fast....

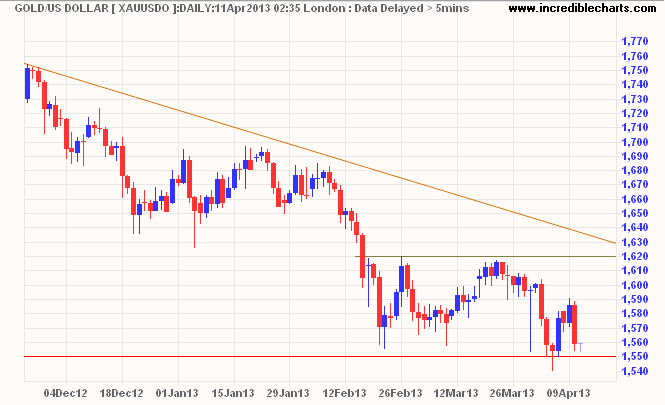

A short trade with a stop at $1600 and target of $1450 (according to GS), for a breakout below $1550, seems a reasonable risk-reward ratio. But what is the probability of a downward breakout and should long-term investors consider selling?

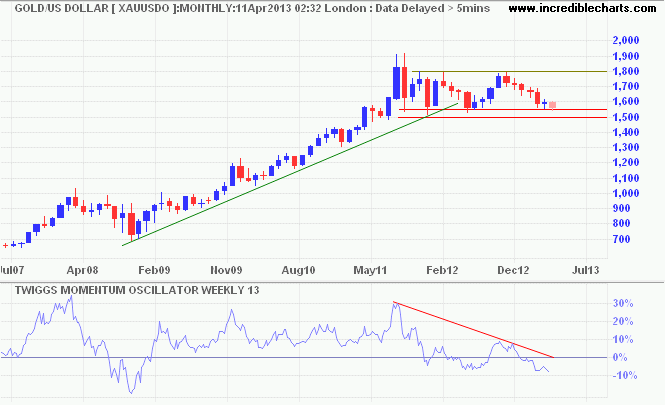

Gold had several consolidations or corrections over the last decade, but each resolved in a continuation of the primary up-trend, with quantitative easing fueling the rise. Latest FOMC minutes indicate that bond purchases by the Fed are likely to be scaled back in the second half of the year. Does this mean the end of QE and gold's bull run?

Hussman Funds' latest market comment includes a chart that shows the economy rallies whenever the Fed introduces QE, but falls when QE ends. The US economy may come off life support but is still going to need a lengthy convalescence. And possibly further episodes of QE to prevent a relapse.

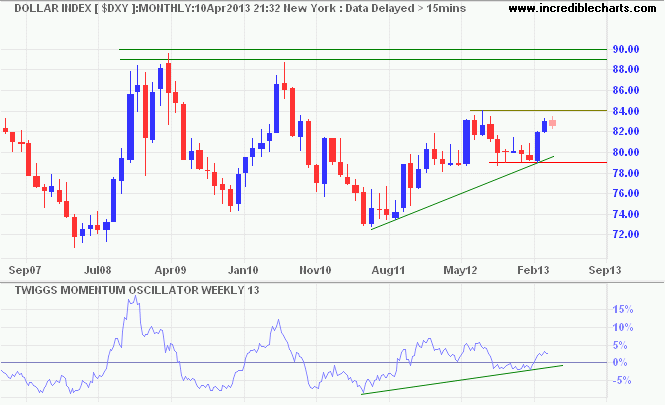

Declining purchasing power of the dollar is also unlikely to reverse. The Dollar Index ($DXY) is in an up-trend, but we need to remember that it reflects values relative to major trading partners, with the Euro accounting for 57.6% of the total weighting, the Yen second highest at 13.6%, and Pound Sterling third at 11.9%. This is a race to the bottom. All four central banks are debasing their currencies. The Dollar only looks strong because it is sinking slower than the others. Purchasing power of the dollar is definitely not rising in real terms.

So my long-term view of gold remains bullish, but that does not rule out a 30% correction like 2008 below. Retail investors are definitely sellers, with substantial outflows from gold ETFs, but central banks according to Agustino Fontevecchia at Forbes have bought $3 billion in gold this year:

As prices have dropped and investors lost faith, central banks have been on the opposite side of the trade, gobbling up bullion at a rate of 27-metric tons a month, according to UBS' gold expert Edel Tully. Russia and South Korea are among the biggest buyers....

This could still go either way. On the monthly chart we can see gold testing support at $1550. The third dip below zero on 13-week Twiggs Momentum gives strong warning of a down-trend. Breakout below $1500 would offer a target of $1200*, but respect of support — indicated by recovery above the February 26 high at $1620 — would signal a rally to $1800.

* Target calculation: 1500 - ( 1800 - 1500 ) = 1200

Dollar Index

The Dollar Index is testing resistance at 84.00. Breakout is likely and would signal an advance to 89.00/90.00. Rising momentum supports this view.

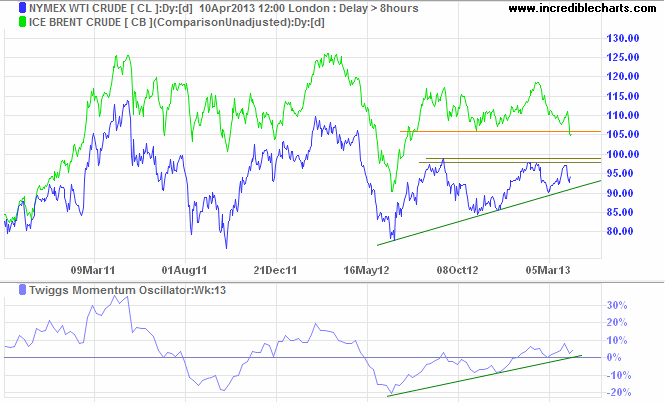

Crude Oil

The ascending triangle and rising 13-week Twiggs Momentum both signal a primary advance for Nymex Crude, supported by an improving economic outlook. Brent Crude breaking support at $106/barrel, reflects the opposite view in Europe and we could see the crude prices in North America and Europe converge — if not cross — for the first time in more than two years.

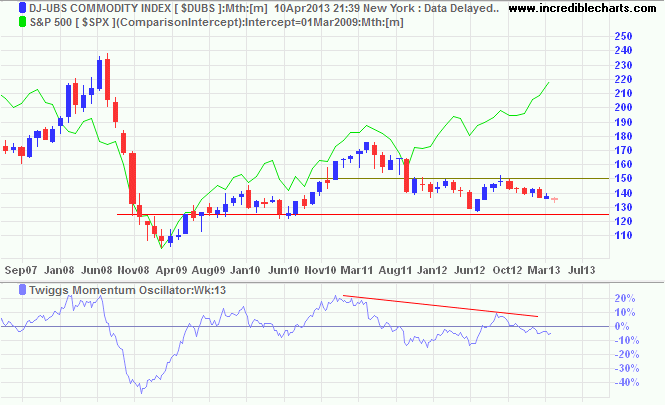

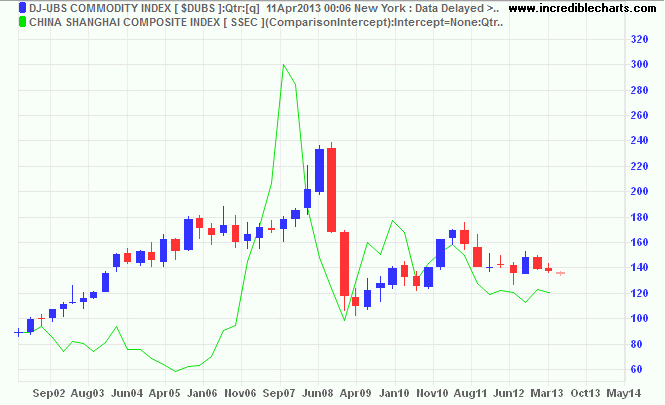

Commodities

Dow Jones-UBS Commodity Index continues in a primary down-trend.

China — the major driver of global commodity prices — is significantly lagging the recovery in the US.

No theory of government was ever given a fairer test or a more prolonged experiment in a democratic country than democratic socialism received in Britain. Yet it was a miserable failure in every respect. Far from reversing the slow relative decline of Britain vis-a-vis its main industrial competitors, it accelerated it. We fell further behind them, until by 1979 we were widely dismissed as 'the sick man of Europe'.....To cure the British disease with socialism was like trying to cure leukaemia with leeches.

~ Margaret Thatcher (1993)

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.