What's New: Stock Screens

By Colin Twiggs

March 1st, 2013 8:30 p.m. EST (12:30 a.m. AEDT)

These extracts from my trading diary are for educational purposes. Any advice contained therein is provided for the general information of readers and does not have regard to any particular person's investment objectives, financial situation or needs and must not be construed as advice to buy, sell, hold or otherwise deal with any securities or other investments. Accordingly, no reader should act on the basis of any information contained therein without first having consulted a suitably qualified financial advisor. Full terms and conditions can be found at Terms of Use.

Stock Screens

Stock screens are the next item on our development program. Please use the Chart Forum to post any suggestions, requests and questions — so that we can keep everything in one place. We cannot respond to all requests but they may still be useful in guiding future discussion and development.

Here is a screen example that I posted recently:

Donchian Channel Breakouts

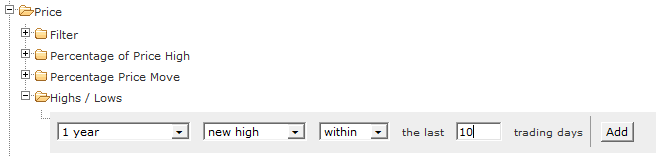

How to find breakouts (new highs) from a 1-year Donchian Channel:

- Select Price >> Highs/Lows >> 1 year; new high; within the last 10 days

- Click the Add button

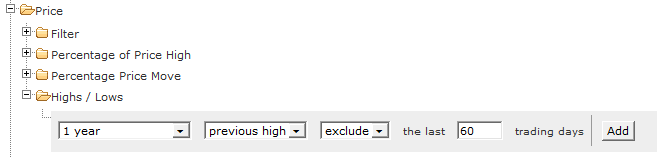

If you are looking for breakouts, you will need to eliminate stocks that are already in a fast up-trend:

- Select Price >> Highs/Lows >> 1 year; previous high; exclude the last 60 days

- Click the Add button

- Run or save.

You will find this example at #58074 on the Shared tab.

New Budget Packages

Readers may have noticed recent changes to free data and stock screens. We have turned the free offering into a lite version of Incredible Charts without a number of features available to premium subscribers. Free data was originally intended to afford newcomers an introduction to technical analysis, before they commenced trading, but has proved so popular that we believe it is competing with the subscription service.

Some subscribers are on a tight budget and we have tried to make transition to the paid service as easy as possible. There has been a phenomenal response to our new budget packages introduced in December last year. Starting at only $5.95 (or £ 2.95) per month, the new packages include:

- Premium Indicators

- Premium stock screen filters

- Wide market coverage, including NYSE, NASDAQ, OTC Markets, OTCBB, TSX and TSX Venture, LSE, SGX, ASX, Forex and Precious Metals

- Dow Jones, CME and World Indices

- End-of-day stock screening

- No advertising

While global deleveraging is not yet over, I believe the worst is behind us and markets are starting to normalize. This is the ideal time for us to expand our services and we will concentrate on stock screens, indicators, drawing tools and text boxes in the months ahead.

Economic News| US & Asia: Contrasting levels of activity

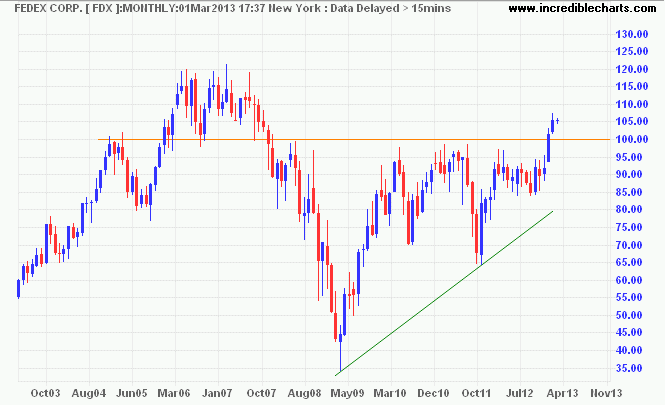

While Fedex broke through long-term resistance at $100, signaling rising activity in North America....

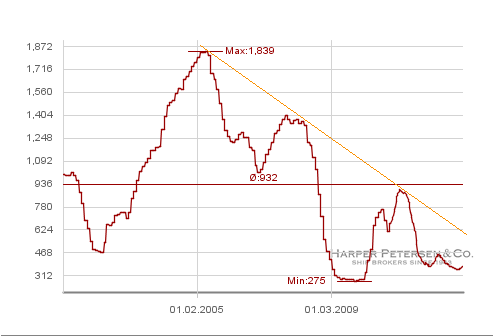

The Harpex index of container shipping (charter) rates, primarily for movement of finished goods, remains close to its 2009 low. There is no indication of a resurgence in exports between Asia and the West.

While the Chinese economy has rebounded on the strength of new infrastructure development, new projects must deliver diminishing returns as the economy approaches satuation point. Building bridges to nowhere is unproductive. One might as well build ships, sail them out to sea and sink them.

Our number for the month is 178,171

The number of containers (TEUs) that arrived loaded but returned empty from the Port of Los Angeles (or parked) during January 2013 is 178171. That is 53 percent of all inbound containers.

As I have said before, those containers are not really empty:

Shippers attempt to fill containers on their return journey, even at super-low rates, in order to offset the cost of completing the round-trip. Empty containers indicate failure to locate manufactured goods that can compete in these export markets. This affects not only the shipper, but the entire economy. Those containers leaving the West Coast are not really empty. They contain something far more valuable than the goods being imported. They contain manufacturing jobs — and the infrastructure, skills and know-how to support them.

In 2011, when President Obama announced his jobs program, empty outbound containers were running at 48 percent.

More....

Life is a school of probability.

~ Walter Bagehot

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.