Gold and commodities find support

By Colin Twiggs

January 24th, 2013 2:00 a.m. ET (6:00 p:m AET)

These extracts from my trading diary are for educational purposes. Any advice contained therein is provided for the general information of readers and does not have regard to any particular person's investment objectives, financial situation or needs and must not be construed as advice to buy, sell, hold or otherwise deal with any securities or other investments. Accordingly, no reader should act on the basis of any information contained therein without first having consulted a suitably qualified financial advisor. Full terms and conditions can be found at Terms of Use.

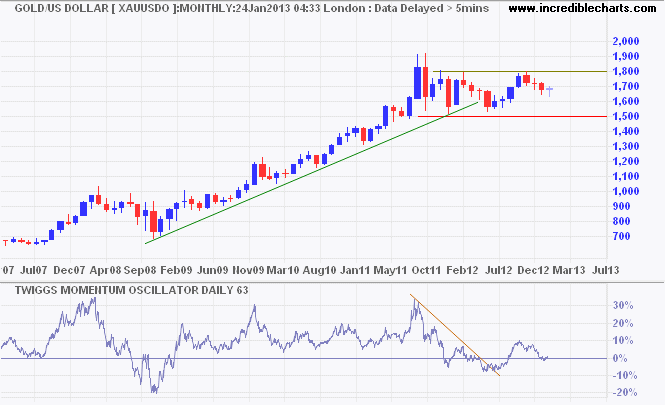

A look at the long-term (monthly) chart shows gold undergoing a correction before encountering support at $1650/ounce. Recovery above $1700 would re-test resistance at $1800, the higher trough suggesting resumption of the primary up-trend. Breakout above $1800 would confirm. A 63-day Twiggs Momentum trough close to the zero line would strengthen the signal, while reversal below zero would suggest that the 5-year bull-trend is over and a test of primary support at $1500 likely.

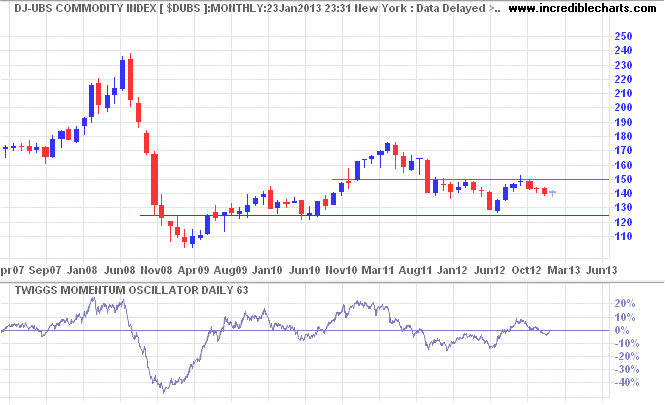

Commodity Prices are a good predictor of stock market performance. Dow Jones-UBS Commodity Index retreated from 150 but support around 140 would indicate another attempt at a breakout — and recovery above 144 would strengthen the signal. Rising Twiggs Momentum suggests a primary up-trend but only breakout above 152 would confirm.

Regard your soldiers as your children, and they will follow you into the deepest valleys.

Look on them as your own beloved sons, and they will stand by you even unto death!

~ Sun Tzu: The Art of War

(This may seem a strange choice of quote but investors/traders should conserve their capital in the same way as a general conserves his troops. You cannot make gains without taking risks, but do not take unnecessary risks or expose your entire "army" to destruction. Always be capable of withdrawing with your main force intact.)

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.