US: Honeymoon is over

By Colin Twiggs

November 8th, 2012 2:00 a.m. ET (6:00 p.m. AET)

These extracts from my trading diary are for educational purposes. Any advice contained therein is provided for the general information of readers and does not have regard to any particular person's investment objectives, financial situation or needs and must not be construed as advice to buy, sell, hold or otherwise deal with any securities or other investments. Accordingly, no reader should act on the basis of any information contained therein without first having consulted a suitably qualified financial advisor. Full terms and conditions can be found at Terms of Use.

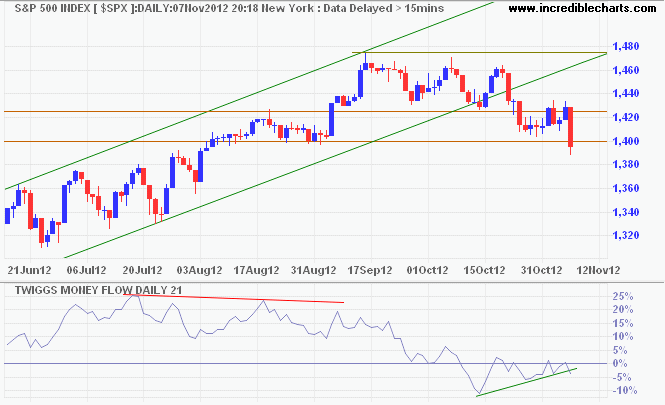

The S&P 500 broke support at 1400, warning that a top is forming. A 21-day Twiggs Money Flow peak below zero would indicate medium-term selling pressure. The honeymoon period leading up to the election is over. It is back to business-as-usual as the President and the Republican-controlled Congress arm-wrestle over taxes, entitlements and the budget deficit. Speaker of the House John Boehner extended an olive-branch of sorts, saying that Republicans were willing to accept additional tax revenues, but his emphasis remains on reforming entitlement programs and curbing "special interest loopholes and deductions".

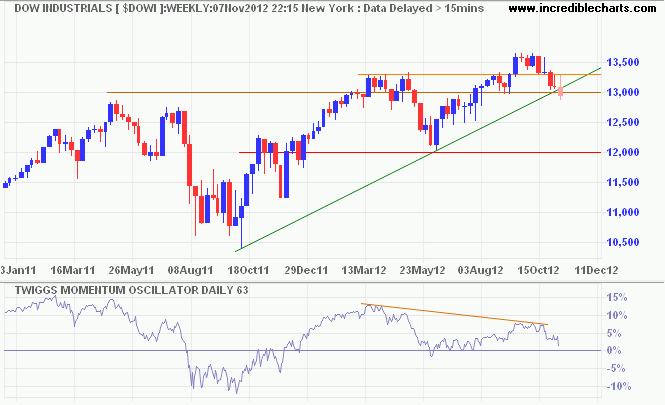

The Dow Jones Industrial Average similarly broke support at 13000 on the weekly chart. Breach of support and the primary trendline warn that a top is forming. Reversal of 63-day Twiggs Momentum below zero would suggest a primary down-trend. Recovery above 13300 is unlikely at present but would indicate another advance.

* Target calculation: 13000 + ( 13000 - 12000 ) = 14000

Of course, in nominal terms a dollar

is always worth a dollar. But in real terms, the value or purchasing power of a dollar

falls in half each time the cost of living doubles. During the period since the United

States left the gold standard in 1933, the price level has gone up nearly 18 fold; a

dollar in 2012 has less purchasing power than 6 cents in 1933. That sort of currency

depreciation is almost impossible under a gold standard regime. Indeed, the cost of

living in 1933 was not much different from what it was in the late 1700s. This is the

most powerful argument in favor of the gold standard.

~ Scott Sumner: THE CASE FOR NOMINAL GDP TARGETING

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.