Gold and commodities fall

By Colin Twiggs

October 24th, 2012 11:00 p.m. ET (2:00 p:m AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Any advice contained therein is provided for the general information of readers and does not have regard to any particular person's investment objectives, financial situation or needs and must not be construed as advice to buy, sell, hold or otherwise deal with any securities or other investments. Accordingly, no reader should act on the basis of any information contained therein without first having obtained investment advice from a suitably qualified advisor. Full terms and conditions can be found at Terms of Use.

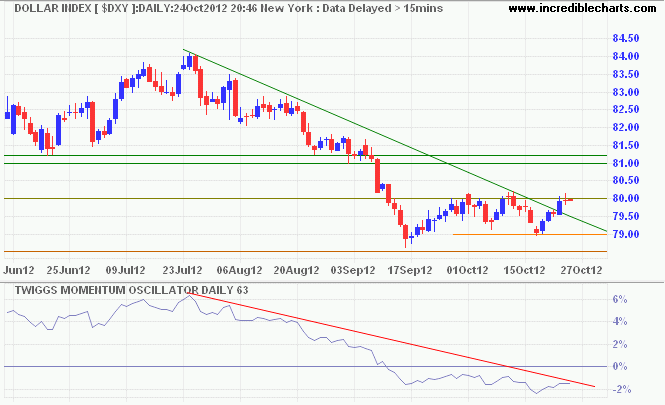

The Dollar Index is consolidating between 79 and 80. Upward breakout would test resistance at 81.00/81.50 — penetration of the descending trendline indicating the correction has ended — but the primary trend is downward and breach of support at 79 would signal another decline. A 63-day Twiggs Momentum peak below zero would strengthen the bear signal.

* Target calculation: 79 - ( 81 - 79 ) = 77

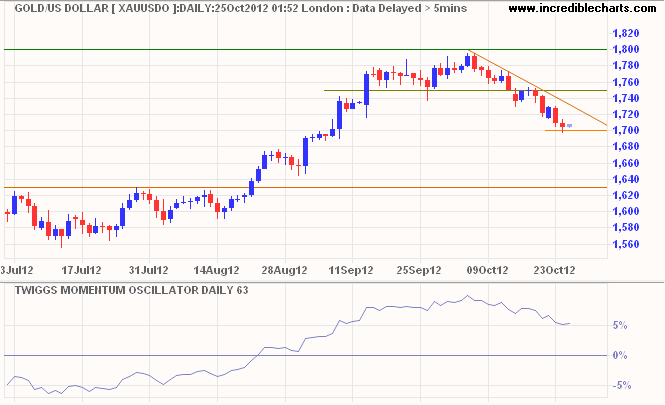

Inflation expectations are easing, with spot gold undergoing a correction since breaking support at 1750. Expect short-term support at 1700 and penetration of the descending trendline would indicate another test of $1800 per ounce*. A 63-day Twiggs Momentum trough above zero is likely — and would signal a primary up-trend, while breakout above $1800 would confirm.

* Target calculation: 1650 + ( 1650 - 1500 ) = 1800

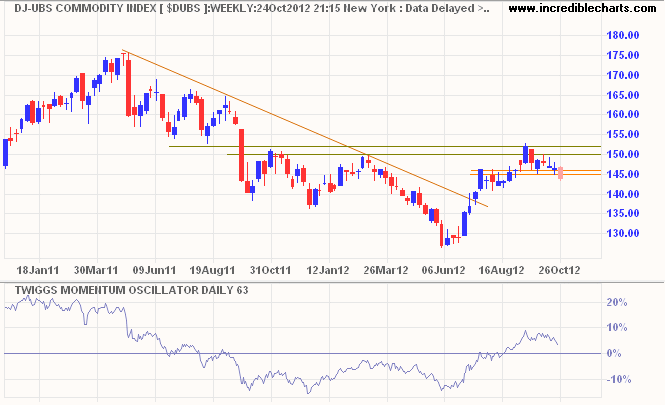

The DJ-UBS Commodity Index also reflects an easing inflation outlook, breaking medium-term support at 145 to signal a correction. 63-Day Twiggs Momentum is unlikely to remain above zero but a shallow trough would be a bullish sign.

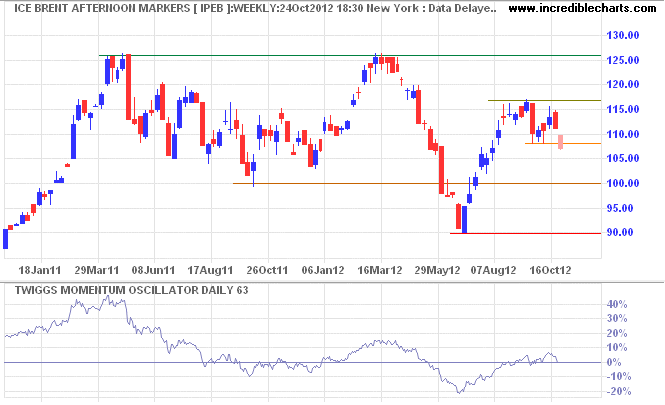

Brent Crude is also falling, having broken support at $108 per barrel. Expect a test of $100. Reversal of 63-day Twiggs Momentum below zero would strengthen the bear signal.

* Target calculation: 108 - ( 117 - 108 ) = 99

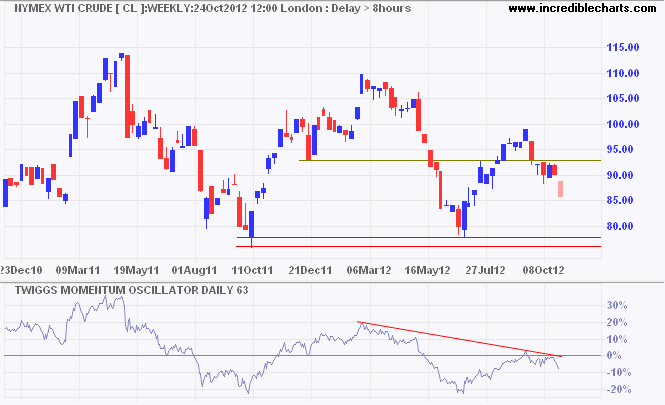

Nymex WTI Light Crude is similarly headed for a test of primary support at $76/$78 per barrel. The 63-day Twiggs Momentum peak below zero warns of a primary down-trend.

Markets are fundamentally volatile. No way around it. Your problem is not in the math. There is no math to get you out of having to experience uncertainty.

~ Ed Seykota

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.