US: Buying pressure easing

By Colin Twiggs

October 2nd, 2012 3:00 a.m. ET (5:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

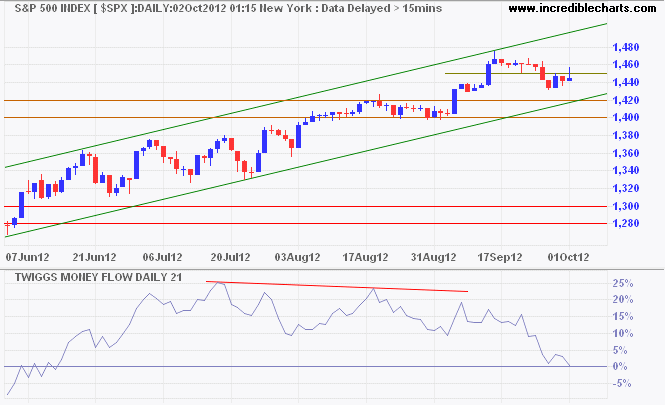

The September Quarter has ended, bonuses have been determined, and buying pressure is now likely to ease. The S&P 500 is testing resistance after breaking support at 1450. Bearish divergence on 21-day Twiggs Money Flow indicates selling pressure. Respect of 1450 is likely and would indicate a test of 1400.

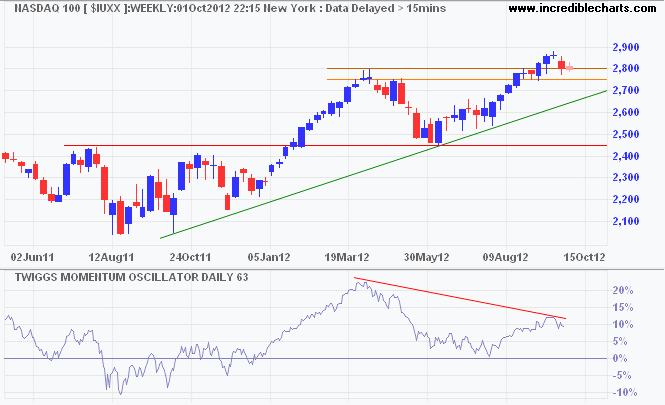

The Nasdaq 100 weekly chart shows the index testing support at 2800/2750. Bearish divergence on 63-day Twiggs Momentum indicates a weakening up-trend; reversal below zero would warn of a primary down-trend. Failure of support would strengthen the signal. Respect of support is unlikely but would indicate another advance.

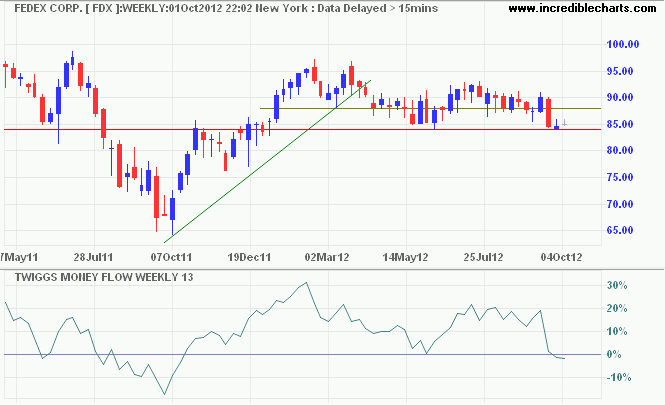

Bellwether transport stock Fedex is testing support at $84. Narrow range of last week's candle indicates selling pressure — as does reversal of 13-week Twiggs Money Flow below zero. Downward breakout would confirm the primary down-trend earlier signaled by 63-day Twiggs Momentum below zero. A Fedex down-trend would warn of slowing activity in the broader economy.

There has been a renewed search for investible assets going on. Not the old, indiscriminate,

invest-in-anything-with-a-high-return-and-ask-no-questions "search-for-yield". It has so far

been a much more calculated hunt. Not so much for return on capital but return of capital......

~ Paul Fisher, Executive Director for Markets at the Bank of England

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.