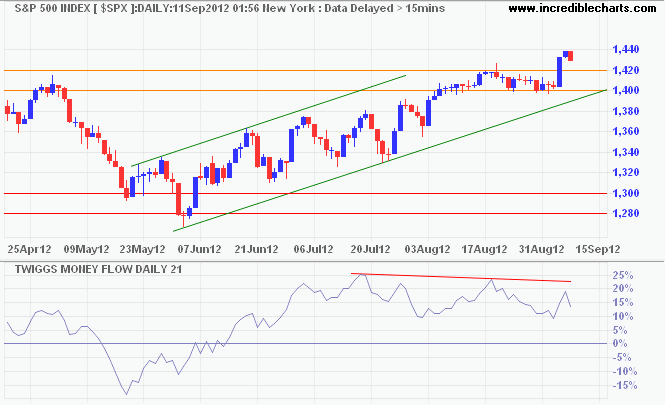

S&P 500 retraces

By Colin Twiggs

September 11th, 2012 3:00 a.m. ET (5:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

The S&P 500 is retracing to test its new support level after breaking resistance at 1420. Respect would signal an advance to 1570*, while failure of support at 1400 would indicate a bull trap. Bearish divergence on 21-day Twiggs Money Flow continues to flag medium-term selling pressure. Breach of the lower trend channel — and support at 1400 — would warn of another test of primary support at 1300.

* Target calculation: 1420 + ( 1420 - 1270 ) = 1570

Baseball is ninety percent mental.

The other half is physical.

~ Yogi Berra

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.