Dollar tests support; gold and commodities strengthen

By Colin Twiggs

August 9th, 2012 2:30 a.m. ET (4:30 p:m AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

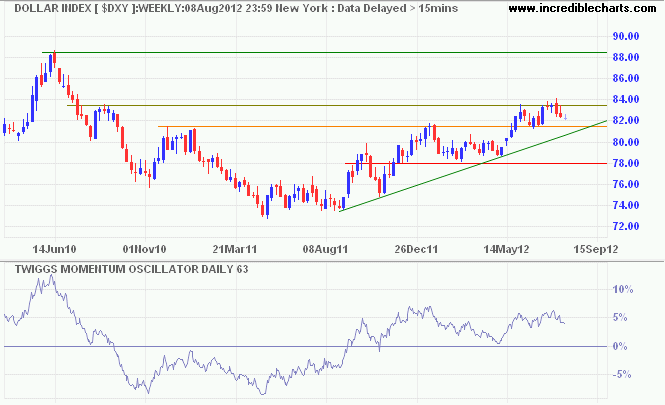

The US Dollar Index made a false break above resistance at 83.50 before retracing to test support at 81.50. Respect of support and the rising trendline would confirm the primary up-trend is intact. Breakout above 83.50/84.00 would signal an advance to 86.00* in the next few weeks and to the 2010 high at 88.50 in a few months. Another 63-day Twiggs Momentum trough above zero would reinforce the healthy up-trend. Failure of support at 81.50 is unlikely, but would warn of a trend reversal.

* Target calculation: 82 + ( 82 - 78 ) = 86

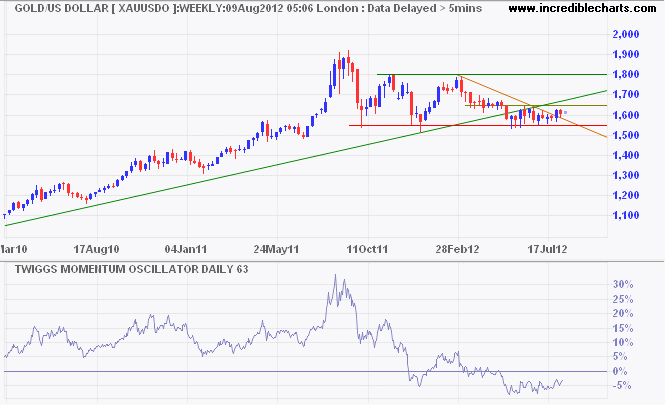

Spot Gold continues to consolidate on the weekly chart between $1530 and $1650 per ounce. 63-Day Twiggs Momentum below zero warns of a primary down-trend. Recovery above zero, however, would confirm that a bottom is forming. Breakout below primary support at $1530 would offer a target of $1300*; recovery above $1640 would indicate an advance to $1800.

* Target calculation: 1550 - ( 1800 - 1550 ) = 1300

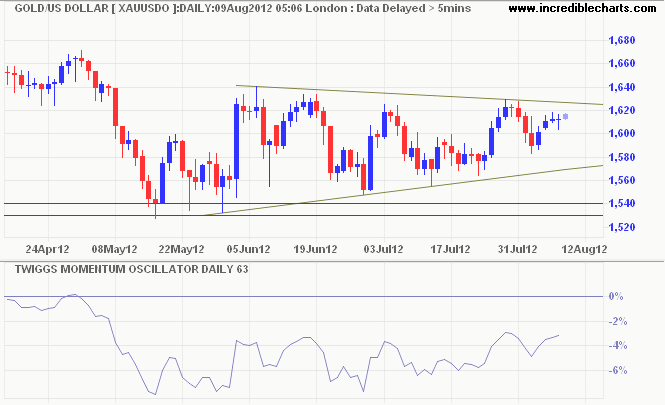

The daily chart displays a symmetrical triangle formation. Breakout would indicate direction of the next primary move. The failed down-swing — with a reversal short of the lower border — suggests an upward breakout. Follow-through above 1640 would confirm.

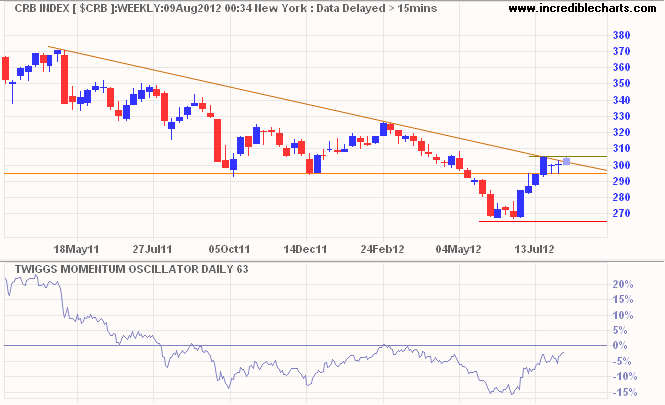

The CRB Commodities Index broke its descending trendline, indicating that a bottom is forming. Breakout above medium-term resistance at 305, strengthening the signal, would test 325. Reversal below 295, however, would suggest another test of 265. Recovery of 63-Day Twiggs Momentum above zero would also suggest a primary up-trend.

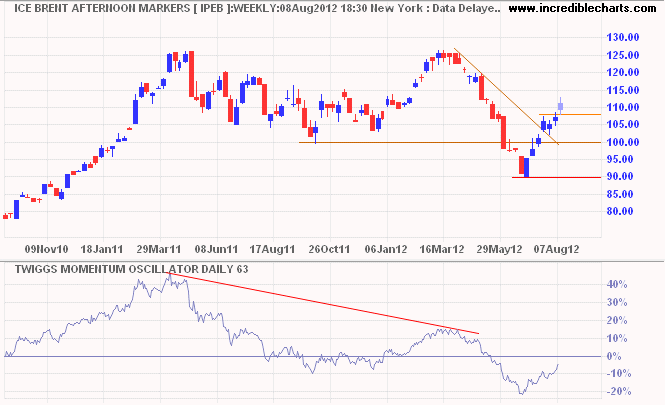

Brent Crude has already penetrated its descending trendline, suggesting that a bottom is forming. Follow-through above $108 strengthens the signal. Recovery of 63-day Twiggs Momentum above zero would indicate a primary up-trend, while a peak below zero would signal a decline to $75 per barrel*.

* Target calculation: 100 - ( 125 - 100 ) = 75

Asia: India recovering but China & Japan bearish

There is one living spirit, prevalent over this world, (subject to certain contingencies of organic matter chiefly heat), which assumes a multitude of forms according to subordinate laws.

~ Charles Darwin

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.