Forex Update

By Colin Twiggs

July 5th, 2012 9:30 p.m. ET (11:30 p:m AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

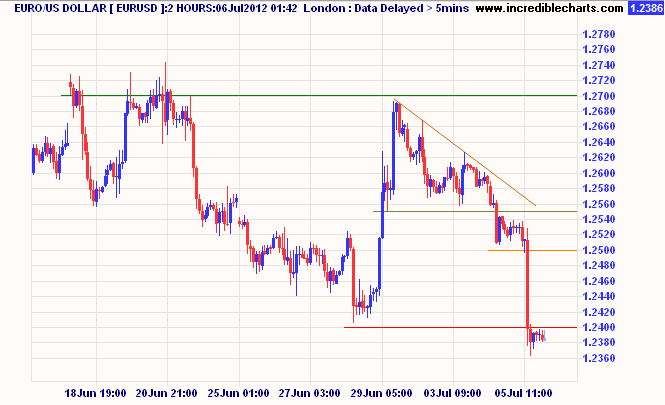

The Euro broke support at $1.25 before falling sharply through $1.24, warning of another decline. Narrow consolidation below the new resistance level is a bearish sign. Follow-through below $1.23 would offer a target of $1.20.

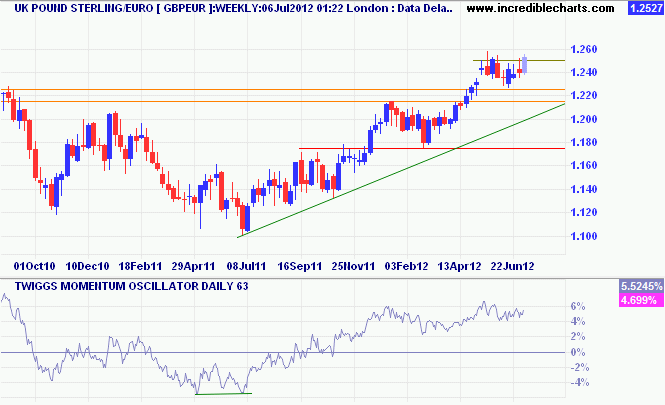

Pound Sterling broke resistance at €1.25 against the Euro, offering a target of €1.28.

* Target calculation: 1.25 + ( 1.25 - 1.215 ) = 1.285

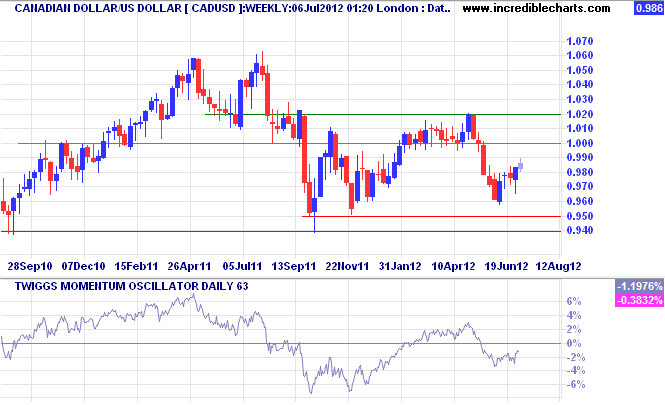

Canada's Loonie is strengthening against the US Dollar on the back of rising oil prices. Expect another test of $1.02.

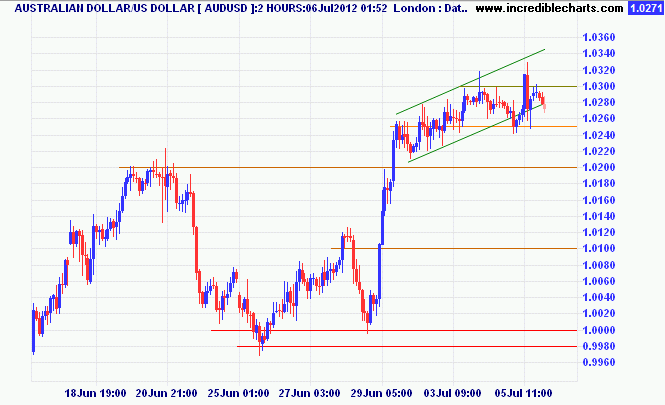

The Aussie Dollar threatens to break down from its recent flag formation. Failure of support at $1.025 would suggest a test of $1.01.

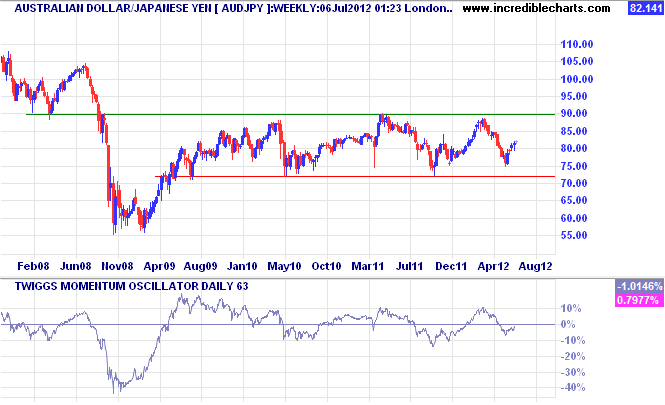

The Aussie Dollar continues to range between ¥72 and ¥90 Japanese Yen. Dips are getting shorter and range traders may need to move their base to ¥75.

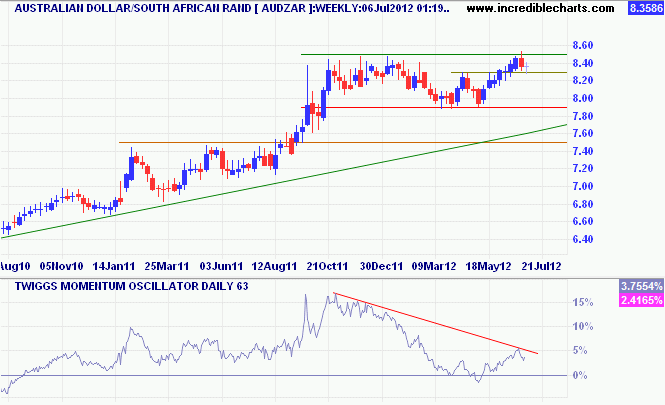

Against the South African Rand, the Aussie Dollar is testing resistance at R8.50. Breakout would offer a target of R9.00. Narrow consolidation above R8.30 would be a bullish sign.

* Target calculation: 8.50 + ( 8.50 - 8.00 ) = 9.00

What you get by achieving your goals is not as important as what you become by achieving your goals.

~ Zig Ziglar

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.