US: Wait for Nasdaq confirmation

By Colin Twiggs

July 3rd, 2012 3:00 a.m. ET (5:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

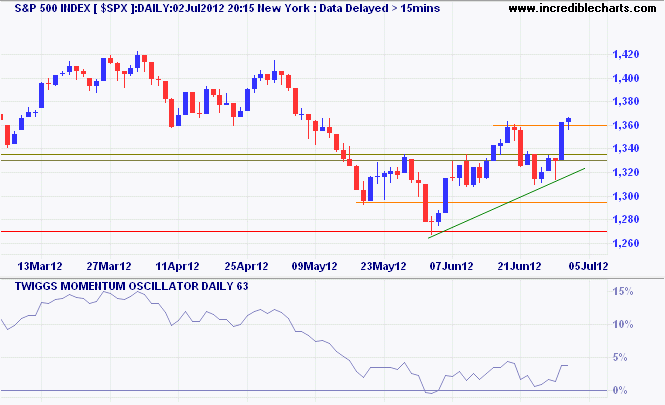

The S&P 500 closed above medium-term resistance at 1360. I am normally wary of quarter-end prices moves as fund managers have a vested interest in boosting their performance bonuses. But the breakout appears to have a legitimate basis, with Germany's key concessions at the Euro summit, and should test the 2012 high of 1420. 63-Day Twiggs Momentum holding above zero suggests the primary trend is intact. Reversal below the new support level (1360), however, would indicate a false signal. Falling 10-year treasury yields warn of another flight to safety (unless the Fed is driving down yields through its "Twist" operations) and we need to exercise caution.

* Target calculation: 1360 + ( 1360 - 1300 ) = 1420

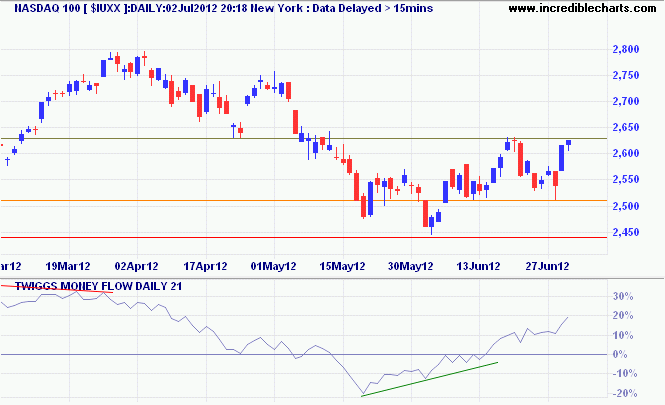

Wait for the Nasdaq 100 to break resistance at 2630 and confirm the S&P 500 signal. Rising 21-day Twiggs Money Flow indicates medium-term buying pressure.

* Target calculation: 2650 + ( 2650 - 2500 ) = 2800

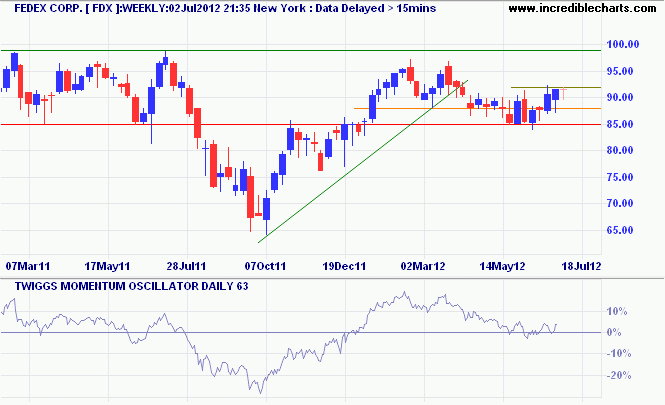

Bellwether transport stock Fedex (weekly chart) completed a double top reversal in April but since then has oscillated around the former neckline at $88. 63-Day Twiggs Momentum also recovered above zero. Follow-through above $92 would suggest that the correction is over and broader economic activity is recovering. Reversal below $85 is unlikely but would warn of a primary down-trend.

The power which the strong have over the weak, the employer over the employed, the educated over the unlettered, the experienced over the confiding, even the clever over the silly—the forbearing or inoffensive use of all this power or authority, or a total abstinence from it when the case admits it, will show the men in a plain light...... A true man of honor feels humbled when he cannot help humbling others.

~ Confederate General Robert E. Lee

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.