Rising Dollar suggests lower gold and commodities

By Colin Twiggs

June 20th, 2012 11:00 p.m. ET (1:00 p:m AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

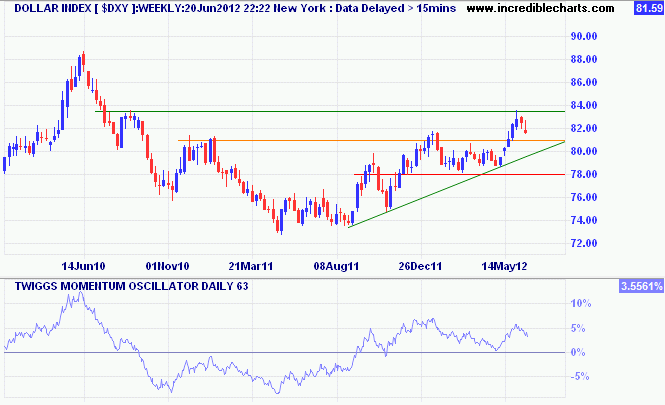

The Dollar Index is testing medium-term support at 81.00/81.50. Respect would confirm a healthy primary up-trend. Reversal below the rising trendline is unlikely, but would indicate trend weakness. Another trough above zero on 63-day Twiggs Momentum would strengthen the bull signal.

* Target calculation: 81 + ( 81 - 78 ) = 84

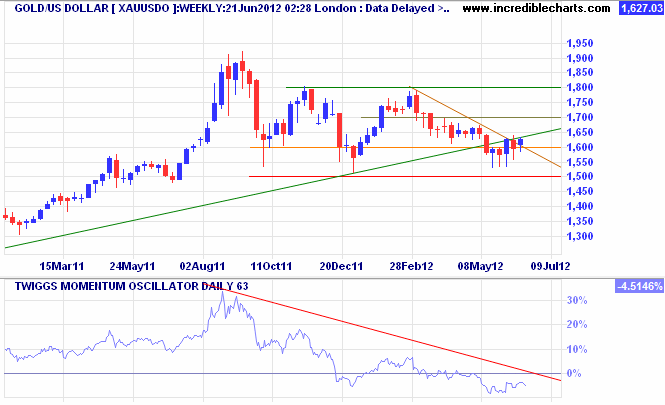

Gold displays strong buying support above $1500 with four long tails on the weekly chart. Recovery above $1700/ounce would suggest a new primary up-trend, but the rising dollar warns of weakness. Reversal below $1600 would strengthen the bear signal from 63-day Twiggs Momentum declining below zero.

* Target calculation: 1550 - ( 1800 - 1550 ) = 1300

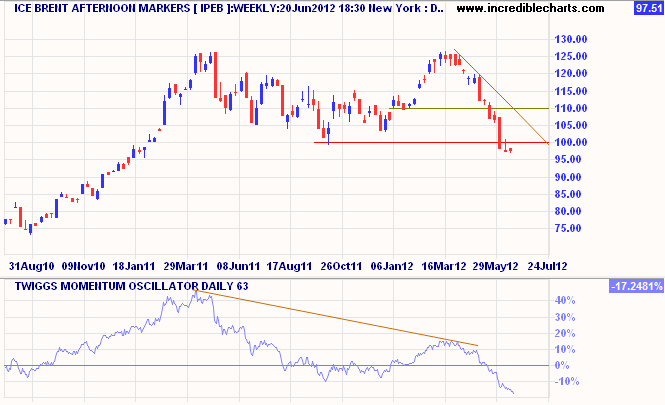

Brent crude is consolidating after breaking support at $100/barrel. Respect of the new resistance level would warn of another decline, while reversal would test $110.

* Target calculation: 100 - ( 125 - 100 ) = 75

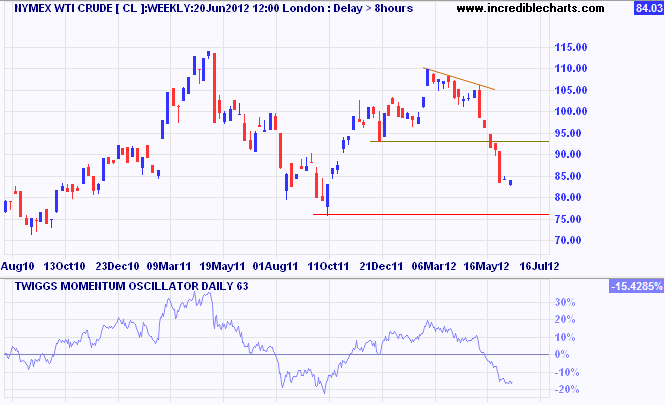

The Nymex WTI Light Crude is similarly consolidating below $85/barrel. Respect of the new resistance level would indicate a decline to $75/76 per barrel.

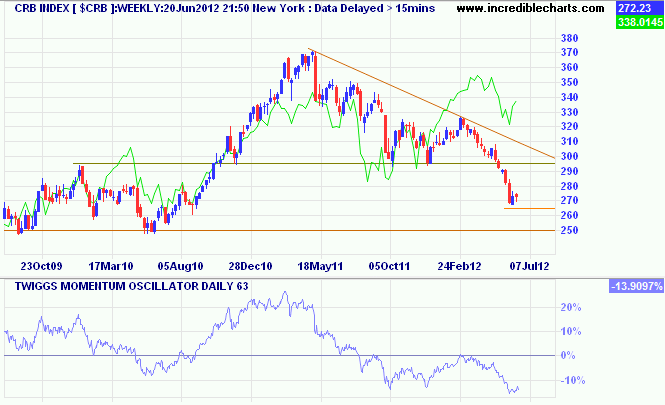

The broader CRB Commodities Index found short-term support at 265 as the dollar weakened, but is likely to follow through to long-term support at 250 as the greenback strengthens. 63-Day Twiggs Momentum oscillating below zero warns of a strong down-trend.

* Target calculation: 290 - ( 330 - 290 ) = 250

There are significant differences between the American and European version of capitalism. The American traditionally emphasizes the need for limited government, light regulations, low taxes and maximum labour-market flexibility. Its success has been shown above all in the ability to create new jobs, in which it is consistently more successful than Europe.

~ Margaret Thatcher

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.