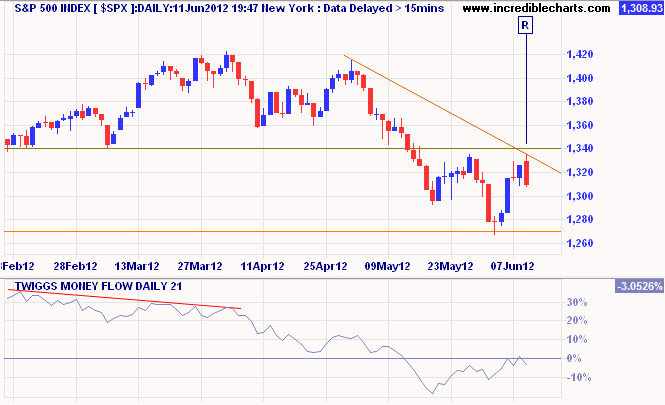

S&P 500 engulfing candle

By Colin Twiggs

June 12th, 2012 1:00 a.m. ET (5:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

Monday's engulfing candle [R] on the S&P 500 warns of reversal to re-test support at 1270. Respect of the zero line (from below) by 21-day Twiggs Money Flow would indicate strong medium-term selling pressure. Failure of support would offer a target of 1200*.

* Target calculation: 1270 - ( 1340 - 1270 ) = 1200

My experiences of men has neither disposed me to think worse of them nor be indisposed to serve them: nor, in spite of failures which I lament, of errors which I now see and acknowledge, or the present aspect of affairs, do I despair of the future. The truth is this: The march of Providence is so slow and our desires so impatient; the work of progress so immense and our means of aiding it so feeble; the life of humanity is so long, that of the individual so brief, that we often see only the ebb of the advancing wave and are thus discouraged. It is history that teaches us to hope.

~ Confederate General Robert E. Lee

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.