US banks face squeeze

By Colin Twiggs

June 4th, 2012 2:00 a.m. ET (6:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

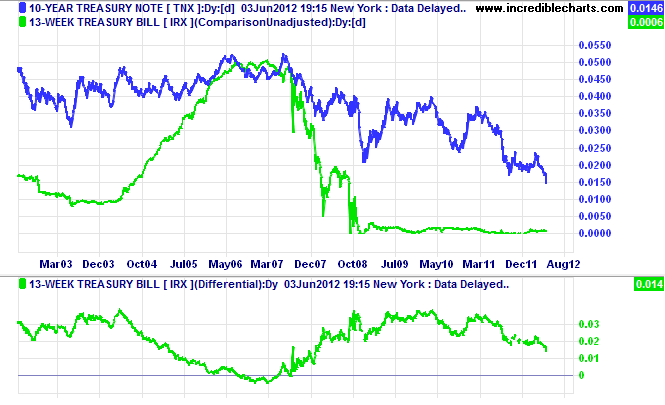

Rising short-term interest rates (represented by 3-month Treasury yields on the chart below) caused negative yield differentials in 2006/2007 which led me to warn of an economic down-turn. Yield differentials are calculated by subtracting short-term (3-month) yields from long-term (10-year) yields. Banks borrow mostly at short-term rates and lend at long-term rates, generating a profitable interest margin. But when the yield differential turns negative, bank interest margins are squeezed, forcing them to contract lending. A lending contraction shrinks aggregate demand (Consumption + Investment) and sends the economy into a tail-spin.

Negative yield differentials (or yield curves) are normally caused by rising short-term rates as in 2006/2007, but now we are witnessing the opposite phenomenon. Short-term rates are near zero, but falling long-term rates are starting to squeeze the yield differential from the opposite end. The situation is not yet desperate but a further decline in long-term yields would shrink bank interest margins. Fed initiation of QE3, purchasing additional long-term Treasuries, is likely to drive long-term rates lower and exacerbate the problem. The resulting contraction in bank lending would cause another economic down-turn.

The trite saying that honesty is the best policy has met with the just criticism that honesty is not policy. The real honest man is honest from conviction of what is right, not from policy.

~ Confederate General Robert E. Lee

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.