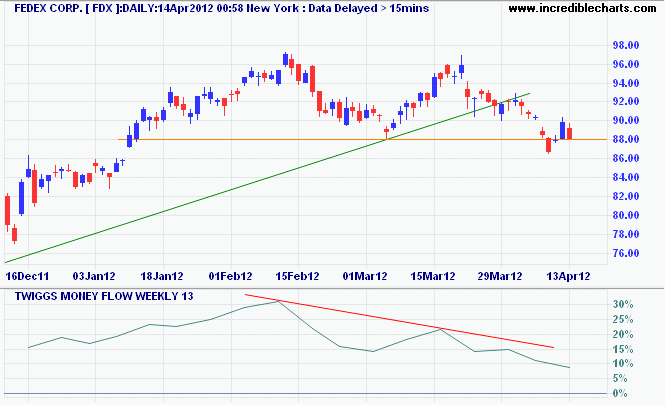

Fedex double top

By Colin Twiggs

April 16th, 2012 9:00 p.m. ET (11:00 a.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

Bellwether transport stock Fedex completed a double top reversal with a break through the neckline at $88. Retracement found resistance at $90 and reversal below the original neckline at $88 would signal a primary down-trend. Follow-through below Tuesday's low would confirm. Bearish divergence on 13-week Twiggs Money Flow warns of strong selling pressure. A primary down-trend on Fedex normally warns of slowing activity in the broader economy.

Whenever you feel like criticizing any one... just remember that all the people in this world haven't had the advantages that you've had.

~ F. Scott Fitzgerald (1925)

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.