Europe on the rise

By Colin Twiggs

March 18th, 2012 6:00 a.m. ET (10:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

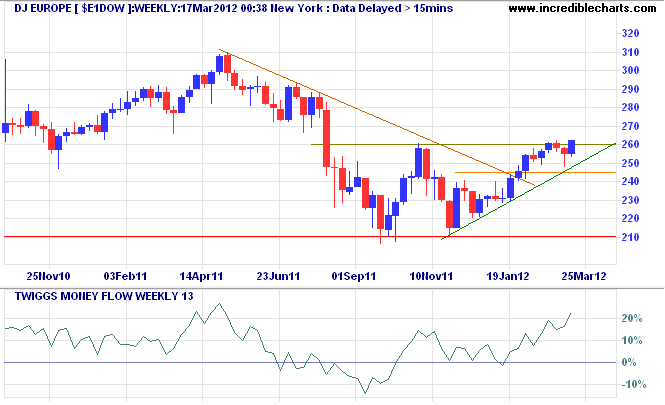

Dow Jones Europe Index broke through 260 to signal a primary up-trend. Respect of the zero line by 13-week Twiggs Money Flow confirms strong buying pressure. Target for the advance is 310*.

* Target calculations: 260 + ( 260 - 210 ) = 310

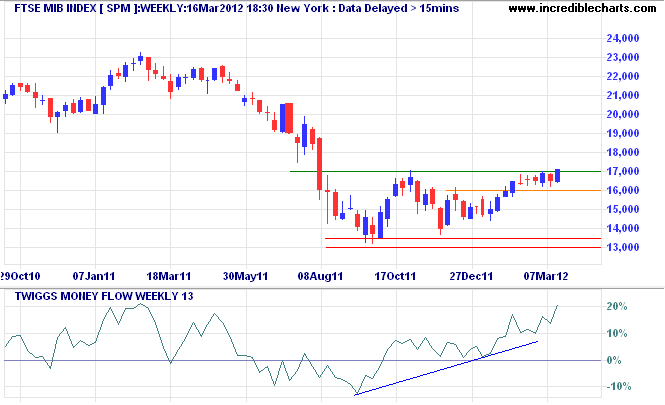

Italy's MIB Index reflects a similar pattern, signaling an advance to 21000*.

* Target calculations: 17 + ( 17 - 13 ) = 21

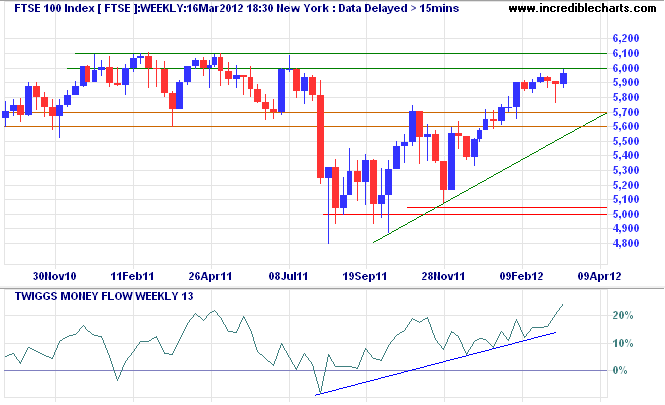

The FTSE 100 is already in a primary up-trend. A trough high above zero on 13-week Twiggs Money Flow indicates strong buying pressure and a likely breakout above resistance at 6100.

* Target calculations: 5700 + ( 5700 - 5000 ) = 6400

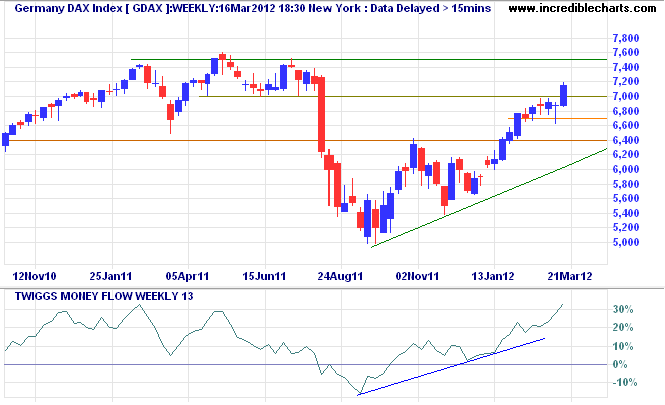

The DAX shows similar strong buying pressure and breakout above the 2011 high of 7500 is likely.

* Target calculations: 6400 + ( 6400 - 5700 ) = 7400

Let me introduce Mauldin's Rule of Thumb Concerning Unintended Consequences:

For every government law hurriedly passed in response to a current or recent crisis, there

will be two or more unintended consequences, which will have equal or greater negative effects

then the problem it was designed to fix. A corollary is that unelected institutions are at least as

bad and possibly worse than elected governments. A further corollary is that laws passed to

appease a particular group, whether voters or a particular industry, will have at least three

unintended consequences, most of which will eventually have the opposite effect than the

intended outcomes and transfer costs to innocent bystanders.

~ John Mauldin

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.