Gold hesitates on dollar strength

By Colin Twiggs

February 16th, 2012 2:30 a.m. ET (6:30 p:m AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

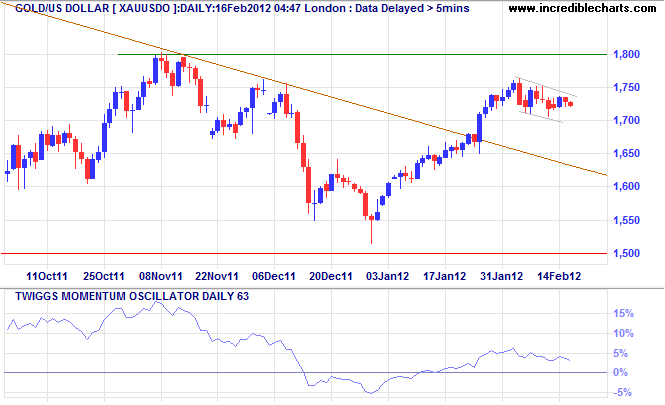

Spot gold displays a small flag consolidation, suggesting continuation of the advance to test $1800/ounce. Breach of the descending trendline indicates that the down-trend has ended and breakout above $1800 would signal an advance to $2100*. Respect of the zero line by 63-day Twiggs Momentum would strengthen the signal. A strengthening dollar, however, would weaken demand for gold.

* Target calculation: 1800 + ( 1800 - 1500 ) = 2100

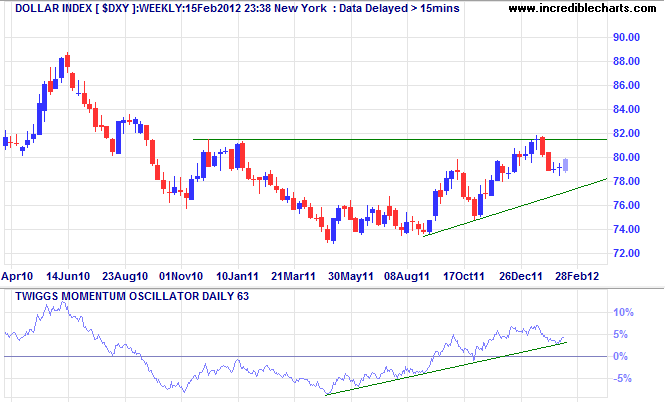

The US Dollar Index found support above 78. Recovery above 80 would indicate another test of resistance at 82. Rising 63-day Twiggs Momentum continues to signal a strong up-trend. Breakout above 82 would confirm the target of 85*.

* Target calculation: 80 + ( 80 - 75 ) = 85

Commodities: Crude rises on Iran tensions

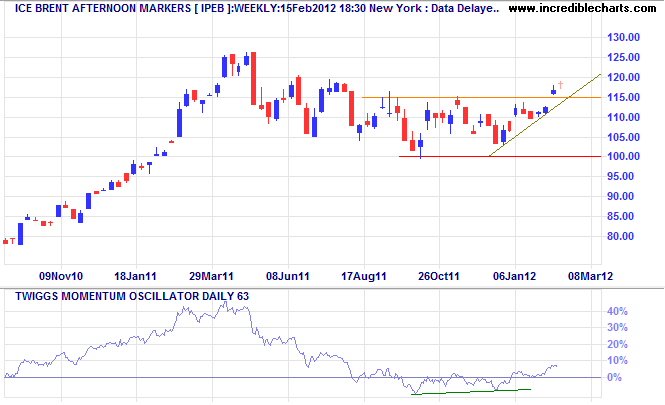

Brent Crude is advancing towards its target of $130/barrel* after breaking resistance at $115. Respect of the zero line by the last trough on 63-day Twiggs Momentum strengthens the bull signal.

* Target calculation: 115 + ( 115 - 100 ) = 130

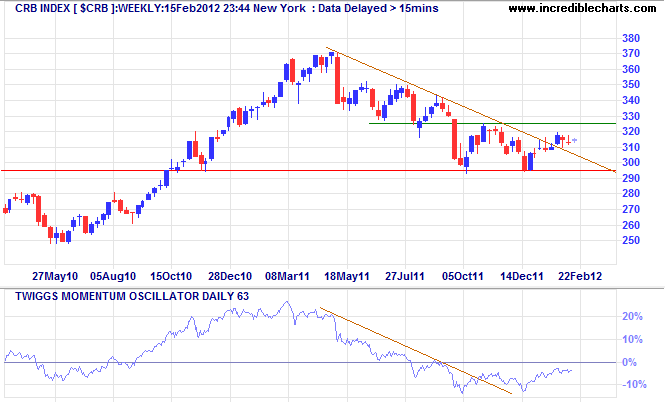

The broader CRB Commodities Index breached its descending trendline but continues to display uncertainty. Breakout above 325 would signal a primary up-trend with an initial target of 350*. A stronger dollar is likely to retard commodity prices.

* Target calculation: 325 + ( 325 - 300 ) = 350

The opening up of new markets, foreign or domestic, and the organizational development from the craft shop and factory to such concerns as U.S. Steel illustrate the same process of industrial mutation—if I may use that biological term—that incessantly revolutionizes the economic structure from within, incessantly destroying the old one, incessantly creating a new one. This process of Creative Destruction is the essential fact about capitalism. It is what capitalism consists in and what every capitalist concern has got to live in......

~ Joseph Schumpeter: Capitalism, Socialism and Democracy

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.